Financial Results

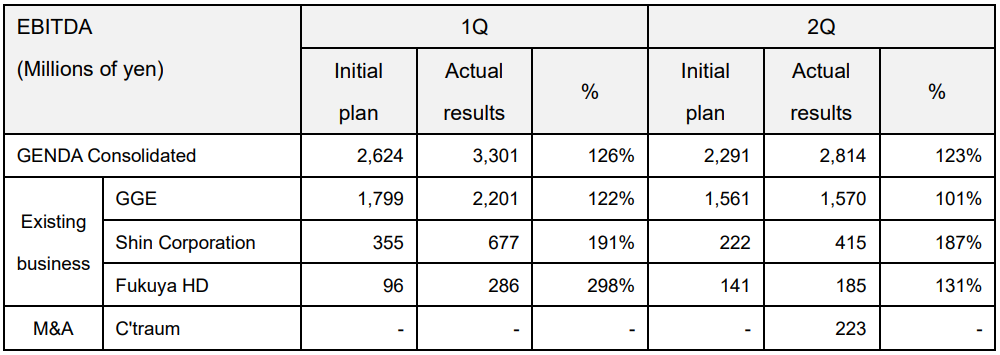

There are two factors for that performance which were (1) an upturn in existing businesses and (2) contributions from companies acquired through M&A.

Note: Showing existing businesses and new M&A targets with a consolidated contribution of more than 1bn yen. “GGE” refers to GENDA GiGO Entertainment; GGE and FUKUYA HD are consolidated financials (although GGE numbers are excluding Kiddleton basis).

- (1) Upturn in existing business

Existing businesses significantly exceeded the initial plan as shown above. This was mainly due to the continued strong performance of amusement arcade and its peripheral areas, as well as the increase in profit from karaoke.

- (2) Contribution of companies acquired through M&A

Among the M&A projects announced this fiscal year, which were not anticipated in the initial plan, C’traum, which has already closed, is contributing to profits.

Our company’s core business is M&A, and as we repeat M&A, there is a large discrepancy between our cashflow generating ability at the beginning of the fiscal year, and that of after M&As during the fiscal year. We believe that such information asymmetry is undesirable for investors to make investment decisions in our company, which advocates Continuous Transformational Growth, and that it is important for us to present our M&A-consolidated cashflow generating ability in a timely and appropriate manner.

We consider the sales and profits that can be generated in a 12-month period to be the actual cashflow generating ability. The assumptions for this are that there will be no additional M&A activity, and therefore no one-time M&A-related expenses during the period, and no contribution to earnings by the target company of the M&A activity.

When we try to show you this actual ability, we cannot do so with a full-year forecast during the same fiscal year in which the M&A took place. This is because (1) one-time M&A-related expenses are included in the forecast for the year in which the M&A is announced, and (2) the M&A target company will contribute to the forecast for less than 12 months.

On the other hand, the actual cashflow generating ability is almost synonymous with the “next fiscal year” earnings forecast. This is because we do not incorporate undisclosed M&A into our earnings forecast, thus eliminating (1) and (2) above.

Therefore, in the future, when M&As during the fiscal year have a certain impact on our cashflow generating ability that are initially assumed at the beginning of the year, we expect to disclose such based on the assumption that M&A-related expenses are excluded and contribute to our performance for a full 12 months, i.e., our forecast for the following year, in a timely and appropriate manner without waiting for the full fiscal year results.

Although we will incur a certain amount of M&A-related expenses this fiscal year, we have already increased the KPI of EBITDA by 5.5 billion yen (+42%) from 13.0 billion yen to 18.5 billion yen at the end of the first half of the fiscal year. We would like to achieve transformational growth with M&A expenses rather than 13 billion yen +α growth avoiding M&A expenses.

The forecast for the next fiscal year (1) does not include the contribution to earnings (and one-time expenses) from undisclosed M&A, and (2) conservatively incorporates growth from existing businesses.

The reason for doing (1) is that if we announce a business forecast that incorporates potential M&As , there is a risk that we might execute an unreasonable M&A to achieve our business performance, resulting in M&A that will result in a high price tag. The reason why we do not disclose our medium-term management plan is based on the same reason.

On the other hand, regardless of the earnings forecast for the next fiscal year that we are currently announcing, we are working rigorously to announce our current M&A pipeline as soon as possible.

The entire amount of 10 billion yen raised through this public offering will wholly be used as standby funds for future M&A. Therefore, this 10 billion yen will never be spent to the M&As that have already been announced or closed as of today. The 10 billion yen will be used sequentially for M&A projects after today, together with debt financing.

Since July 31, when we received 10 billion yen, although there is actually no cash outflow, we are aware that the cost of capital for the shares is incurred as well as interest on debt, and that the cost to be returned to investors is compounding even before we actually use the funds for M&A. On the other hand, as M&A being our core business, we believe that we should not rush to use the funds for a poor M&A.

Therefore, in order to minimize the opportunity loss until the funds are actually used in the M&A, we currently do not keep the 10 billion yen funds in our deposit account, but rather manages the funds in a low-risk, short-term manner in order to generate as much interest income as possible. Since the funds for M&As are actually remitted at the time of final completion, not at the time of announcement, the short-term fund management does not interfere with the M&A process.

We will be aggressively pursuing M&A projects with the funds entrusted to us by our investors, and will announce our current pipeline one by one as soon as possible.

Business

ince NEN is pre-closing as of today, we will refrain from mentioning specific results.

On the other hand, the Financial Results for the Second Quarter of the Fiscal Year Ending January 31, 2025 The results of the location test that Kiddleton is developing to replace Japanese-style game machines and prizes, which was mentioned in part in “2Q Results”, have exceeded our initial expectations, and we will report on the progress at the appropriate time after the closing.

The forecast of EBITDA of 18.5 billion yen for the next fiscal year conservatively assumes a growth rate of zero for NEN.

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)