M&A Strategy

This report shows what kind of preconditions (specifically, perpetuity growth rate) we should set to get a stock price of 2,900 yen (which is our present stock price) in a DCF analysis.

The conclusion of the report shows that regarding a perpetuity growth rate in a DCF analysis, while generally setting a precondition of ±1%, it cannot be explained without entering a “excessively low and unrealistic” input of perpetuity growth rate of -19.4%, which means that “in other words, this analysis confirms that the current valuation is significantly undervalued.” (CGS Report p1)

Please let us explain the details.

First, a DCF analysis is the most corporate finance theory-based approach, that calculates theoretical stock prices from the bottom up.

On the other hand, it has drawbacks, too.

Specifically, “the theoretical stock price is highly sensitive to the terminal value assumption, making the results prone to subjectivity,” which means that the theoretical stock price fluctuates greatly depending on the input value of the perpetuity growth rate. (CGS Report p1)

This drawback has been eliminated this time. Specifically, “a reverse DCF helps reduce subjectivity in investment analysis by revealing the perpetual growth rate assumed in the current stock price,” which means that it was calculated backwards what percentage the perpetuity growth rate should be to get 2,900 yen in the DCF analysis (this “back-calculated” part is the reason for the “reverse” DCF). (CGS Report p1)

Consequently, this perpetuity growth rate becomes the explained variable which is calculated backwards to connect DCF⇄ market stock prices based on the DCF analysis, and the arbitrariness is eliminated.

The back-calculated perpetuity growth rate is -19.4% mentioned at the beginning of this section. This means that if we assume that our free cash flow (hereinafter “FCF”) will decrease by -19.4% every year forever (after CGS’s 10-year earnings forecast period), the stock price calculated by the DCF analysis will be 2,900 yen. For EBITDA growth rate, the precondition will be that our EBITDA will decrease -24.5% every year forever.

Next, let us take a look at CGS’s 10-year earnings forecast. Since the perpetuity growth rate above is the growth rate after CGS’s 10-year earnings forecast period, if the 10-year earnings forecast was really aggressive, it would be natural that the perpetuity growth rate were -24.5%.

First of all, as a premise, since we went public, EBITDA has grown by approximately +60% for two consecutive fiscal years, from 8.1 billion in FY2024/1 to the forecast of 13.0 billion for FY2025/1, and to the forecast of 21.2 billion for FY2026/1, and we keep conducting M&A activities having a similar growth rate as our benchmark in the future as well.

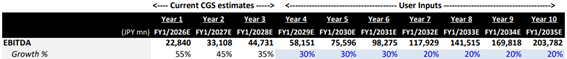

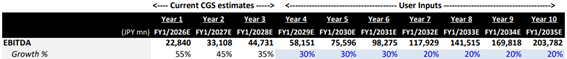

On the other hand, CGS’s forecast assumes that we failed in our plan. Specifically, it will be +45% for this fiscal year, +35% for the next fiscal year, and then slowing to +30% and +20% each year after that.

As stated above, even though it is a precondition which is far below what we are aiming at, since a 10-year earnings forecast alone exceeds the current market capitalization, the result shows that the only way to calculate 2,900 yen backwards is to push down the perpetuity growth rate to -19.4%.

Besides, against an opinion that the above 10-year earnings forecast is still strong, in this report, the perpetuity growth rate is also calculated backwards in case that the forecast for EBITDA growth rate is further revised downward.

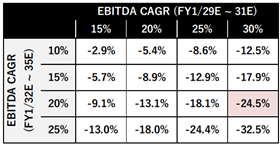

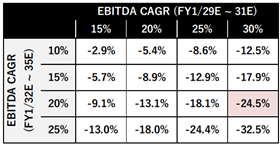

Specifically, as you can see in the upper row of the chart below, if “the EBITDA growth rate from the 4th to the 6th year is 15%” and “the EBITDA growth rate from the 7th to the 10th years is 10%,” a perpetuity growth rate of -2.9% is back-calculated (the upper left in the chart).

