M&A Strategy

As we aim to become the world’s No. 1 entertainment company, our M&A targets are not limited to the amusement arcade industry, which has a market size of 540 billion yen, but rather target the whole entertainment industry. As individual companies of the entertainment industry formed a group of companies, countless cross-selling synergies have been actually generated, resulting in significant growth in business performance after joining in the group even outside of amusement arcades.

Fukuya and Shin Corporation are specific examples of non-amusement arcade companies that have had a significant impact on consolidation. In this fiscal year, which is the first one after M&A, it is already ensure that they will achieve a record profit in their corporate history, 71 years of Fukuya and 35 years of Shin Corporation. We believe that it is difficult to explain this without synergies.

On that condition, synergies and PMI are only means, not goals, in M&A. In order to make M&A succeed, the goal should be that “the total amount ofcash flow acquired through M&A exceeds the consideration for M&A paid.” On the other hand, we think that having synergies and PMI as their goal, which means “having means as the goal,” is a typical example of failure in M&A. The details are explained below.

・Our definition of failure in M&A is a reduction in capital as a result of M&A

First, let me explain our definition of failure in M&A. Our definition of failure in M&A is that “the total amount of cash flow acquired through M&A is less than the consideration for M&A paid,” which means that we have decreased our capital as a result of M&A. The reasons for this are as follows.

As a stock company, it is required to maximize its stock value. Maximizing stock value requires maximizing corporate value. Maximizing corporate value requires maximizing cash flow. Nevertheless, if “the amount paid for M&A > the total amount of cash flow acquired through M&A,” the stock value will be damaged because cash flow is lost as a result of the M&A.

We define a M&A which damages stock value, which means “the total amount of cash flow acquired through M&A is less than the consideration for M&A paid,” as “a failure in M&A.” In other words, the definition of success in M&A is that “the total cash flow acquired through M&A exceeds the consideration for M&A paid (on a present value basis),” and we have this as our goal.

・A typical example of failure in M&A is “having means as the goal,” which means having synergies and PMI as the goal.

The goal of M&A is as stated above, and synergies and PMI are just means to increase cash flow. However, we believe that having “synergies and PMI” which are means as a goal, which means “having means as the goal,” is a typical example of failure in M&A. Specifically, this means “to conduct M&A (regardless of the acquisition price) because synergies are likely to be generated with the existing business and increase by PMI.”

When a company has been conducting M&A aggressively in a particular field, if it continues to conduct M&A without caring the acquisition price only because it is likely to generate synergies, even if synergies are actually generated, the acquisition price may be higher than the synergies and it could fail to recover the investment. We should have cash flow as our goal, and having synergies or PMI as the goal is a typical example of failure in M&A.

・Background factors behind the likelihood of failure in M&A by having synergies as a goal.

We believe that the following characteristics of M&A are behind the likelihood of such failures.

・ It is easy to conduct M&A just by paying a high price and we can increase PL immediately afterwards.

・On the other hand, it takes some years to find out if the acquisition price was right.

・In M&A, the sunk cost is high because it has a lot of person-hours. People on the line want to complete the M&A if possible.

・To solve this issue, the function to check the acquisition price deteriorates in the cause of synergies.

These are the characteristics of M&A. We have analyzed that the cause of typical failure is having means as the goal, which means that “Let’s carry out M&A because it looks like we can generate synergies (even at a slightly higher price).”

・The premise of the doubt that synergies and PMI are all right is a thought that “M&A = overpriced.”

When it comes to M&A, there is a common doubt that “synergies and PMI are all right.” A cause underlying this doubt is a mind that “basically, the acquisition price in M&A is relatively high compared to the cash flow of the target company on its own, and M&A will fail if the cash flow of the target company does not increase through synergies and PMI because we cannot recover the investment in the first place.”

However, the premise that M&A = relatively expensive is not correct. In the entertainment industry, which is our target, there are structures which are suitable for M&A, such as stable business conditions with a long business history, balance sheets of net cash and needs for business succession etc. For more information, please see the following sponsored research report.

(For reference: “Capital Growth Strategies (Initial Report)” dated October 18, 2024)

・GENDA is an operating company which conducts M&A specializing in the entertainment field by using an investment firm’s perspective of M&A.

