M&A Strategy

In the first place, the structure makes it almost practically impossible to break the discipline of M&A in itself, and the “discipline of M&A,” which has been the most important aspect of our company since we went public, will not change.

The two reasons are as follows.

①The Company is not in a position to freely use surplus funds at its own discretion and is forced to be examined to get finance for each M&A, making it virtually impossible to force through undisciplined M&A.

② Theoretically, M&A through stock issuance in disregard of stock price is a possibility. However, since the incentive in this case is not cash but a stock acquisition right and the mechanism is such that no benefits accrue without an increase in the stock price, an increase in the stock price itself is a clear incentive.

Let us explain each of them.

①The Company is not in a position to freely use surplus funds at its own discretion and is forced to be examined to get finance for each M&A, making it virtually impossible to force through undisciplined M&A.

If we had ample equity capital and cash on hand, we might be at risk of executing an unreasonable M&A based solely on our own judgment. However, the reality is different.

We are a developing company which is in the eighth year since its establishment and has only accumulated seven fiscal years of financial results. Therefore, each time we execute an M&A, we need to raise funds from creditors and investors and undergo their review.

In particular, in M&A through borrowing, which we mainly carry out, financial institutions as creditors have a strict view of “downside risk.” We go through a process in which detailed M&A information (which is not disclosed to equity investors) is shared with creditors before they make a decision on financing.

Thus, even if we were to ignore our discipline and pursue reckless M&A, it would not be feasible because we would not be able to obtain financing.

→ As a result, our structure has always allowed us to execute only “disciplined M&A.”

We add a supplementary point regarding equity financing just to make sure. Although such a situation is not possible in practice, it is not absolutely impossible for a listed company to raise funds by forcibly issuing new shares in disregard of equity value.

However, the reason why such a situation cannot happen in reality is not simply a matter of ethics or the rule of faith, but because the stock acquisition right incentive we have designed is a mechanism that discourages such behavior from the standpoint of economic rationality. We will explain this in ②.

②Theoretically, M&A through stock issuance in disregard of the stock price is a possibility, but since the incentive in this case is not cash but a stock acquisition right and the mechanism is such that no benefits accrue without an increase in the stock price, an increase in the stock price itself is a clear incentive.

We will explain that the design of the stock options (stock acquisition rights) we are introducing does not in itself have any incentive to break the discipline of M&A.

First of all, if the incentive were to be “a ‘cash’ bonus for achieving EBITDA of 75.0 billion yen,” there could be an incentive to pursue EBITDA alone, even at the expense of the stock price.

However, since these are stock acquisition rights, they can only be exercised if “the stock price at the time of issuance is at or above the stock price at the time of issuance.” We assume the issuance within this fiscal year and the stock price at the time of issuance will be determined at that moment (However, since they can be exercised only when both the performance-related and tenure-related conditions are fulfilled, dilution will not occur until the financial results for the fiscal year ending on January 31, 2030 are finalized.).

Only the amount in excess of the stock price at the time of its issuance will be the incentive. To give a simple example, for example, let me see a case of an officer or employee who was allocated 1,000 shares at a share price of 1,000 yen. If the person remains with the company until the end of January 2029 and an EBITDA of 75.0 billion yen is achieved in the fiscal year ending on January 31, 2030.

If the stock price remains at 1,000 yen, 1,000,000 yen worth of stock acquisition rights become exercisable. However, the incentive is zero because 1,000,000 yen must be paid upon exercise. Similarly, if the stock price were 5,000 yen, the incentive would be 4,000,000 yen because it would be worth 5,000,000 yen and 1,000,000 yen would be paid upon exercise.

In other words, this incentive is designed to be “beneficial only when the stock price rises.”

In addition, especially, our officers and employees, who are in almost constant contact with M&A information, have significant restrictions on selling their shares, unlike our outside shareholders. We will be able to exercise our GENDA shares for the first time approximately five years from now, and will also have to pay the exercise price first upon exercise.

