Financial Results

We think that your concern about the dilution caused by a follow-on offering is general and understandable.

Although we wanted to respond to this kind of question as soon as possible, as an issuing entity, we were not institutionally allowed to mention the issue expressly before the follow-on offering was completed. Therefore, we would appreciate it very much if you could kindly understand that today is the earliest possible date to respond to your question, immediately after the completion of the follow-on offering.

In conclusion, we will explain that “even though the number of shares increased through the follow-on offering, earnings per share have increased because the growth in earnings has greatly exceeded it” in a later part. However, first, let us give you a hypothetical example to help you intuitively understand that.

For example, we made the previous follow-on offering of 10.0 billion yen in July 2024 and this follow-on offering of 18.5 billion yen in May 2025. If we made a follow-on offering of 28.5 billion yen in total at 969 yen (instead of 1,021 yen) in July 2024, and even if we did not spend a single yen of the 28.5 billion yen raised, earnings per share (EPS) would have increased (EPS indicates IFRS-basis net income (net income before amortization of goodwill)).

This has occurred because our debt capacity has significantly increased through the follow-on offerings and, most of all, we regard EPS as our most important indicator and have achieved an “increase in earnings” that far exceeds the “increase in the number of shares.” This is because the following factors have compositely worked:

・Carefully select M&A with high returns “for creditors + shareholders” to be made by the target company on a stand-alone basis without synergies

・From there, furthermore, utilize borrowings as much as possible to the appropriate extent, and maximize returns for “shareholders”

・From that launch pad, further raise returns by creating synergies through PMI

Next, let us show you the actual story with actual results. First, we will explain the actual results of last year’s follow-on offering (c.10.0 billion yen), which led to significant growth in EPS.

Last year’s follow-on offering (c. 10.0 billion yen) was promptly used for M&As, and as a result;

・While the number of shares increased by approximately +7% (dilution ratio by follow-on offering),

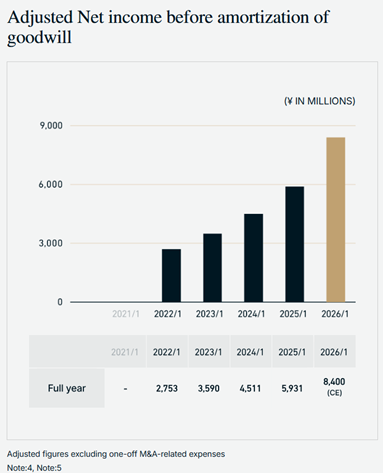

・Adjusted Net income before amortization of goodwill increased by +31% (excluding tax effects, intrinsic performance increased by +97%)and,

・EPS increased by +19% (division between the two, the denominator further increased by stock delivery M&A).

We have disclosed that we will promptly use this follow-on offering (about 18.5 billion yen) for attractive M&As along with borrowings within one year, though,

・The number of shares increased by approximately +10.9% (dilution ratio by follow-on offering),

・We will increase net income before amortization of goodwill as same as last, then

・We will keep maximizing EPS. As same as last year, let us run the numbers as follows.

First, let us assume the following as a simplified premise in M&A (to show that this does not include any arbitrariness and help you understand the growth in M&A, we prepared spread sheet for you).

⓪ Our Net Debt (net interest-bearing debt) before the follow-on offering: 62.5 billion yen

(Forecast consolidated EBITDA for the next fiscal year after the acquisition of Player One is 25.0 billion yen and Net Debt / EBITDA is 2.5x)

①The amount of cash raised by the follow-on offering and to be allotted to future M&As: 15.5 billion yen

(As disclosed, 3.0 billion yen out of 18.5 billion yen, which is a disposable amount, is supposed to be allotted to acquire Player One)

②The amount to be allotted to future M&As through stock delivery / exchange: 17.7 billion yen

(Number of shares (10%) possible to issue only for M&As as curve-out even during lock-up period)

③The amount of cash raised by interest-bearing debt and to be allotted to future M&As: 60.0 billion yen

(Net Debt / EBITDA is 2.7x after pro-forma basis. Debt financing can go up to 88.4 billion yen if 3.0x)

④Valuation of M&A: EV / EBITDA 5.0x

(As a result, what is practically assumed here is valuation 5.0x (same level of our M&A track records) but growth after M&A is none, or a case we acquire at 6.0x and EBITDA increased by 20% after M&A)

➄Further, no organic growth to simplify

(However, growth in existing businesses in Japan and in the US is as already disclosed)

Under the above assumption, we will calculate EBITDA, net income before amortization of goodwill and EPS, which are our three KPIs.

