Company Information

The “Deal of the Year 2024” is selected and ranked based on a survey conducted by NIKKEI Veritas for institutional investors and securities companies.

The survey has evaluation criteria with three points; (1) whether we have met the issuing entity’s capital needs and business strategy needs, (2) whether the demand survey on issuing or selling situation, the change in prices after issuing were valued by investors and (3) whether the deal was meaningful to the capital markets.

As reported, our follow-on offering conducted in July 2024 was highly valued and we ranked as number three in the Best Equity Finance category for the “Deal of the Year 2024,” which was announced in NIKKEI Veritas dated January 26, 2025 (please refer to “Frequently Asked Questions and Answers (August 2024)” disclosed on August 5, 2024 for more details of the follow-on offering concerned).

Considering the offering size that the No.1, ASICS was about 200.0 billion yen (secondary only) and the No.2, HONDA was about 500.0 billion yen (secondary only), why our 12.6 billion yen (primary + secondary) was ranked number three, we believe that this is primarily due to our shareholders’ support in the capital market and we really appreciate the great support from our valued shareholders.

We will make further efforts in 2025 and aim to make further progress. Your continued support would be highly appreciated.

M&A Strategy

In February 2024, Shin Corporation, which operates karaoke boxes nationwide under the “Karaoke BanBan” brand, joined GENDA. The karaoke business operated by Shin Corporation has achieved robust growth as of the third quarter compared to the initial target thanks to successful PMI (post-merger-integration) after joining GENDA. In addition, Shin Corporation is expected to achieve the highest earnings in this fiscal year in its 35 years history since its establishment and in its first year in GENDA.

With Karaoke JIYU-KAN’s joining of GENDA, we now operate a total of approximately 390 karaoke boxes. As PMI in the karaoke domain, we have implemented measures to both increase sales and reduce costs to create synergies in the group.

【Measures to increase sales】

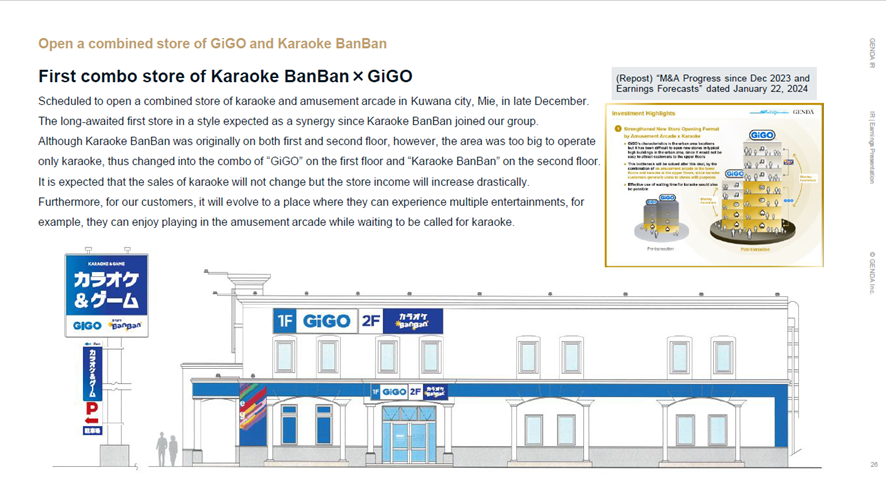

- Develop and open a new combined store with amusement arcades

(Page 26 of “FY 2025/1 3Q Earnings Presentation” disclosed on December 10, 2024)

This is the first combined store with GiGO on the first floor and Karaoke BanBan on the second. Originally, only Karaoke BanBan used to operate on both floors there as Karaoke BanBan Kuwana. As a result, while using the same building but operating both GiGO and Karaoke BanBan, sales increased 2.2x year-on-year.

As previously reported, the karaoke business itself has significantly exceeded its initial target. However, we believe that there is room for further growth through these full-scale synergies, and we believe that we can see the core of roll-up M&A in the M&A of these 23 stores.