Therefore, we hope that you will understand that even a slight increase in the stock price is not enough.

As described above, the design is to maximize shareholder value along with earnings growth, or more precisely, to maximize “equity value per share,” which is also in the interest of the officers and employees themselves.

As described above, we have a structure that makes it structurally difficult to deviate from discipline in M&A, based on the dual safeguards of rigorous funding screening for each M&A project due to financial constraints and sound incentive design in stock options.

Even if these mechanisms did not exist, we would continue to consistently orient and accelerate our “growth through disciplined M&A.” We will continue to earnestly serve our shareholders and all other stakeholders and work to steadily and sustainably enhance our enterprise value. We would sincerely appreciate your continued support.

In conclusion, the reasons are ①Quantitative side: the growth rate in North America is very different from that in Japan and ②Qualitative side: the strategic significance of becoming a platform which provides Japanese IP in North America, taking the lead in the change by Japanese anime IP occurred in amusement arcades in Japan in North America and creating a new market is extremely significant. There is no change whatsoever in our M&A policy.

①Quantitative side: the growth rate in North America is very different from that in Japan

First, it is true that this level of EV/EBITDA 8.5x is relatively high compared to domestic projects in the past. While M&A deals in Japan are possible at attractive valuations in many cases against a background of business succession needs, the same environment is not necessarily the case overseas.

The important point, however, is that we should evaluate not only the multiples on the surface but also take into account the growth rate. For example, in Japan, our M&A projects have achieved a growth rate of 20 to 30% through synergies as we have shown in the past, while the same-store growth rate has been only a few percent. In contrast, NEN, which we acquired in North America last year, has achieved an “average of +201%” same-store growth rate, a completely different performance from that in Japan.

Specifically, although the target company’s most recent EBITDA is $18.2 million, we plan to grow this to $35 million over the medium term. If EBITDA were to double, the effective acquisition multiple would be half as well. One discipline is to make investment decisions without factoring in any future growth. However, it is overly conservative to completely ignore growth potential that has already been demonstrated, and rather risk missing out on investment opportunities that will help maximize shareholder value.

Furthermore, from a shareholder value perspective, we must not forget that we are leveraged. The yield on the investment based on company-wide free cash flow (FCFF) is sufficient in absolute terms (although it is true that domestic projects are very high in relative terms), and we plan to finance the majority of this acquisition with debt, assuming extremely high free cash flow (FCFE) for our shareholders.

The CGS report released today quotes the following: “We analyzed the acquisition ROI of Player One to be approx. 10% on an FCF basis, driven by synergies created through the planned replacement and addition of game machines this fiscal year and next. Additionally, it is estimated that the majority of the acquisition funds (80% assumed) will be financed through debt, and the acquisition ROE is expected to increase to over 60% in the mid-term. From these analyses, CGS believes that the sufficient capital efficiency can be consolidated compared to the cost of capital.” (Page 1 of Capital Growth Strategy Report (PLAYER ONE ROI Analysis) dated April 30, 2025)

If the ROE of 60% as envisioned in the report were to be achieved, we believe it would provide more than adequate returns to shareholders and the management team should not overlook such a project.

②Qualitative side: the strategic significance of becoming a platform which provides Japanese IP in North America, taking the lead in the change by Japanese anime IP occurred in amusement arcades in Japan in North America and creating a new market is extremely significant

The target company was originally owned by Cineplex. Although it was on our long list since then, we could not directly access to it at that time because we did not have sufficient sourcing capabilities in North America, unlike in Japan. As a result, the business was once sold to a PE fund, which we acquired shortly thereafter.

Even though the acquisition price was naturally higher than the one which the PE fund had paid, we believe that there is significant strategic value in acquiring a North American platform of this size in the first place.

The rationale behind the higher acquisition price than the one which the PE fund paid is a growth strategy through PMI utilizing Japanese anime IPs, which is difficult for foreign players but possible for us as a Japanese player. Instead of growing our business performance through existing game machine contents, we will be able to grow by utilizing prize games.