Even in the earnings forecast that EBITDA growth rate of 60%, which is our result and target, will slow down to 45%, 35%, 15% and 10%, which means that we cannot conduct M&A for mid- and long-term and the growth is only organic one, it is still -2.9%, a conservative growth rate compared to +/-1%, which is used in a general DCF analysis..

Based on the above result of analysis, the conclusion is that “In other words, this analysis indicates that the current stock price and valuation are highly undervalued.” (CGS Report p2)

We have maintained our M&A discipline by intentionally not issuing a medium-term management plan to prevent blind M&A. However, internally, we have the current growth of 60% per annum as a benchmark.

Therefore, we do not assume an EBITDA growth rate of 10 to 15% on a mid- and long-term basis, which substantially means that we can barely conduct M&A (“the long-term EBITDA and FCF projections do not reflect any input or intentions from GENDA” (CGS Report p2)).

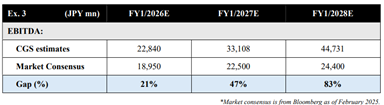

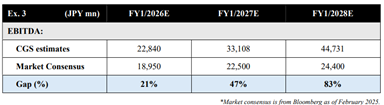

In addition, it says that “CGS does not consider the market consensus forecast for GENDA to be a good reference for the mid-to-long term. The primary reason is that we estimate the consensus forecasts have largely not incorporated the company’s future M&A potential beyond those that have been publicly announced.“ (CGS Report p4).

In fact, regarding the EBITDA forecast for FY2026/1, while the market consensus is 18.95 billion yen, we have already disclosed that the EBITDA forecast for FY2026/1 will be 21.2 billion yen in the presentation on December 24,2024, and this is a forecast under the assumption that there will be no M&A conducted in the future.

Based on them, the report ends with “a consensus forecast that largely excludes future M&A is not particularly useful given the GENDA’s growth strategy. Furthermore, it means that the trading multiples derived from consensus estimates do not account for the cash flow contribution from future M&A. For a valuation that incorporates the potential earnings contribution from future M&A as an estimated figure, please refer to the trading multiples based on CGS projections.” (CGS Report 4).

Our business model is in the early days in the domestic market, and we believe there are a lot of different views on valuations. However, this result of DCF analysis by CGS, which eliminated the arbitrariness, shows that the level of our market stock price is the one which cannot be derived theoretically.

We will keep striving to quickly execute, enhance our capability to generate cash flow, our equity and enterprise value, and to deliver the fruits of Continuous Transformational Growth to our investors.

Reference: “Capital Growth Strategies Report (Valuation Analysis),” February 12, 2025

https://capital-gs.co.jp/wp-content/uploads/2025/02/GENDA-CGS-Report-English-20250212.pdf

Financial Results

In conclusion, the purpose is to enable us to issue corporate bonds and to diversify the financing sources required for M&A companies. We have newly obtained a JCR rating of BBB+ (stable), which is an investment grade rate.

Corporate bonds are generally issued for the purpose of refinancing existing loans, and in our case, we mainly expect to use them at the time of execution of M&A, as described below.

With “Continuous Transformational Growth” through M&A, we execute M&A with financing repeatedly. Practically, we transfer the amount of the share acquisition in a lump sum to the seller on the date on which the M&A is completed.

When executing a debt financing, it is common to borrow funds from a small number of banks on the payment day through a “bridge loan,” which is a short-term loan, and then, several months later, to execute a “permanent loan” by refinancing the bridge loan with a number of banks through a syndicated loan or other means for the same amount on a long-term basis.

It will become possible to use corporate bonds for this permanent loan in the future. Companies which conduct many M&As around the world utilize corporate bonds as a means of financing their M&As. From now on, we will be able to utilize this global and common financing process for M&A.

For banks which provide the above short-term bridge loans for M&A, the ability to refinance with a permanent loan is a key factor when they decide whether or not to lend.

In the past, the only way for us to make the loan permanent by borrowing was to borrow from banks, which is indirect financing. However, since we will be able to access the corporate bond market of about 15 trillion yen, which is direct financing, on our own from now on, we believe that it will be possible for banks which provide bridge loans to make credit decisions more flexibly.