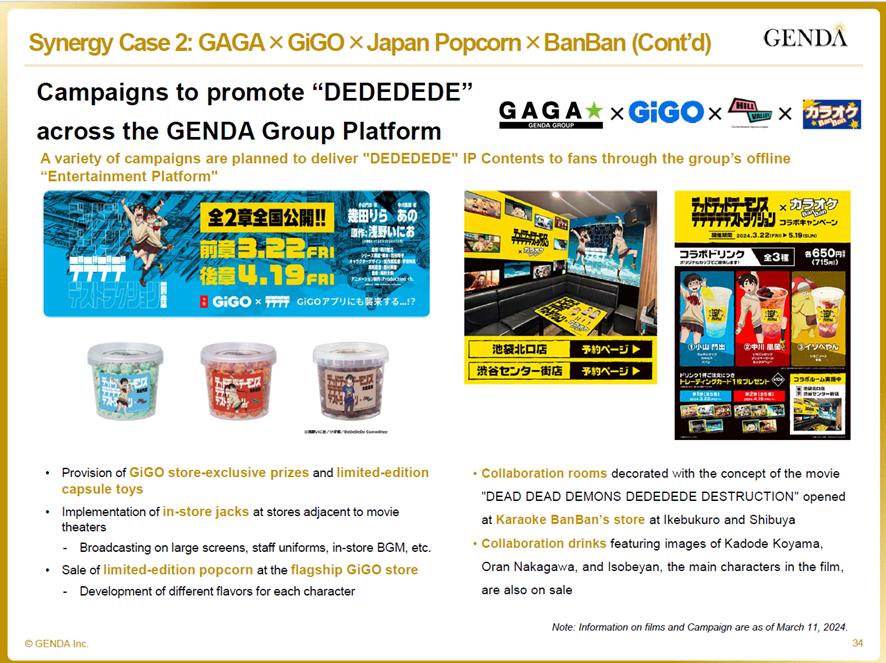

- Mutual expansion of sales by developing IP collaborations and providing food and beverage products of the F&B domain

(Page 34 of “FY2024/1 Earnings Results and FY2025/1 Earnings Forecasts” disclosed on March 11, 2024)

- Strengthen measures to enclose customers by utilizing GENDA ID

- Mutual customer transfer with amusement arcades between neighboring stores

We have implemented a mutual customer transfer measure between stores within a 1km radius of each other since last June. The targets are 75 GiGO stores and 67 Karaoke BanBan stores, which have distributed service tickets and displayed promotional posters.

【Measures to reduce costs】

- Make the cost more efficient such as bulk purchase of consumables etc. as GENDA, which is the core of roll-up M&A.

- Make the capital more efficient by GENDA’s group finance.

In terms of valuation, karaoke boxes have a strength which recoupment period is shorter than that of amusement arcades because they require less investment in equipment upgrades. Specifically, while the conversion ratio from EBITDA to free cash flow (FCF) is about 50% in amusement arcades, this indicator is about 70% in karaoke boxes because machine installment and maintenance CAPEX are less. Therefore, if M&A were conducted in amusement arcades and karaoke boxes at the same EV/EBITDA multiple, karaoke boxes would have an advantage of a shorter recoupment period.

Although the acquisition of “Karaoke JIYU-KAN” resulted in an EV/EBITDA 7x+ (the latest actual value), in light of the above EBITDA to FCF, the recoupment period is comparable to that of M&A with EV/EBITDA 5x+ in amusement arcades. Furthermore, the above valuation is based on the “actual results of the previous fiscal year” of “23 stores in the single business.” If this is evaluated based on the “results of the next fiscal year and beyond” with “group synergies” arising among “approximately 390 consolidated stores” and “a recover of number of customers after COVID-19 pandemic,” we can expect a shorter recoupment period.

The above “EBITDA to FCF” denotes FCF divided by EBITDA. The background is, since the actual source of investment recoup is not precisely EBITDA but FCF, from which taxes and maintenance CAPEX are deducted, we consider the investment recoup on a cash flow basis as most important in a M&A transaction.

On the other hand, since actual FCF fluctuates greatly depending on the CAPEX in a single year, thus EV/EBITDA is generally used as a simple reference. Therefore, we disclose EV/EBITDA multiple whenever possible.

We place a high priority on investing at appropriate valuations. Besides, we consider the roll-up of amusement arcades, which is easy to enter at appropriate valuations and for which a PMI pattern has been established, to be the most important in our M&A strategy. However, we believe that the roll-up of the karaoke business, which is currently significantly higher than our target, will also have great significance from the perspective of investment recoupment efficiency.

