In February 2024, Shin Corporation, which operates karaoke boxes nationwide under the “Karaoke BanBan” brand, joined GENDA. The karaoke business operated by Shin Corporation has achieved robust growth as of the third quarter compared to the initial target thanks to successful PMI (post-merger-integration) after joining GENDA. In addition, Shin Corporation is expected to achieve the highest earnings in this fiscal year in its 35 years history since its establishment and in its first year in GENDA.

With Karaoke JIYU-KAN’s joining of GENDA, we now operate a total of approximately 390 karaoke boxes. As PMI in the karaoke domain, we have implemented measures to both increase sales and reduce costs to create synergies in the group.

【Measures to increase sales】

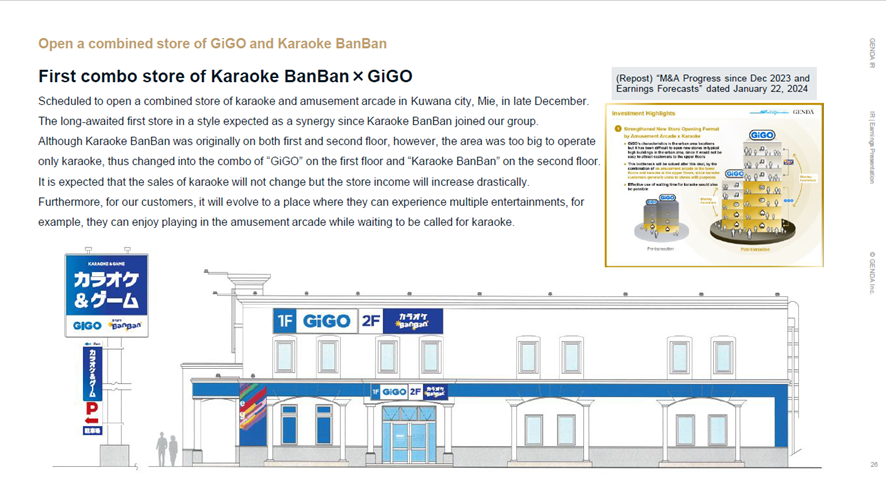

- Develop and open a new combined store with amusement arcades

(Page 26 of “FY 2025/1 3Q Earnings Presentation” disclosed on December 10, 2024)

This is the first combined store with GiGO on the first floor and Karaoke BanBan on the second. Originally, only Karaoke BanBan used to operate on both floors there as Karaoke BanBan Kuwana. As a result, while using the same building but operating both GiGO and Karaoke BanBan, sales increased 2.2x year-on-year.

As previously reported, the karaoke business itself has significantly exceeded its initial target. However, we believe that there is room for further growth through these full-scale synergies, and we believe that we can see the core of roll-up M&A in the M&A of these 23 stores.

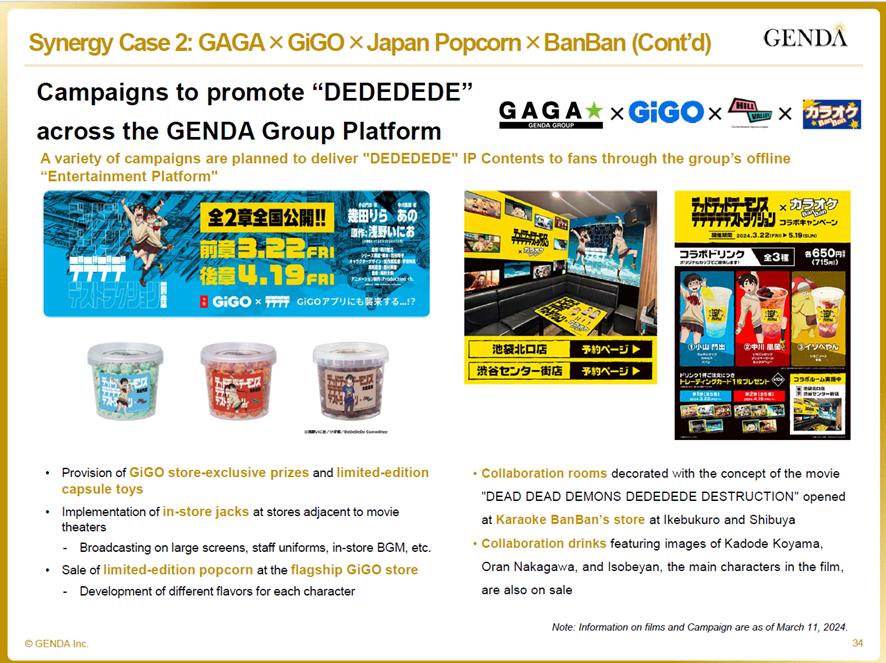

- Mutual expansion of sales by developing IP collaborations and providing food and beverage products of the F&B domain

(Page 34 of “FY2024/1 Earnings Results and FY2025/1 Earnings Forecasts” disclosed on March 11, 2024)

- Strengthen measures to enclose customers by utilizing GENDA ID

- Mutual customer transfer with amusement arcades between neighboring stores

We have implemented a mutual customer transfer measure between stores within a 1km radius of each other since last June. The targets are 75 GiGO stores and 67 Karaoke BanBan stores, which have distributed service tickets and displayed promotional posters.

【Measures to reduce costs】

- Make the cost more efficient such as bulk purchase of consumables etc. as GENDA, which is the core of roll-up M&A.

- Make the capital more efficient by GENDA’s group finance.

In terms of valuation, karaoke boxes have a strength which recoupment period is shorter than that of amusement arcades because they require less investment in equipment upgrades. Specifically, while the conversion ratio from EBITDA to free cash flow (FCF) is about 50% in amusement arcades, this indicator is about 70% in karaoke boxes because machine installment and maintenance CAPEX are less. Therefore, if M&A were conducted in amusement arcades and karaoke boxes at the same EV/EBITDA multiple, karaoke boxes would have an advantage of a shorter recoupment period.

Although the acquisition of “Karaoke JIYU-KAN” resulted in an EV/EBITDA 7x+ (the latest actual value), in light of the above EBITDA to FCF, the recoupment period is comparable to that of M&A with EV/EBITDA 5x+ in amusement arcades. Furthermore, the above valuation is based on the “actual results of the previous fiscal year” of “23 stores in the single business.” If this is evaluated based on the “results of the next fiscal year and beyond” with “group synergies” arising among “approximately 390 consolidated stores” and “a recover of number of customers after COVID-19 pandemic,” we can expect a shorter recoupment period.

The above “EBITDA to FCF” denotes FCF divided by EBITDA. The background is, since the actual source of investment recoup is not precisely EBITDA but FCF, from which taxes and maintenance CAPEX are deducted, we consider the investment recoup on a cash flow basis as most important in a M&A transaction.

On the other hand, since actual FCF fluctuates greatly depending on the CAPEX in a single year, thus EV/EBITDA is generally used as a simple reference. Therefore, we disclose EV/EBITDA multiple whenever possible.

We place a high priority on investing at appropriate valuations. Besides, we consider the roll-up of amusement arcades, which is easy to enter at appropriate valuations and for which a PMI pattern has been established, to be the most important in our M&A strategy. However, we believe that the roll-up of the karaoke business, which is currently significantly higher than our target, will also have great significance from the perspective of investment recoupment efficiency.