We firmly emphasize M&A at the right price, not conducting M&A based on synergies or PMI. M&A will fail if the goal is not to increase cash flow, and the axis of investment decisions is whether this can be secured or not. Acknowledging the aforementioned temptation, we avoid having means as the goal and make investments which are faithful to the theory of stock value.

On that basis, countless cross-selling synergies have been generated. Let me explain specific examples of the synergies that have actually occurred in Q2, that is why GENDA is an operating company, not an investment firm in Q3, the rationality of conglomerate in Q4 and the connection between GENDA’s strategy and its Aspiration “More fun for your days” in Q5.

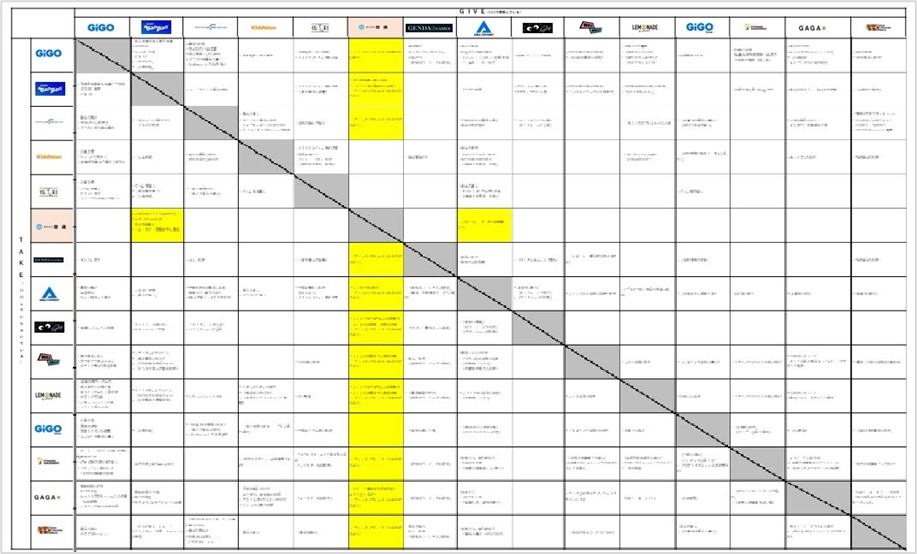

We have countless synergies within our group and we have verbalized them in detail. Below is the latest table of our group synergies that we use in our internal management meetings.

This is just an example for your reference.

For example, although amusement arcades and karaoke seem to be different businesses and customer segments, the concept of opening new stores is the same, and the amount of information on available tenants is critical. While we used to collect tenant information as an operator of about 330 amusement arcades, the addition of about 360 karaoke premises has improved our store development capabilities by integrating store development with tenant information on the karaoke side.

This has also made it possible that it is possible to open an amusement arcade even if it is unprofitable to open karaoke (or vice versa). Even among existing stores, we have changed a store which is too big only for karaoke to an amusement arcade and improved the profitability. In areas where store locations overlap, we attract new customers by distributing discount coupons for both.

Fukuya, which designs prizes, is located on the upstream of value chain of amusement arcades. Its volume of transactions has dramatically increased not only because of the expansion of GiGO’s operation, but also the creation of huge demand for Japanese Kawaii products in North America through Kiddleton and NEN as GENDA. There is a big effect of increasing the stock value just to take in the profits by making it consolidated, which would flow away outside if we did not conduct the M&A. Besides, we share the information on sales of each product in a timely manner and this makes us possible to make minor changes. The same effect has arisen for Ares, too, which has a function as a trading company of prizes.

As for Lemonade and Kleiner, the sales functions have dramatically improved, that was difficult when they stood alone. By joining in the group, products of Lemonade and Kleiner are distributed on the grand menus of all 360 Karaoke BanBan premises, and they have opened new stores in existing amusement arcades, too. In addition, it is possible for them to share the opportunity when we open a new amusement arcade in a shopping center.