Financial Results

In conclusion, I would like to explain that the impact from increasing interest rates is insignificant. The reason is that we have been able to conduct M&As at appropriate valuation. The details are as follows.

First, many of our past M&A transactions have been financed through borrowings. In many cases, the condition was eight-year equal repayment.

The source of repayment of this fund is solely dependent on the free cash flow (FCF) of the target company. In other words, it is assumed that the free cash flow of the company joined the group by M&A (although each case has its characteristics) will be able to repay the amount paid for the consideration = the borrowing within eight years.

Based on the assumption that the target company has going concern, this condition (repayment within eight years) corresponds to an investment yield conversion of at least 12.5% per annum (100 divided by 8). Besides, centering on amusement arcades and karaoke, the target companies have grown a lot after joining the group with synergy effects as already reported, which means that the FCF has grown strongly, too, with that growth.

As a result, the recoupment period was 5 years (20% yield), 4 years (25%), 3 years (33%), etc., in some cases of M&A in the past. These are yields including debt and corresponding to our weighted average cost of capital (WACC). We believe that they are significantly above the level required of listed companies.

In addition, since our interference is suppressed as the majority of our M&As are financed by debt and the majority of the debt costs are slightly more than 1% only, the return on equity investment excluding debt spikes and is much higher than the above figures. This is the return corresponding to our cost of equity, and we believe that we have been able to manage at a significantly higher level.

Getting back to the interest rate, this means that we are managing funds, raised at an interest rate of about 1%, at the above yield. Therefore, in an extreme case, even if our borrowing rate suddenly rises to 2%, we would still be able to secure a substantial margin.

From a comparative perspective, let me explain a case in which negative effects from increasing interest rates are significant. It is a case where the investment yield is low. For example, let us take a look at a case where the yield is 5%.

When an M&A project with a yield of 5% (which means the recoupment period of consideration paid for M&A is 20 years) is financed with a borrowing with an interest rate of 1%, if the interest rate rises to 2%, the margin goes from 4% (5%-1%) to 3% (5%-2%), and although the margin itself remains plus, the return itself is reduced by 25% (3% ÷ 4% -1) and the project’s contribution to earnings is reduced by 25%, too (in real, it will be lessened a bit by tax shield). Thus, by ensuring conducting M&A at an appropriate price, we have a large buffer against interest rate fluctuations.

In terms of the amount of interest paid, even if interest rates were to rise by 1% against the balance of interest-bearing debt of 48.6 billion yen as of the end of the third quarter of the fiscal year ending January 31, 2025, the increase in interest paid would only amount to 0.486 billion yen annual increase. In this case, EBITDA for the fiscal year ending January 31, 2025 would decrease from 21.2 billion yen (forecast as of December 24, 2024) to 20.7 billion yen and the growth rate of EBITDA would decrease from +60% to +58%, of which impact on our long-term growth strategy quite limited.

As a result of M&As at an appropriate price, our cash flow indicators are at the highest level compared to other companies that engage in continuous roll-up M&A in mature industries.

| GENDA | Waste Management | Service Corp | Rollins | Danaher | |

| OPCF Growth / Invested Capital | Approx. 25% | Approx. 20% | 8-9% | Approx. 25% | Approx. 10% |

(Compiled from “Capital Growth Strategies Report”, page 22)

At present, under the situation where there are many projects that will generate further cash flow by reinvestment, we do not accumulate the cash flow of the target companies which is increased by M&A but make it resource for further investment. We do not try to maximize FCF as of today when it is possible to invest. Therefore, we use operating cash flow to see the investment performance in this way.

There is a significant difference from an investment safety perspective between acquiring a company with EBITDA of 1.0 billion yen for 5.0 billion yen and acquiring the same company for 50.0 billion yen. However, in both cases, it would only be recorded as EBITDA +1.0 billion yen on the PL.

Thus, although we believe that our primary value is in cash flow because indicators of cash flow do not show our intrinsic performance on PL, we have been conducting M&A with a sense of speed, such as by ranking first in the number of M&As among listed companies for two consecutive years, and as a result, our PL has grown significantly. This is because we have secured appropriate M&A and high yields.

The cash flow of companies which joined us by M&A is further expanded through synergies and PMI. With this strong cash flow base, the stability of our strategy is well secured against increasing interest rates.

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)