This report shows what kind of preconditions (specifically, perpetuity growth rate) we should set to get a stock price of 2,900 yen (which is our present stock price) in a DCF analysis.

The conclusion of the report shows that regarding a perpetuity growth rate in a DCF analysis, while generally setting a precondition of ±1%, it cannot be explained without entering a “excessively low and unrealistic” input of perpetuity growth rate of -19.4%, which means that “in other words, this analysis confirms that the current valuation is significantly undervalued.” (CGS Report p1)

Please let us explain the details.

First, a DCF analysis is the most corporate finance theory-based approach, that calculates theoretical stock prices from the bottom up.

On the other hand, it has drawbacks, too.

Specifically, “the theoretical stock price is highly sensitive to the terminal value assumption, making the results prone to subjectivity,” which means that the theoretical stock price fluctuates greatly depending on the input value of the perpetuity growth rate. (CGS Report p1)

This drawback has been eliminated this time. Specifically, “a reverse DCF helps reduce subjectivity in investment analysis by revealing the perpetual growth rate assumed in the current stock price,” which means that it was calculated backwards what percentage the perpetuity growth rate should be to get 2,900 yen in the DCF analysis (this “back-calculated” part is the reason for the “reverse” DCF). (CGS Report p1)

Consequently, this perpetuity growth rate becomes the explained variable which is calculated backwards to connect DCF⇄ market stock prices based on the DCF analysis, and the arbitrariness is eliminated.

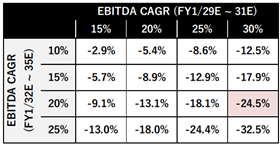

The back-calculated perpetuity growth rate is -19.4% mentioned at the beginning of this section. This means that if we assume that our free cash flow (hereinafter “FCF”) will decrease by -19.4% every year forever (after CGS’s 10-year earnings forecast period), the stock price calculated by the DCF analysis will be 2,900 yen. For EBITDA growth rate, the precondition will be that our EBITDA will decrease -24.5% every year forever.

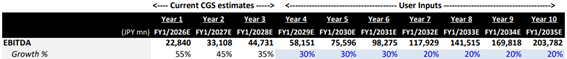

Next, let us take a look at CGS’s 10-year earnings forecast. Since the perpetuity growth rate above is the growth rate after CGS’s 10-year earnings forecast period, if the 10-year earnings forecast was really aggressive, it would be natural that the perpetuity growth rate were -24.5%.

First of all, as a premise, since we went public, EBITDA has grown by approximately +60% for two consecutive fiscal years, from 8.1 billion in FY2024/1 to the forecast of 13.0 billion for FY2025/1, and to the forecast of 21.2 billion for FY2026/1, and we keep conducting M&A activities having a similar growth rate as our benchmark in the future as well.

On the other hand, CGS’s forecast assumes that we failed in our plan. Specifically, it will be +45% for this fiscal year, +35% for the next fiscal year, and then slowing to +30% and +20% each year after that.

As stated above, even though it is a precondition which is far below what we are aiming at, since a 10-year earnings forecast alone exceeds the current market capitalization, the result shows that the only way to calculate 2,900 yen backwards is to push down the perpetuity growth rate to -19.4%.

Besides, against an opinion that the above 10-year earnings forecast is still strong, in this report, the perpetuity growth rate is also calculated backwards in case that the forecast for EBITDA growth rate is further revised downward.

Specifically, as you can see in the upper row of the chart below, if “the EBITDA growth rate from the 4th to the 6th year is 15%” and “the EBITDA growth rate from the 7th to the 10th years is 10%,” a perpetuity growth rate of -2.9% is back-calculated (the upper left in the chart).

Even in the earnings forecast that EBITDA growth rate of 60%, which is our result and target, will slow down to 45%, 35%, 15% and 10%, which means that we cannot conduct M&A for mid- and long-term and the growth is only organic one, it is still -2.9%, a conservative growth rate compared to +/-1%, which is used in a general DCF analysis..

Based on the above result of analysis, the conclusion is that “In other words, this analysis indicates that the current stock price and valuation are highly undervalued.” (CGS Report p2)

We have maintained our M&A discipline by intentionally not issuing a medium-term management plan to prevent blind M&A. However, internally, we have the current growth of 60% per annum as a benchmark.

Therefore, we do not assume an EBITDA growth rate of 10 to 15% on a mid- and long-term basis, which substantially means that we can barely conduct M&A (“the long-term EBITDA and FCF projections do not reflect any input or intentions from GENDA” (CGS Report p2)).

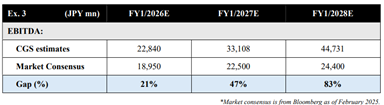

In addition, it says that “CGS does not consider the market consensus forecast for GENDA to be a good reference for the mid-to-long term. The primary reason is that we estimate the consensus forecasts have largely not incorporated the company’s future M&A potential beyond those that have been publicly announced.“ (CGS Report p4).

In fact, regarding the EBITDA forecast for FY2026/1, while the market consensus is 18.95 billion yen, we have already disclosed that the EBITDA forecast for FY2026/1 will be 21.2 billion yen in the presentation on December 24,2024, and this is a forecast under the assumption that there will be no M&A conducted in the future.

Based on them, the report ends with “a consensus forecast that largely excludes future M&A is not particularly useful given the GENDA’s growth strategy. Furthermore, it means that the trading multiples derived from consensus estimates do not account for the cash flow contribution from future M&A. For a valuation that incorporates the potential earnings contribution from future M&A as an estimated figure, please refer to the trading multiples based on CGS projections.” (CGS Report 4).

Our business model is in the early days in the domestic market, and we believe there are a lot of different views on valuations. However, this result of DCF analysis by CGS, which eliminated the arbitrariness, shows that the level of our market stock price is the one which cannot be derived theoretically.

We will keep striving to quickly execute, enhance our capability to generate cash flow, our equity and enterprise value, and to deliver the fruits of Continuous Transformational Growth to our investors.

Reference: “Capital Growth Strategies Report (Valuation Analysis),” February 12, 2025

https://capital-gs.co.jp/wp-content/uploads/2025/02/GENDA-CGS-Report-English-20250212.pdf