Since we got listed, we have announced 22 M&As in 2023 and 11 in 2024, the highest number of M&As executed as a listed company in Japan for two consecutive years. We have succeeded in conducting M&A at the top speed in Japan.

To conduct M&A, of course, we need to prepare the funds required to acquire the share by the payment date.

We have mainly financed such funds by borrowing from banks. In other words, we have succeeded in borrowing from banks at the top speed in Japan, too.

As a result, in fact, we have succeeded in borrowing from 68 financial institutions including banks and leasing companies at present (as of the end of February 2025).

Besides, we believe that we have established a high degree of trust with each of the banks because our purpose of loan is “funds for M&A,” which generally requires more complicated examinations than general business funds.

Furthermore, when we ask for examination of loans for M&A, a set of materials related to due diligence (which is not disclosed to the stock market), which is the result of evaluation on the target company of the M&A, is also submitted to financial institutions such as banks. These materials will be also reviewed to judge whether we can borrow or not.

Based on the undisclosed information regarding the details of each M&A project in the past, the banks have approved a loan to us so fast in their internal decision-making process. We flatter ourselves that this is because they fully understand the appropriateness of our price for M&A, our discipline and the reproducibility of post-M&A PMI, and we have successfully established a relationship of trust with them.

Creditors need to eliminate downside risk in particular because the upside from lending is limited. However, we passed such examinations and succeeded in borrowing.

After passing this credit judgment of financial institutions such as banks and leasing companies in indirect financing, we received an “investment grade” rating this time as a result of the examination by JCR, one of the largest credit rating agencies in Japan, which is a guideline for the investment judgment of creditors in direct financing.

We are a growth company in our seventh year of operations and have been continuously conducting M&A, which is our core business. As a result, the absolute amount of “goodwill” is larger than that of a general company. We are proud that the fact we received a “BBB+,” which is the same rating as that of TOMY Company, Ltd. and FUJI KYUKO Co., Ltd. in the entertainment industry, means that the safety of discipline in M&A is additionally guaranteed.

As mentioned above, in addition to accelerating M&A activities through the diversification of financing through the issuance of corporate bonds, we have received various approvals from financial institutions which are lenders in indirect financing and the credit rating agency which is a guideline for lenders in direct financing after being examined for the solidity of the purpose of loans and the downside risk in particular. We believe that this fact means our M&A is a solid investment with limited downside (after the undisclosed information was examined) for our shareholders who will enjoy the upside of transformational growth through M&A, and we hope that this will further reassure our shareholders and encourage them to invest in us. We would like to take this opportunity to express our gratitude to our shareholders.

Please see the news release issued by JCR below.

We have been developing our business activities in a wide range of fields in the entertainment industry, and as proof of this, we used to report the number of our stores to investors every month by “GENDA Sales Progress Report” from August 2023 till December 2024.

However, with the acquisition of NEN in the U.S. as a consolidated subsidiary in November 2024, the number of our entertainment platforms has increased significantly, especially exceeded 10,000 locations as our site network in the U.S., and we believe that we have reached a certain target.

Accordingly, we have disclosed sales information by segment since January 2025, as we believe that it is more important to inform investors in a timely manner about the growth of revenue in each business rather than the number of locations.

In terms of revenue information, there are business companies which disclose “a monthly growth rate of ‘existing stores’.” We understand that for companies in which organic growth is the mainstay of growth, “a monthly growth rate of ‘existing stores’” is important to understand the company.

On the other hand, we do not think that for us, who keep expanding our business portfolio through “continuous M&A,” the disclosure of monthly sales growth rate of ‘existing’ amusement arcades and karaoke is the most important to understand us.

It is because the growth rate of ‘existing stores’ is greatly influenced by the number of holidays in the same term of the previous year or weather conditions, and it is not our real intention to increase the volatility of shares unnecessarily due to that because our strategy is to grow on a long-term basis through “continuous M&A.”

