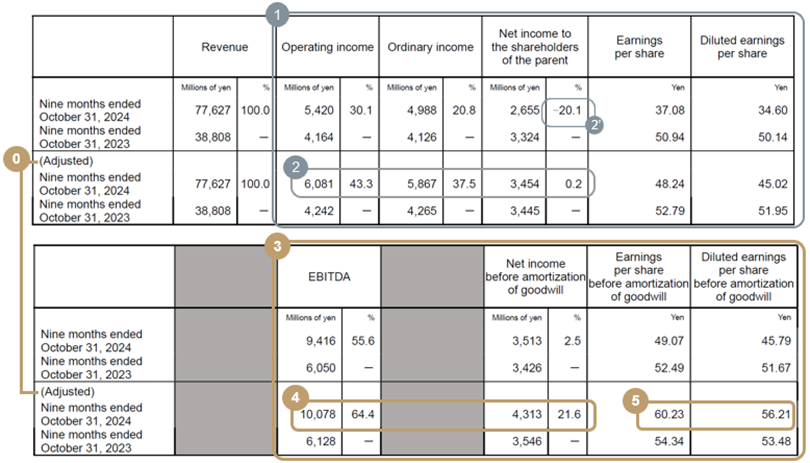

Our company expanded the disclosure of “Tanshin” from the latest explanation of FY2025/1 3Q results.

Why we expanded is because it is difficult to “measure organic business” via GAAP results even though earnings release is an “stationary measurement of organic business.”

One of the main causes is one-off M&A-related expense.

Our company continuously engages M&A activities – while one-off M&A-related expenses incur when those M&As are completed. The total amount of these expenses is recorded as expenses in a lump sum when M&A is completed, which means one-off expenses, although they are originally expenses in order to acquire the target company which will contribute to income every year forever.

Then, in the GAAP results, only the figures, after recording these M&A-related expenses, are presented.

On the other hand, our organic business itself has remained strong as already reported. Specifically, GENDA GiGO Entertainment, which runs amusement arcades as GiGO brand, Shin Corporation, which runs karaoke boxes as BanBan brand, and Fukuya, which plans prizes of prize games, are the top three companies in the amount of contribution to our consolidated earnings, and all of the three expect to record the highest earnings in each company’s history.

However, in the GAAP results, only the figures mixing figures of these strong organic businesses and one-off M&A-related expenses are presented.

Therefore, those working in our company who know the internal figures can see that our organic businesses are strong. However, if only the GAAP results are shown to external investors, the information is quite asymmetric, and we are afraid that it will interfere with appropriate decision making in investments.

Therefore, we are doing our best to solve the asymmetric diversity of information by providing the internal figures which those in our company know, to external investors as well.

The internal figures which those in our company know mean the earnings results excluding M&A-related expenses. We show external investors such figures as “adjusted” income.

We believe that “adjusted” figures are important indicators to measure “intrinsic performance of organic business.”

Now, let us explain to you based on our 3Q earnings presentation.

We are showing the referenced figures by the number for your reference.

(Reference: “FY2025/1 3Q Earnings Presentation” disclosed on December 10, 2024, pages 12-13)

“Adjusted” indicators presented in ⓪

We put “adjusted” indicators after deducting “one-off expenses which would not incur without M&A” so that you can understand the “intrinsic performance of organic business.” Specifically, we deducted M&A executing fees, M&A financing fees and Equity offering fees.

Now, let us explain each of them specifically.

- M&A executing fees

We deduct brokage fee, legal fee, DD fee, FA fee, appraisal fee for the current and previous fiscal year.

- M&A financing fees

We deduct M&A financing fees for current and previous fiscal year. We limited this to M&A-related financing fees and do not deduct the ones for organic business.

- Equity offering fees

We deduct the follow-on offering fee in July 2024 (UoP: M&A). We deducted the IPO fee in July 2023, too, to show the intrinsic performance of organic business and stay conservative comparison although we did not have to because it was not related to M&A (which means this is a conservative comparison because income of previous fiscal year is adjusted upward and the comparison hurdle increases).

Next, let us zoom in on each item.