Furthermore, since ONTSU, which is a distributor of karaoke equipment, joined us, the volume of business with Karaoke BanBan has increased and this has enabled our group to take in the profits which were supposed to flow away outside of the company. In addition, it is now possible to sell Kleiner for the night market which is ONTSU’s customer base. C’traum, which sells Kleiner, did not have any employee or sales function before the M&A. But now it is possible to access to sales channels on a number of fronts without no additional cost.

GAGA, which is a movie distribution company, has also created countless cross-selling synergies that were difficult to achieve on its own, such as extensive advertising of its movies on digital signage at GiGO Flagship Store facing Ikebukuro Sunshine 60 Street, staff of amusement arcades wearing a T-shirt with movie ads, and offering rooms with movie characters and food and beverages at karaoke etc.

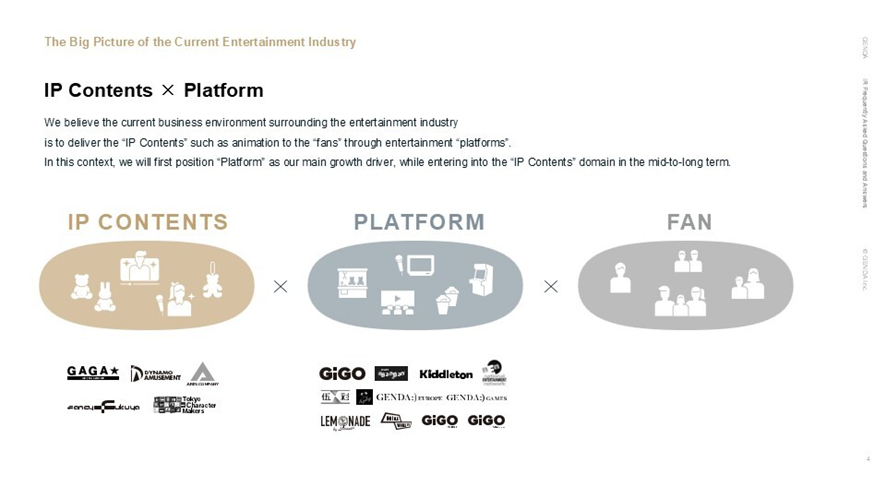

These are just a few of the verbalized synergies, but the reason for the various synergies is that although the entertainment industry seems to be broad, from a broad perspective, it is connected from the upstream “Contents” to the downstream “Platform” from the customers’ (entertainment fans’) perspective. Based on the structure of entertainment industry, which is “IP→platform→fans,” there are countless cross-selling synergies.

Of course, there are synergies from roll-up M&A of amusement arcades. However, there is much room to create synergies in M&A focused on the entertainment field which is contiguous, more than in M&A limited to amusement arcades. From these perspectives above, we believe that the formation of an entertainment conglomerate through GENDA’s unique Entertainment Ecosystem has many advantages.