On the other hand, we think that it is an indicator which is of strong interest as well and mention it in the quarterly financial closing, etc.

The interpretation of the “sales information by segment” has a point to be noted, too, which means that it is influenced by the size and number of companies consolidated during the month.

For example, the revenue growth rate in the amusement domain for December 2024 was +59.1% YoY, the company-wide revenue growth rate was +106.7% YoY, and the revenue growth rate in the amusement domain for January 2025 was +45.0% YoY, the company-wide revenue growth rate was +83.4% YoY, we have achieved incredible growth.

This is not only because existing stores grew and opening of new stores increased the sales, but also because the revenue of PLABI Corporation, which has 47 amusement arcades and that of Shin Corporation Co., Ltd., which has 368 karaoke premises, were not included in December 2023 but included in December 2024 and likewise, they were not included in January 2024 but included in January 2025 (both numbers of stores are as of the end of January 2025).

On the other hand, since the companies that are the difference in consolidated revenue when comparing February 2024 to February 2025 include SANDAI, AMEX, C’traum, ONTSU, NEN and others, it seems as if the growth is slowing down when compared to what was reported in January and February 2025.

However, we have to note that is a monthly “screenshot,” which greatly fluctuates depending on the timing of consolidation of M&A.

In the report to be released in April 2025, the growth rate is expected to expand because ActPro, HALOS and D-eight, which are scheduled to be consolidated from March 2025. However, this will not mean that the growth rate goes up but that the consolidation of M&A is started at that timing.

In terms of that, it is better to compare yearly, not monthly, to understand the true state. For example, comparing actual results for FY2024/1 to the target for FY2025/1, revenue is +98% and EBITDA is +60%, and we assume that revenue will be +42% and EBITDA will be +63% for FY2026/1 (the target figures for FY2026/1 do not include M&A, which is not publicly announced at this moment).

On the other hand, we used to make a monthly disclosure because we want to increase our contact with investors as much as possible. However, since we received some comments about concerns for slowdown in the growth rate because of the fluctuations of monthly growth rate, we hereby explain the background again in this FAQ. When you make an investment decision on our stock, we would be grateful if you could kindly understand our growth strategy including M&A and the track record, our future prospects, in addition to the change in single month sales. We would appreciate it very much if you could keep watching our growth and support us.

Stock Information

This report shows what kind of preconditions (specifically, perpetuity growth rate) we should set to get a stock price of 2,900 yen (which is our present stock price) in a DCF analysis.

The conclusion of the report shows that regarding a perpetuity growth rate in a DCF analysis, while generally setting a precondition of ±1%, it cannot be explained without entering a “excessively low and unrealistic” input of perpetuity growth rate of -19.4%, which means that “in other words, this analysis confirms that the current valuation is significantly undervalued.” (CGS Report p1)

Please let us explain the details.

First, a DCF analysis is the most corporate finance theory-based approach, that calculates theoretical stock prices from the bottom up.

On the other hand, it has drawbacks, too.

Specifically, “the theoretical stock price is highly sensitive to the terminal value assumption, making the results prone to subjectivity,” which means that the theoretical stock price fluctuates greatly depending on the input value of the perpetuity growth rate. (CGS Report p1)

This drawback has been eliminated this time. Specifically, “a reverse DCF helps reduce subjectivity in investment analysis by revealing the perpetual growth rate assumed in the current stock price,” which means that it was calculated backwards what percentage the perpetuity growth rate should be to get 2,900 yen in the DCF analysis (this “back-calculated” part is the reason for the “reverse” DCF). (CGS Report p1)

Consequently, this perpetuity growth rate becomes the explained variable which is calculated backwards to connect DCF⇄ market stock prices based on the DCF analysis, and the arbitrariness is eliminated.

The back-calculated perpetuity growth rate is -19.4% mentioned at the beginning of this section. This means that if we assume that our free cash flow (hereinafter “FCF”) will decrease by -19.4% every year forever (after CGS’s 10-year earnings forecast period), the stock price calculated by the DCF analysis will be 2,900 yen. For EBITDA growth rate, the precondition will be that our EBITDA will decrease -24.5% every year forever.