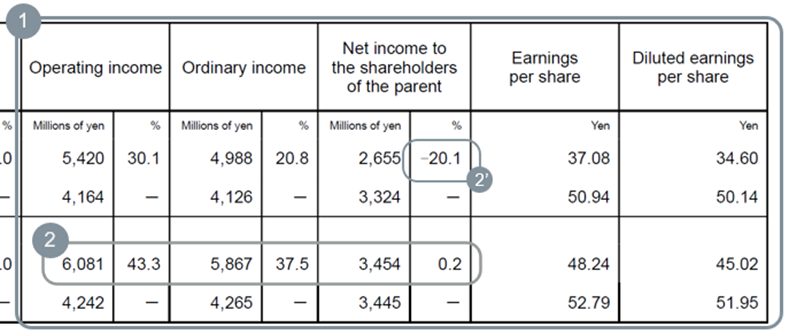

① Income indicators after amortization of goodwill = figures for reference

We think that these income indicators are figures just for reference because amortization of goodwill which is not related to cashflow is deducted. That means, if you measure the enterprise value by using income indicators after amortization of goodwill, you will deduct the enterprise value double.

Following is an excerpt from “Frequently Asked Questions and Answers (March 2024).”

First, we believe that for a normal company that only does organic growth, it is appropriate to measure it in terms of operating income. This is because depreciation is something that will “actually” continue to cash out in the future due to capital expenditures. We do not believe that it is inherently necessary to add it back to operating income.

On the other hand, there is no additional cash outflow for amortization (of course, capital investment will be made, and the same arguments apply for depreciation as described above). In this respect, it differs significantly from depreciation, that actually need additional cash outflow whereas none for amortization.

Because of this difference, if goodwill amortization is also deducted in the analysis of performance, as discussed below, it is doubly deducted from the value of the enterprise. This is because the cash outflow has already been completed at the completion of the acquisition, it has already been factored into the balance sheet either through a decrease in cash or an increase in debt, and unlike capital expenditures, it will not occur in the future.

In the DCF method, which measures the intrinsic corporate value of a company, the equity value is calculated by adding up all the free cash flows that will be generated forever, and then deducting the “Net Debt” on the balance sheet at the end, which exactly deducts the completed cash out for the M&A. Therefore, judging the M&A company by its operating income afterwards is a double deduction of value. M&A companies emphasize the addition back of goodwill amortization because only the amortization of goodwill differs from companies with organic growth, and GENDA, in that regard, is an appropriate inspection indicator as long as the goodwill amortization is added back to operating income. In other words, it is precisely speaking, “EBITA.”

In addition, companies that only grow organically basically have zero goodwill amortization, so in a sense, operating income = EBITA as a figure that adds back (zero) goodwill amortization to operating income.

However, EBITA is not an indicator that is displayed in a general-purpose database, so we recommend that you make your decision based on EBITDA, which is a common indicator.

On this point, we officially resolved to aim to apply IFRS in FY2027/1 at a meeting of the Board of Directors and we believe that this will be solved by applying IFRS.

② All indicators are increase YoY even after amortization of goodwill although they are figures just for reference

We show the year-on-year comparison of operating income, ordinary income and net income in organic business which are adjusted, which means “one-off expenses which would not incur without M&A” are deducted.

Although they are indicators after amortization of goodwill and just for your reference, we believe that you can see that our organic business has been strong so that all indicators have increased YoY. Operating income +43.3% and ordinary income +37.5%, a big increase YoY. Only the growth rate of net income looks lower, this is because corporate tax started incurring from this year.

Besides, since the absolute amount of net income (after tax) is smaller than operating income and ordinary income, the impact of “amortization of goodwill and M&A-related expenses” is bigger than operating income and ordinary income. Because these expenses are not tax deductible, and “the same amount” is deducted from all of operating income, ordinary income and net income. As a result, net income in the accounting results presented in ②’ tends to look lower.

On the other hand, with these M&A-related expenses, we expect that the target EBITDA of FY2026/1 should be 21.2 billion yen against the target EBITDA of FY2025/1, 13.0 billion yen, which means transformational growth with +63% / +8.2 billion yen.

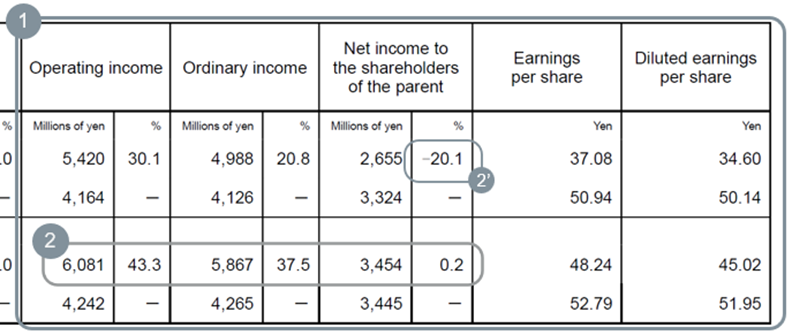

③ Indicators before amortization of goodwill = our KPI

Because of the reasons stated above, we believe that it is better for you to see ③ which we voluntarily and additionally disclose to make an investment decision on our company, which focuses our strategy on M&A, until IFRS is introduced to us.