First, it is assumed to be possible to allot 93.2 billion yen, the total of ①, ② and ③, to future M&As.

The increased amount of EBITDA is +18.6 billion yen, calculated by dividing 93.2 billion yen by 5.0x (in this analysis, it is assumed that although we acquired Player One with EV / EBITDA 8.5x but no growth, to simplify this analysis. However, we actually assume 75% growth in EBITDA in the medium to long term, and the real EV / EBITDA post synergy is expected to be 4.8x).

If we assume that net income before amortization of goodwill is the same as margin of forecasted EBITDA of 25.0 billion yen and forecasted net income before amortization of goodwill of 9.5 billion yen for the next fiscal year (i.e. acquire a company in the same business category through M&A with the same borrowing conditions) to simplify this analysis, net income before amortization of goodwill will increase approximately +7.1 billion yen.

Although EPS is affected by the number of shares, even if the stock price conservatively remains at 969 yen, the offer price, when conducting M&A with stock mentioned in ② (which means the stock price will not go up but the number of shares increased), EPS will be 82.51 yen, +41% increase against 58.40 yen before the follow-on offering.

In fact, under the above assumption, even if we will not commence the next follow-on offering in the future, the effects on our KPI can be calculated as follows (the whole amount of follow-on offering in ① is assumed to be allotted to M&A within one year as disclosed).

・EBITDA:

25.0 billion yen (forecast for FY2027/1) → +18.6 billion yen → 43.6 billion yen

・Net income before amortization of goodwill:

95.0 billion yen (forecast for FY2027/1) → +7.1 billion yen → 16.6 billion yen

・EPS (no forecast for FY2027/1):

58.40 yen (before follow-on offering) → +41% → 82.51 yen

We prepared those calculations based on mechanical calculations which eliminate arbitrariness as much as possible just for your reference because we received a lot of inquiries centered on concerns about dilution from our shareholders.

On the other hand, of course, this does not present our official forecast and will significantly change depending on future M&As. We will promptly disclose information when it is necessary to disclose.

Finally, If the fund raised through a follow-on offering were used to repay past debt or to invest in business retention, it would depress EPS, and the “dilution” argument would be inescapable.

With that perspective, the extreme and hypothetical example at the beginning is the same as a case that the whole amount of 28.5 billion yen was allotted to past investment, and even in that case EPS would have increased as presented.

In fact, the whole amount of our follow-on offering will be used for M&A to be paid from today on. The actual results show that EPS significantly increased after the previous follow-on offering as we have already explained earlier.

Last Wednesday, which was the day before yesterday, 18.5 billion yen, the funds from our investors, were safely deposited into our ordinary account. Same as last, we will immediately resume investment in a group of M&A projects which are expected to increase earnings more than an increase in the number of shares.

Since we held funds which are a little less than twice the amount of the previous follow-on offering, we will use them very carefully on behalf of our shareholders.

※ Notes on the financial simulations:

The aforementioned case study is a mechanical simulation of how our EPS would change if we were to acquire 100% of another entertainment company under certain assumptions (assumptions regarding the financing of the acquisition, the use of proceeds, and post-acquisition synergies). This is not an indication that we intend to acquire a particular entertainment company, nor is it a forecast of our future EPS. The figures used in this simulation would yield different results if different assumptions are used in the simulation. Each of the assumptions used in this simulation was made independently by the Company for the purpose of this simulation. This is neither an indication nor a guarantee that the actual acquisition (including the financing and post-acquisition synergies assumed therein) will be executed or realized on similar terms. In addition, there is no assurance that we will acquire other entertainment companies in the future.

As you point out, if our growth through M&A could be achieved entirely through debt financing alone, earnings per share would increase more.