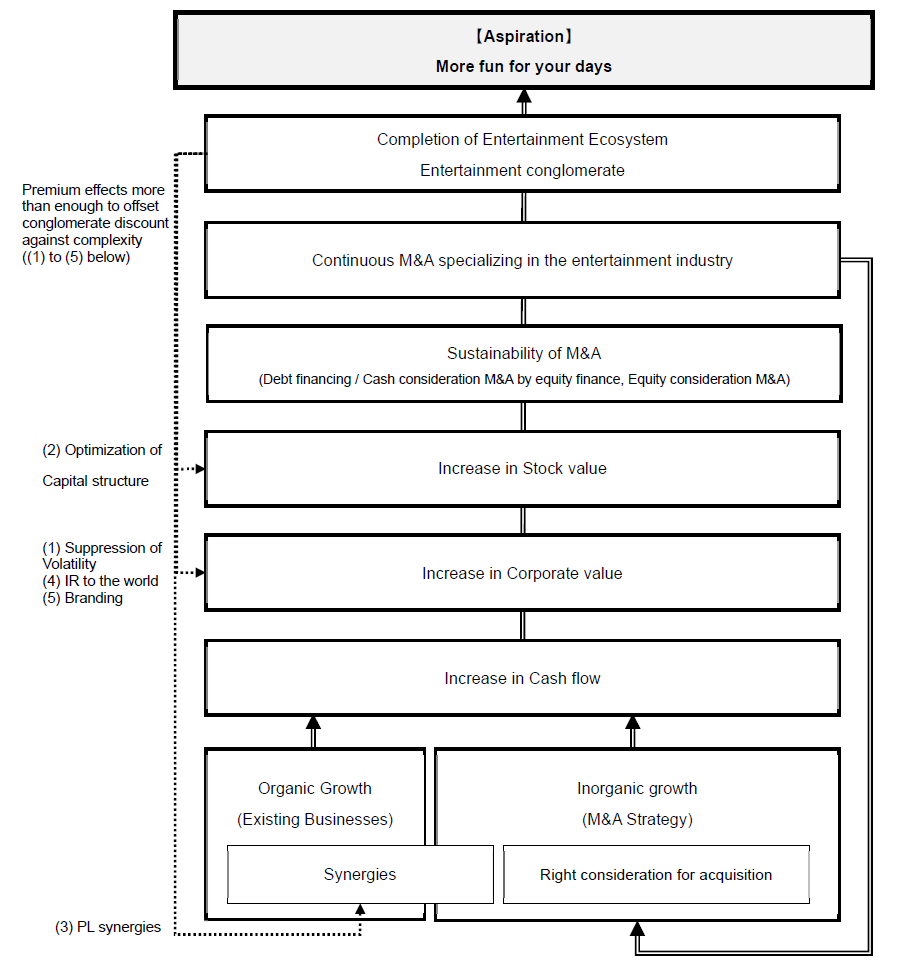

In conclusion, we believe that GENDA’s Entertainment Ecosystem can realize a “conglomerate premium” that more than offsets the conglomerate’s discount for complexity. We provide more details below.

・What is conglomerate discount?

This is a phenomenon in which the corporate value of a company with multiple businesses is valued lower than the sum of the business values of the individual businesses. This basically occurs because investors dislike “incomprehensibility.”

・Why GENDA believes that a conglomerate premium can be achieved.

GENDA hopes to achieve the exact opposite: a “conglomerate premium”. In other words, a state in which the value of the whole group continues to be valued higher than the sum of the values of the individual businesses. The following five points explain why we can achieve this.

(1)Suppression of Volatility: Increase in Corporate value (and increase in stock value by that)

“Individual entertainment companies are undervalued.”

Entertainment is ever-changing, ups and downs and tends to be valued low by investors who avoid volatility from the perspective that “Will what is accepted by the world now be accepted next year and the year after?” “Will it be able to maintain sales profits?” Even if individual businesses are volatile, GENDA will transcend this volatility by forming an appropriate business portfolio. In other words, we aim to create a situation where “we keep growing strongly every year as a group even though an individual business might have a bad year.”

→As it is necessary to tolerate volatility when you invest in each company itself, the expected return goes up and the capital cost is high, too. However, by forming an entertainment conglomerate, the volatility will be reduced as whole GENDA and the capital cost will decrease. The decrease in capital cost, which is the discounted rate of cash flows, will increase the present value of total amount of cash flows and the corporate value will increase.

(2)Optimization of capital structure: Increase in Stock value

“Individual entertainment companies have unnecessary cash.”

For the same reason as (1), individual entertainment companies themselves often have cash which they do not need for the time being to prepare for “future volatility.” GENDA, by managing funds on a group-wide basis, will put the remaining funds into investments for the next growth while preparing for sudden capital needs.

→Based on the “Modigliani-Miller Proposition (MM Proposition),” the first proposition of the MM Proposition theoretically proves that “capital structure has no effect on corporate value in a perfect capital market.”

On the other hand, even if the corporate value remains constant, we can increase the stock value by capital structure. We can do that by utilizing excess funds and debt properly and making the stock structure more appropriate (In reality, the capital market is not perfect, and taxes and bankruptcy risks exist. Therefore, the pursuit of the best capital structure will increase the corporate value as well). In addition, it is possible to do business on a consolidated basis with financial institutions that each company could not meet on their own, making it possible to effectively utilize debt with low capital cost compared to the equity, which also leads to an increase in corporate value.

(3)PL synergies: Increase in Corporate value (and increase in stock value by that)

Realization of countless and cross-selling synergies within the group

As stated in Q2, countless cross-selling synergies are generated, which occur in the contiguous entertainment industry.

