The reason for the decrease in all earnings indicators in our consolidated financial results, based on Japanese Accounting Standards (“JGAAP”), is attributable to the continuous execution of M&A. On the other hand, our existing businesses are performing strongly, having achieved growth in earnings and cash flow, and are exceeding the initial target.

To clarify the difference between our financial reporting and the underlying business reality, we have disclosed the following two aspects.

(1) M&A-related expenses (=adjusted indicators)

(2) Accounting standards (=differences between JGAAP and International Financial Reporting Standards (“IFRS”))

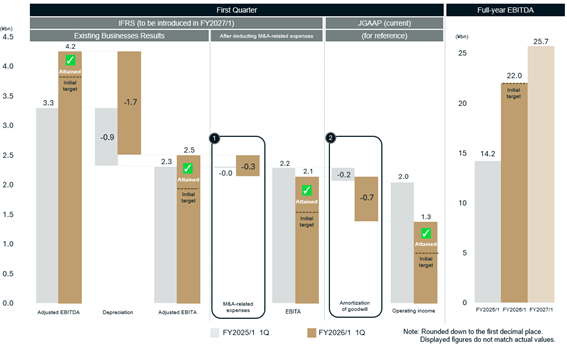

The graph below illustrates points (1) and (2).

(1) M&A-related expenses (adjusted indicators)

In the reported accounting figures, M&A-related expenses are not separated from the profit and loss of existing businesses, making it difficult to discern the true performance (whether good or bad) of these existing businesses. Consequently, we provide “adjusted indicators” to illustrate the performance of our existing businesses, representing the profit generated prior to the deduction of M&A-related expenses.

・Significance of adjusted indicators

-Existing businesses results = Accounting results + M&A-related expenses = Adjusted indicators

・Adjusted indicator results (=existing businesses)

-Adjusted EBITDA, which is our KP, increased by 29% compared to the same period last year and stood at +11% relative to the target.

・Significance of M&A-related expenses

-One-off expenses incurred from M&A funded by existing businesses

-As a result of our continuous M&A transactions, contrary to common corporate practice, these are accounted for quarterly, in addition to being recognized on a full-year basis.

-These expenditures are not core to the continuous running of existing operations. Instead, they are proactive growth investments strategically made to achieve stable and increased profitability in the future. The forecast of 25.7 billion yen in EBITDA for the fiscal year ending on January 31, 2027 assumes no further M&A transactions going forward. We anticipate additional growth potential through future M&A.

(2) Accounting standards (differences between JGAAP and IFRS)

Differences in accounting standards also impact on our earnings reporting.

・Recognition of goodwill under JGAAP

-Under JGAAP, which we adopt currently, goodwill (amortization) is recognized as a cost.

-Amortization of goodwill has the nature of a fixed cost, with a constant amount recorded quarterly, regardless of sales.

-Therefore, the more M&A we pursue, the more fixed costs on our financial statements will increase.

-Especially during the first half of the fiscal year when sales are low, our structure results in even less apparent earnings (as explained in Q. Why are GENDA’s consolidated earnings concentrated in the second half of the fiscal year?).

・Discrepancy between accounting results and operational reality

-(Unlike depreciation expense,) amortization of goodwill does not result in any future cash outflow.

-As M&A progresses, disclosures under JGAAP increasingly diverge from the actual cash flow situation.

・Transition to IFRS and temporary measures

-Scheduled to transition to IFRS at the end of the fiscal year ending on January 31, 2027, representing the earliest practical timeline.

-Throughout the transition period from JGAAP to IFRS, we will disclose information by adopting IFRS indicators as our KPI.

Additionally, in our 1Q financial results presentation, we characterized our existing businesses as having made a “strong start.”

This is based on the achievement of our 1Q target.

Specifically, based on our KPI, adjusted EBITDA;

・Our plan for the current fiscal year projects 22.4 billion yen, a +45% increase in earnings, against the 15.4 billion yen achieved in the previous fiscal year.

・In the first quarter of our planned +45% increase in earnings, we exceeded the target by 0.45 billion yen / +11%.

Should M&A be halted, M&A-related expenses would no longer arise, potentially resulting in a short-term improvement in reported accounting earnings, especially under JGAAP. We also have the option to halt M&A activities, which would improve the appearance of our accounting results, and allow us to pursue a moderate growth of 22.0 billion yen in EBITDA for the current fiscal year.

However, we have a clear policy of focusing on maximizing future cash flow generation capability. Based on this policy, we have proactively chosen to engage in M&A activities and have already disclosed an estimated EBITDA of 25.7 billion yen for the next fiscal year.

Furthermore, over the remaining six months of this fiscal year, we anticipate even more active M&A activities, fueled by funds from our follow-on offering.

We will not just stand by concerning the apparent accounting results, which are a side effect of our strategy. Instead, we will ensure transparent disclosure, focusing on the previously mentioned “(1) M&A-related expenses (adjusted indicators)” and “(2) Accounting standards (differences between JGAAP and IFRS).” Since the summary of financial results (Tanshin) only contains limited information, we kindly ask you to refer to the financial presentation materials for full details.

For reference: “FY2026/1 1Q Earnings Presentation” disclosed on June 11, 2025.

https://ssl4.eir-parts.net/doc/9166/ir_material_for_fiscal_ym2/181316/00.pdf