In Japan, prior to 2014, when prize games began to grow rapidly, the market of overall amusement arcade industry was in decline. Since then, however, the prize game market has consistently expanded, with the exception of the Covid-19 pandemic, and amusement arcades have transformed into “platforms anchored by Japanese anime IPs.”

At present, amusement arcades in North America function as a physical playground as same as the ones in Japan before the tipping point in 2014. By leading the transformation of amusement arcades into platforms for Japanese anime IPs, which occurred in Japan in and after 2014, this transaction is not just an M&A for us, but the first step in creating the “future of the North American market.”

Furthermore, the Japanese anime market has continued to expand rapidly, with overseas consumption growing 7.5 times over the past 11 years, finally surpassing domestic consumption for the first time in 2023. This trend is expected to continue to grow.

In contrast, in the North American market, the prize game business utilizing Japanese IP is still immature and supply is not keeping up with demand. With this M&A, we have secured 120 amusement arcades and approximately 12,000 mini-locations in North America. Considering the population size and economic strength of North America, the potential of the North American market is much greater than that of the domestic market, and we have laid the foundation for growth in this untapped market together with Japanese anime IP. As mentioned above, we should not discuss merely in terms of price in this project. We believe that it was a very meaningful investment decision based on the growth rate in the North American market, the creation of an untapped market utilizing Japanese IP, a future roll-up strategy and a long-term perspective to maximize shareholder value.

Financial Results

The strong yen will have a positive effect because we have not yet hedged our M&A financing settlement, which is a large amount of payment in U.S. dollar, for PLAYER ONE as of today (we plan to implement a forward exchange contract as the closing becomes more definite).

The M&A consideration is $170 million and is expected to be executed upon closing in or about July 2025.

The PLAYER ONE project has been in progress since late 2024, and compared to the exchange rate at the end of the year when negotiations were in full swing (around 158 yen to the dollar), the current exchange rate level (around 142 yen to the dollar) would reduce the yen-based expenditure by about -2.7 billion yen on a simple conversion.

On the other hand, PLAYER ONE’s U.S. dollar-denominated cash flow will be partially depreciated when converted to yen. However, PLAYER ONE’s borrowings are denominated in Japanese yen, and we plan to repay the borrowings using the ample yen-denominated cash flow held by the entire group. Therefore, the impact from the exchange rate will not interfere with our financial operation. In addition, other North American operations, including Kiddleton and NEN, will also be affected by the depreciation of a portion of their cash flow due to the strong yen. However, on the cost side, there are also benefits such as lower import costs for prizes and other items. Therefore, the impact on the P/L statement is limited at this time.

Business

(Page 14 of “M&A announced today,” disclosed on April 9, 2025)

The impact is still limited at present, and we plan to minimize the impact through further management efforts.

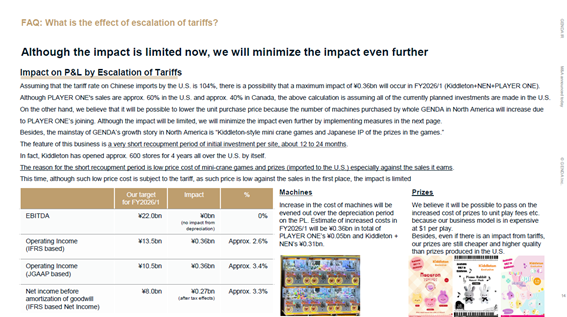

Assuming a tariff rate of 104% by the U.S. on China, there could be an impact of up to 360 million yen in the current fiscal year.

The impact on each stage of earnings in this fiscal year target will be 0% for EBITDA, since there is no impact from the increase or decrease in depreciation and amortization. For EBITDA before amortization of goodwill, which corresponds to operating income under IFRS, it will be 360 million yen, or about 2.6%. For operating income, it will be 360 million yen, or about 3.4%. For net income before amortization of goodwill, it will be 270 million yen, or about 3.3%, after taking tax effects into account. In contrast, as the participation of PLAYER ONE will increase the number of machines purchased as GENDA’s whole business in North America, we believe that it will be possible to lower the unit purchase price.