④ Our KPI achieved higher YoY income growth than the strong the first and second quarters

We show the year-on-year comparison of KPIs excluding M&A-related expenses here.

EBITDA, which we use as a KPI, was adjusted to show a year-on-year increase of +64% / +4.0 billion yen, which is a higher rate of increase than in the first and second quarters. This means that we have grown into a company that generates cash flow of over 10.0 billion yen in the first three quarters.

Similarly, our another KPI, net income before amortization of goodwill, increased by +21% / +0.8 billion yen year-on-year after adjustment, and the rate of increase exceeded that of the first and second quarters, with a significant increase in income after offsetting the corporate tax incurred from this year.

⑤ Cash EPS turns upward although “M&A is not announced yet”

Let us explain in detail the fact that Cash EPS had already turned upward, although 10.0 billion yen of follow-on offering was not spent on M&A yet as of the third quarter.

Appropriate discipline is absolutely necessary in M&A strategy. We set to check whether “Cash EPS,” which is a version of “net income before amortization of goodwill” of “EPS,” increases as our discipline of M&A. If you ignore an appropriate valuation and conduct M&A at a higher price in an unregulated way, it is possible to show as if the earnings and cashflow are increasing. However, whether this indicator increases or not, is one of the important axes to test such discipline.

It is because the performance of a company is often judged by the earnings or cashflow after the M&A, while the consideration for M&A was already paid. The important point is whether cashflow increases after comparing with the actual consideration paid for the M&A.

Obviously, if you pay more as consideration for M&A than an increase in cashflow, it is a failure as an investment. Although this is a discussion of M&A consideration combining debt and stock, and the stock portion excluding the debt matters most for the shareholders.

If you increase the number of shares in an unregulated way, the market value will increase but the share price will decrease. Cash EPS is an indicator to check this. This indicator is calculated by dividing net income before amortization of goodwill with the number of shares. As long as this indicator increases, you can see that the increase in income (numerator) is higher than the increase in the number of shares (denominator).

We carried out a follow-on offering with 10.0 billion yen last July. It was a decision-making which increased the number of shares, which is a denominator of Cash EPS, the most in our history. If the numerator is not increased by spending the 10.0 billion yen on M&A, this increase in denominator will damage the equity value.

On the other hand, we had not spent the 10.0 billion yen at all as of the third quarter. Therefore, only the denominator increased drastically. Nevertheless, as provided in ⑤, Cash EPS in the third quarter was +10%. This suggests that our strong results in organic business are producing effects more than offsetting the increased number of shares due to the follow-on offering.

Yesterday we announced that we would acquire the foreign currency exchange machine business through 70% with our shares and +30% in cash. We plan to spend 1.6 billion yen of the 10.0 billion yen raised for the 30% cash portion of the acquisition.

To increase Cash EPS in the most comprehensible way is to acquire a company or business which has a lower P/E multiple than our P/E multiple by conducting M&A. With this assumption, we will spend the M&A fund which was raised by follow-on offering and P/E multiple was 29x at that time, to get 30% of the shares of the target company, of which P/E multiple is 8.7x. And we will exchange the rest, 70%, with GENDA shares, which P/E multiple was 38.7x on the day before the announcement. Therefore, we believe that you can see that Cash EPS will increase remarkably.

If we spend the 10.0 billion yen of follow-on offering for M&A again in future, the absolute amount of Cash EPS will increase if the target company has a surplus. To be exact, because P/E multiple was 29x on a Cash EPS basis which we raised by the follow-on offering in July 2024, “Cash EPS increases” and can justify the follow-on offering only after P/E multiple of the M&A target company is lower than 29x.

Therefore, we do not think that all M&A are acceptable as long as the target company has a surplus in future. We will execute by emphasizing the appropriate valuation the most.

In our company, our officers and employees examine target companies of M&A pipeline and execute M&A. At the same time, these officers and employees consist of more than 25% of our shareholders and we have a strong function to check dilution of Cash EPS as well as our external shareholders.

From our shareholders’ perspective, as a representative of our shareholders, we will invest precious assets of our shareholders together with the assets of our officers and employees in the entertainment industry, which enjoys a tailwind from the worldwide Japanese anime culture, with discipline. As a result, based on our Aspiration, “More fun for your days,” we set “to be the World’s No.1 Entertainment Company by 2040” as our Vision, keep making “Continuous and Transformational Growth” through “M&A in the entertainment industry” and aims to complete “GENDA’s unique Entertainment Ecosystem.”

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)