→Improved PL of each subsidiary increases cash flow and the corporate value will increase.

(4)Communications with investors: Increase in Corporate value (and increase in Stock value by that)

Detailed and sincere explanations to investors

GENDA is committed to explaining our business to investors around the world. We will continue to make efforts to give investors whom we could not meet if we remained an individual company a better understanding of the attractiveness of each business and that of the group.

→As we expand our investor base around the world, we will be able to meet investors and funds with lower capital cost, and as the capital cost decreases, corporate value will increase.

(5)Branding: Increase in Corporate value (and increase in stock value by that)

We will increase the number of fans of GENDA. By doing that, we will achieve greater effects as a group than if each individual company acted individually in all aspects, including recruitment, opening new stores, purchasing, sales, business tie-ups, M&A, fundraising etc.

→Corporate value will increase due to the improvement of PL and decrease in capital cost of each company in points other than (1) through (4).

With GENDA’s becoming a conglomerate, the occurrence of a conglomerate discount due to certain complexities may be unavoidable. However, we believe that there will be effects of increasing corporate value and stock value as described in (1) through (5) above, including reasons specific to entertainment, and these effects will more than offset the discount, resulting in a conglomerate premium that will keep the value of the whole group valued higher than the sum of the values of the individual businesses.

We are an operating company, not an investment firm. Although we are an operating company, we place M&A at the center of our strategy as same as an investment firm does, and conduct M&A based on the same judging criteria as an investment firm. However, we limit our target domain to the entertainment domain, and in reality, countless synergies are generated in the entertainment domain, and we consider ourselves an operating company, not an investment firm.

First, since it is necessary to define an investment firm and an operating company, let me provide a definition based on our ideas.

・Our definition of “investment firm”

Regardless of synergies, an investment firm will choose M&A if it comes into existence as an investment, in other words, if cash flow increases through M&A. No one asks a question about Company A and Company B, with which the investment firm has conducted M&A, “Why did the investment firm conduct M&A with each of these two companies, although they were not related in any way?” This is because it is obvious for the investment firm that there is an assumption that “Company A and Company B, each of them comes into existence as an independent investment (we can recover cash flow compared to the invested capital).

・Our definition of “operating company”

We consider a company to be in a state where it operates business in a specific area, each creating synergies and creating more value than if it existed as a stand-alone company. Although operating companies may also conduct M&A, they are not considered as an investment firm only because they conduct M&A. If an operating company continues to conduct M&A in an industry that is too unrelated to its own, it may be considered as an investment firm. However, if there are more synergies by doing business together as a group than by doing that independently, then we believe that the company can be considered as an operating company.

・GENDA is an operating company that conducts M&A based on the same judging criteria as an investment firm.

Although we are an operating company, we place M&A at the center of our strategy as same as an investment firm does, and conduct M&A based on the same judging criteria as an investment firm. However, our target domain is limited to the entertainment domain, and in reality, countless synergies are generated in the entertainment domain, and we believe that we are an operating company, not an investment firm.

When you hold several companies which are completely unrelated as an investment firm, there are cases where the value of the whole group is lower than the sum of the corporate values of each group of companies due to the usual conglomerate discount. On the other hand, GENDA will benefit from the advantages of conducting M&A as an operating company through the conglomerate premium described above. Besides, since multiple indexes such as PER are calculated based on the growth rate in theory, we would like to justify it by maintaining a high growth rate through M&A.

The relationship between GENDA’s strategy and our Aspiration based on the description of this document is as follows.

GENDA believes that “fun” is essential for human beings to live life in their own way and has set “More fun for your days” as our Aspiration.

To achieve this Aspiration, GENDA’s vision is to “become the World’s No.1 Entertainment Company by 2040,” and we aim to “complete GENDA’s unique Entertainment Ecosystem” by keeping making “Continuous Transformational Growth” through “M&A in the entertainment industry” as a growth strategy to achieve it.

GENDA will transcend the volatility of the ever-changing, ups and downs entertainment business by diversifying our business portfolio, and at the same time, GENDA’s becoming an entertainment conglomerate will create countless synergies for each entertainment company and we will continue to create new values.

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)