The impact of the tariffs is also analyzed in the report by Capital Growth Strategy released today.

Page 3 of Capital Growth Strategy Report dated April 30, 2025

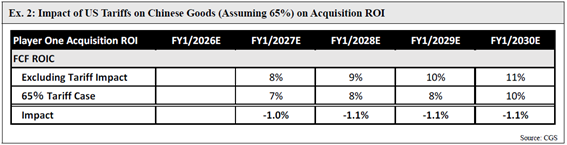

On the other hand, the key risk factors for the ROI of this acquisition are the potential failure to achieve the anticipated synergies and the impact of tariffs between the US and China. Here, we will delve into the impact of US-China tariffs. Currently, GENDA’s North American business imports the majority of Kiddleton’s game machines and prizes from China. Therefore, US tariffs on Chinese goods affect the CF through Capex for game machines and the PL through depreciation and the cost of prizes, both for sales in the US (approx. 60% of sales). Our recent discussions with GENDA’s management have confirmed that the impact of tariffs on prizes can be passed on to the play price due to the low-cost business model ($1 per play). However, the more important risk for investors is the impact on Capex for game machines, which ultimately affects Player One’s invested capital and could alter the acquisition ROI forecasted above. As of April 25, the US President Trump was reported to have said, ‘(the high tariffs on Chinese goods would) come down substantially, but it won’t be zero,’ and the Wall Street Journal reported that White House officials mentioned a range of 50-65% tariffs (35% for items not considered national security threats). Thus, at this stage we assumed that US tariffs on Chinese goods settle at around 65% as reported and estimated the impact on the acquisition ROIC in Ex. 2. Specifically, we apply a 65% tariff to the portion of Kiddleton-style game machine imports related to US sales (60%). In conclusion, the impact on Player One’s Cash ROIC on an FCF basis is approx. 1%pt, which we think is minimal and a limited impact.

Furthermore, GENDA is considering changing its manufacturing value chain to import only game machine components from China and assemble them in the US to minimize the impact of tariffs. Therefore, the actual impact of tariffs on the acquisition ROI could be even more negligible than the figures estimated in Ex. 2. CGS expects the company’s management to execute swiftly in response to these external risk factors.

As you can see, the impact is limited and the impact on the overall PL is well under control. We will strive to further minimize the impact by implementing countermeasures.

In addition, the pillar of GENDA’s growth story in North America is “Kiddleton-style mini-crane machines and the Japanese IP of the prizes inside.” This business is characterized by a very fast recoupment period of 12 to 24 months per location, and in fact, Kiddleton has opened approximately 600 stores in the U.S. over the past four years. The reason for the fast recoupment is that the cost of the mini-crane machines (imported to the U.S.) and the prizes they contain is low relative to sales. This time, the cost portion is subject to the tariff, but the impact will be limited because the cost is low in relation to sales.

(Page 15 of “M&A announced today,” disclosed on April 9, 2025)

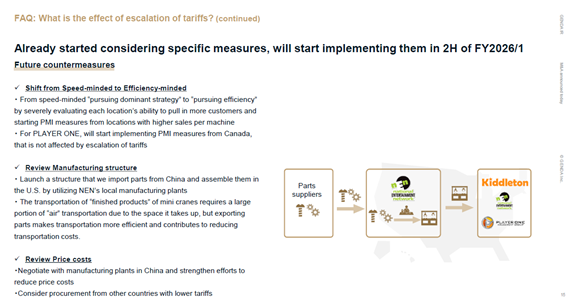

The first measure to address this issue is a shift in emphasis to efficiency in replacement with Kiddleton-style. Until now, we had planned to introduce PMI measures for basically all locations with a sense of speed. However, from now on, we will pursue efficiency by strictly analyzing the ability of each location to attract customers and sequentially introducing PMI measures starting with locations where sales per unit can be expanded more. In addition, for PLAYER ONE, we will implement PMI measures starting with Canada, where tariff hikes have no impact.