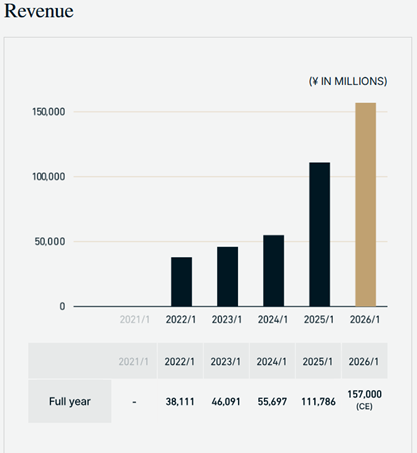

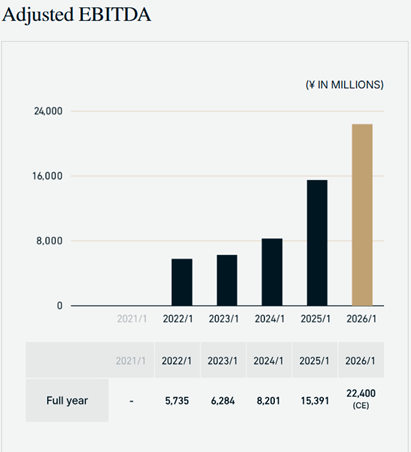

However, unfortunately, it is not realistically feasible to achieve the growth in EBITDA of 8.2 billion yen → 15.3 billion yen → 22.4 billion yen … only with debt.

Growth with “debt financing only + no equity financing” will be a huge opportunity loss for our earnings per share. This is because we are unable to conduct M&A without financial soundness in the first place, however, if we maintain financial soundness without making an offering, we will lose a great opportunity for executable M&As.

On the other hand, with “no debt financing + equity financing only,” it would not lead to the same growth in earnings per share as described above.

What this suggests is not a dichotomy of “debt financing or equity financing,” but it is possible to make a design which keeps growing while maintaining an optimal balance between the two.

That is “to finance maintaining good balance between borrowing and offering to the extent that earnings per share (significantly) increases.”

The key for that scheme is a capital structure that “adding a unit of equity capital (offering) expands Debt Capacity by a larger scale.”

This means that significant debt capacity becomes available only after our capital base is strengthened through an equity offering, and as a result, the total amount of funds which can be raised increases, the available amount for M&A increases and the earnings to be consolidated through M&A will increase subsequently.

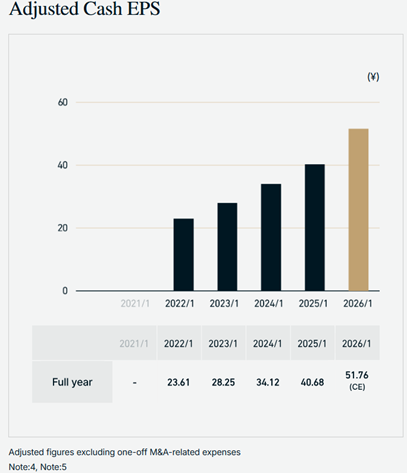

This is a cycle that earnings per share increase if the increase in earnings consolidated through the M&A exceeds the increase in the number of shares through an equity offering. We have consistently achieved this through the aforementioned leverage effect since our establishment, with an EPS growth rate (CAGR) of +21% over the past five years, a forecast EPS growth rate (pre-offering basis) of +27% for the current fiscal year (ended January 31, 2026), and an EPS growth effect from the this follow-on offering of +41% if the underlying assumptions hold.

We refrain from making an official comment regarding the validity of the stock price, as we are not allowed to do so as a listed company. On the other hand, it is possible for us to explain the structure of the stock price formation and organize the facts, and explain the inferences based on them.

Although there are multiple methods for calculating stock price, one of the general formulas is “stock price=EPS × P/E multiple.”

As for “EPS,” we can actively improve it through corporate efforts, and in fact, it has grown substantially since the last equity offering, and we will also invest the funds raised through this offering to lead to further growth, as mentioned earlier.

On the other hand, we do not have complete control over “P/E multiple” as it is based on the macro stock market environment and our specific investors’ forecast for the growth in our EPS. Therefore, regarding P/E multiple, we will first organize objective facts and then describe our observations.