Next, let us take a look at CGS’s 10-year earnings forecast. Since the perpetuity growth rate above is the growth rate after CGS’s 10-year earnings forecast period, if the 10-year earnings forecast was really aggressive, it would be natural that the perpetuity growth rate were -24.5%.

First of all, as a premise, since we went public, EBITDA has grown by approximately +60% for two consecutive fiscal years, from 8.1 billion in FY2024/1 to the forecast of 13.0 billion for FY2025/1, and to the forecast of 21.2 billion for FY2026/1, and we keep conducting M&A activities having a similar growth rate as our benchmark in the future as well.

On the other hand, CGS’s forecast assumes that we failed in our plan. Specifically, it will be +45% for this fiscal year, +35% for the next fiscal year, and then slowing to +30% and +20% each year after that.

As stated above, even though it is a precondition which is far below what we are aiming at, since a 10-year earnings forecast alone exceeds the current market capitalization, the result shows that the only way to calculate 2,900 yen backwards is to push down the perpetuity growth rate to -19.4%.

Besides, against an opinion that the above 10-year earnings forecast is still strong, in this report, the perpetuity growth rate is also calculated backwards in case that the forecast for EBITDA growth rate is further revised downward.

Specifically, as you can see in the upper row of the chart below, if “the EBITDA growth rate from the 4th to the 6th year is 15%” and “the EBITDA growth rate from the 7th to the 10th years is 10%,” a perpetuity growth rate of -2.9% is back-calculated (the upper left in the chart).

Even in the earnings forecast that EBITDA growth rate of 60%, which is our result and target, will slow down to 45%, 35%, 15% and 10%, which means that we cannot conduct M&A for mid- and long-term and the growth is only organic one, it is still -2.9%, a conservative growth rate compared to +/-1%, which is used in a general DCF analysis..

Based on the above result of analysis, the conclusion is that “In other words, this analysis indicates that the current stock price and valuation are highly undervalued.” (CGS Report p2)

We have maintained our M&A discipline by intentionally not issuing a medium-term management plan to prevent blind M&A. However, internally, we have the current growth of 60% per annum as a benchmark.

Therefore, we do not assume an EBITDA growth rate of 10 to 15% on a mid- and long-term basis, which substantially means that we can barely conduct M&A (“the long-term EBITDA and FCF projections do not reflect any input or intentions from GENDA” (CGS Report p2)).

In addition, it says that “CGS does not consider the market consensus forecast for GENDA to be a good reference for the mid-to-long term. The primary reason is that we estimate the consensus forecasts have largely not incorporated the company’s future M&A potential beyond those that have been publicly announced.“ (CGS Report p4).

In fact, regarding the EBITDA forecast for FY2026/1, while the market consensus is 18.95 billion yen, we have already disclosed that the EBITDA forecast for FY2026/1 will be 21.2 billion yen in the presentation on December 24,2024, and this is a forecast under the assumption that there will be no M&A conducted in the future.

Based on them, the report ends with “a consensus forecast that largely excludes future M&A is not particularly useful given the GENDA’s growth strategy. Furthermore, it means that the trading multiples derived from consensus estimates do not account for the cash flow contribution from future M&A. For a valuation that incorporates the potential earnings contribution from future M&A as an estimated figure, please refer to the trading multiples based on CGS projections.” (CGS Report 4).

Our business model is in the early days in the domestic market, and we believe there are a lot of different views on valuations. However, this result of DCF analysis by CGS, which eliminated the arbitrariness, shows that the level of our market stock price is the one which cannot be derived theoretically.

We will keep striving to quickly execute, enhance our capability to generate cash flow, our equity and enterprise value, and to deliver the fruits of Continuous Transformational Growth to our investors.

Reference: “Capital Growth Strategies Report (Valuation Analysis),” February 12, 2025

https://capital-gs.co.jp/wp-content/uploads/2025/02/GENDA-CGS-Report-English-20250212.pdf

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)