The second is a review of our manufacturing structure. NEN has a manufacturing facility in Dallas, the U.S. and we have been manufacturing machines there by ourselves. To utilize this facility, we will start a system to import parts from China and assemble them in the U.S. We will minimize the amount of impact by making parts, not finished products, subject to tariffs. In addition, the transportation of “finished products” of mini cranes requires a lot of “air” because they take up a lot of space. However, by exporting parts, we will streamline the transportation and contribute to reducing transportation costs.

Third, we will review our price costs. We will continue to negotiate with manufacturing plants in China and strengthen our cost reduction efforts. We will also consider procurement from third countries with low tariffs to reduce the risk of tariff hikes against China.

The fourth is to optimize the placement of mini-crane machines and prizes. Although it is assumed that we will be able to recover its investment and generate cash flow even if tariffs are added, we minimize the impact of tariffs by optimizing the placement. Since tariffs have not been finalized at this time, for the time being, we will make effective use of mini crane machines and prizes with low book value that have already been imported to the U.S. and are not subject to tariffs. Furthermore, we will focus on placing mini game machines with high book value, which are subject to tariffs, in more profitable locations in order to improve the profitability of each location as well as the overall revenue and expenditure.

(Page 16 of “M&A announced today,” disclosed on April 9, 2025)

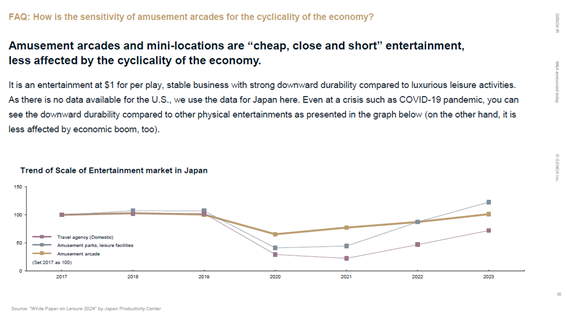

Amusement arcades and mini-locations, which are “cheap, close and short” entertainment, are less affected by business confidence. It is an entertainment at $1 per play, they are stable businesses with strong downward durability compared to more expensive leisure activities.

Since there is no data available for the U.S., we use the data for Japan here. However, we believe that even in the event of a contingency of a Covid-19 pandemic, the downward durability is very strong compared to other physical entertainments.

Stock Information

In conclusion, dividends are not being considered at this time.

The reason is that we recognize a number of attractive opportunities for business investment that exceed our cost of equity and increasing future equity value by reinvesting the cash flow we are currently generating in businesses will contribute to the improvement in shareholder value more than returning it to shareholders right now.

The concept of share repurchase is generally the same as that of dividends. However, in cases where our equity value has declined significantly, it may be judged that allocating funds to share repurchase is more effective in increasing equity value as a result of higher investment returns than acquiring shares in other companies through M&A. We believe that share repurchase is highly effective in increasing equity value relative to dividends due to the mobility of being able to pinpoint and target shareholder returns in a timely manner.

On the other hand, we have established a shareholder benefit program. Since our Entertainment Platform Business is a B to C business, we recognize that shareholder benefits are effective means for our group from various perspectives.

For example, unlike dividends and share repurchase, which are shareholder returns involving actual cash out, shareholder benefits do not directly discourage investment in growth.

In addition, while shareholder benefits lead to the development of a new customer base and expansion of the investor base, we believe that the expansion of the shareholder base leads to a reduction in the daily volatility of the stock price, which in turn has the effect of increasing the equity value through a reduction in the cost of capital.

For more details of the shareholder benefits, please refer to the following documents.

https://genda.jp/en/ir/stock/shbenefits/

Based on the above assumptions, our basic policy is to always continue to implement the optimal allocation of capital from time to time in order to realize an increase in equity value for our shareholders.

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)