As a fact, our P/E multiple is currently around 20x, the lowest level since our listing (P/E multiple is based on the forecast net income on IFRS-basis (= net income before amortization of goodwill) for this fiscal year, 8.0 billion yen). Next, the time series of changes in P/E multiple until today is as follows;

- ~3/24 Since the announcement of financial results and new structure on March 12, the stock price had been close to historical high, and P/E multiple was 29x

- 3/25 Started falling due to US media reports on the Trump administration’s tariffs against China

- 4/8 Kept falling after Trump administration tariffs against China at 104%,

- 4/9 Temporarily rebounded with our largest ever M&A in North America (Player One)

- 4/10 Fell again with Trump administration tariffs against China at 145%

- 5/1 Temporarily rebounded after Tokai Tokyo Securities Co., Ltd. had issued an analyst report

- 5/13 Fell again as we announced a follow-on offering + secondary offering

- 5/30 P/E multiple is about 20x as of today, down approximately -35% since the announcement of financial results and the new management, the lowest level since listing

On May 12, there was good news that tariffs against China would be reduced to 30%. However, the timing of announcement of M&A with Player One coincided with reports of tariffs against China, which added to concerns about the offering and limited the impact on P/E multiple.

Next, as of today, although the tariff issue between the U.S. and China, which is a macro factor, temporarily settled and the concerns about the follow-on offering were dispelled, P/E multiple still remains at the lowest level since listing.

What we can see from this is that it is considered that the market may have become more skeptical about the growth potential of our EPS than before.

In addition, since the use of the funds raised this time is for M&A as well as last time, it is difficult to disclose in advance the explicit use of the funds, as is the case with organic growth, and we believe that further confidence from the market will be required for the growth potential of EPS in the future.

Besides, we recognize that the partial sale of equity by Shin, who is the former Representative Director and President of the Company and currently serving as a Director, has attracted a certain amount of attention in the market.

On the other hand, let us explain that our medium- to long-term growth strategy remains unchanged as follows.

First, the indicators that we have published are as follows.

- In the long term, we aim to be the world’s No. 1 entertainment company in 2040.

- In the medium term, we aim to fulfill the conditions for exercise of stock acquisition rights, 75.0 billion yen in EBITDA in 2030.

The incentives owned by our officers and employees are stock acquisition rights, which directly motivate them to increase the stock price itself, rather than just market capitalization. Since the stock price generally consists of “stock price = EPS x P/E multiple,” we will stubbornly focus on the growth in EPS, which is controllable.

P/E multiple, whose simplified theoretical formula is “P/E multiple = 1 ÷ (weighted average cost of capital – EPS growth rate),” clearly indicates that sustained EPS growth is extremely important for P/E multiple.

In this regard, our growth in EPS is robust although our mainstay is M&A:

- EPS growth rate (CAGR) for five years from FY2022/1 to FY2026/1 (forecast) is +21%

- EPS growth rate (pre-offering basis) from FY2025/1 to FY2026/1 (forecast) is +27%

- EPS growth effect through this follow-on offering, assuming that the assumptions remain unchanged, is +41%

To summarize, based on the fundamental equation: Share Price = EPS × P/E multiple our current position and future direction can be outlined as follows:

- “EPS” has reached an all-time high, as shown in the chart below

- “EPS” has no upper / lower limit, and we are aiming to continuously setting new records from 2025 to 2030 to 2040.

- “P/E multiple” tends to fluctuate within a certain range, due to market arbitrage relative to alternative investment opportunities.

- “P/E multiple” is currently near all-time low.

Given above, the key to factor of P/E multiple lies in how much EPS growth are expected from the market. We will remain committed to proactive and transparent dialogue with the capital markets.

We are aware of your opinion that we should have waited a little longer and made the offering after the stock price had recovered.

We have decided to move forward with this follow-on offering due to two primary factors. Let us explain each of them in detail.

①Minimal impact of current stock price on future EPS

First, to ensure complete transparency, please refer to the spread sheet calculation sheet also attached in Q1. While the input of stock price is 969 yen, which is the offer price, you will see that even a 20% increase in this price would only result in a few percentage points of additional EPS.

The reason for this is that the absolute yield on our capital deployment (M&A) is sufficiently high compared to the cost of financing (debt + equity). In essence, our yield on investment far exceeds our cost of funding.

This is a direct result of our disciplined M&A strategy. We consistently conduct M&As only at right valuations (yield on investment is sufficiently high), compared to the consolidated earnings and cash flows. Furthermore, because we are maximizing debt within appropriate limits (minimizing our cost of funding), this effect is shown very clearly.

Consequently, minor fluctuations in our funding costs have a negligible impact on the overall picture.

While the offer price of 969 yen is 5% lower than the offer price (1,021 yen) of our previous offering (in July 2024), our calculations show that this short-term price difference is fully absorbable over the mid-to-long term. This understanding led us to proceed with the follow-on offering at this timing.

As mentioned earlier, although we are committed to EPS growth, we have no intention of relaxing our discipline in fundraising. On the contrary, we recognize that conducting equity financing at the highest possible stock price is crucial for minimizing dilution for existing shareholders.

In next ②, let us explain another main reason for proceeding with this follow-on offering at this timing even with that perspective.

②Loss of opportunities for M&A at hand is certain while the recovery of stock price is unpredictable

The recovery of stock price, especially heavily influenced by macroeconomic factors, is inherently unpredictable. Conversely, the “loss of opportunity for the growth in EPS” caused by missing promising M&A opportunities right in front of us is certain.

As mentioned earlier, even if we were to accept risks and wait until the stock price increases by 20%, the additional EPS benefit would be limited to a few percentage points.

On the other hand, it is confirmed that we will miss M&A opportunities during that time, which could increase EPS. As a result, it is confirmed that a few percentage points of additional effects from merits gained by accepting risks and waiting will be jeopardized (again, it is unpredictable if the stock price goes up or down).

This creates a dilemma where we must weigh the “uncertain merits” of waiting for the recovery of stock price against the “certain demerits” of losing M&A opportunities. Our quantitative analysis clearly shows that the impact of the latter is significantly greater.

Furthermore, regulatory requirements prevent us from conducting a follow-on offering while holding undisclosed material information (such as M&A). For a company like ours, which engages in continuous M&A, this means we must temporarily “suspend” all ongoing projects to make a follow-on offering. This makes identifying the right timing for a follow-on offering significantly more challenging compared to typical companies.

Therefore, the decision to proceed with a follow-on offering is intrinsically linked to the “loss of opportunities for the growth in EPS,” requiring a careful weighing of the consequences of missing those opportunities.

What makes it more difficult is that we cannot always freely choose the most opportune timing for fundraising because M&A opportunities do not appear solely at “our convenience” and the intentions of the selling companies also play a significant role.

Given these constraints and structural realities, we made the following judgment:

・The impact of current fluctuations in stock price on EPS is limited.

・The recovery of stock price is uncertain.

・The loss of opportunities for M&A which will boost EPS in future is certain.

Considering these three points comprehensively, and after thorough and sincere discussions among all officers and employees, we concluded that proceeding with a follow-on offering at this timing is the most rational decision.

As a matter of fact, our officers and employees currently hold approximately 20% of the company’s shares, aligning our management incentives perfectly with those of our external shareholders. Moreover, as we have insight into growth potential not yet disclosed to external shareholders, we felt an even greater responsibility to make this decision with conviction.

We currently have numerous attractive M&A opportunities in our pipeline that cannot be fully addressed with our existing debt capacity alone. In this situation, we have successfully improved financial leverage markedly and rebuilt the robust financial foundations so that we can accelerate our M&A strategy furthermore.

Moving forward, even after this follow-on offering and secondary offering, our officers and employees will keep being involved in the management as a major shareholder and as “representative of shareholders.” Through our long-term incentive design, including stock acquisition rights, we will truly embody the “management with shareholders.”

Stock Information

This stock split is related to the shareholder benefit program that takes advantage of the characteristics of our B2C business.

First, in introducing a new “shareholder benefit program,” which was particularly requested by individual investors, we wanted to design it at a level that would allow them to realize a “meaningful benefit yield,” rather than merely a formal benefit.

On the other hand, with our stock price level immediately prior to the announcement of financial results, in which we announced the stock split, the benefit yield was 1.5%.

While this was a significant level relative to growth companies, we sought to provide further convenience and investment opportunities in order to gain the medium- to long-term support from more individual investors.

There are two main ways to increase yields in the benefit program, to lower the minimum investment unit (i.e., allow investors to become shareholders with smaller amounts) and to raise the amount of benefits itself. We have implemented both for our individual shareholders’ patronage this time.

Specifically, we chose a “stock split” as a means to reduce the investment unit without affecting the enterprise value, and then maintained the amount of benefits, effectively doubling the amount of benefits.

This will make it easier for more individual investors to become shareholders and at the same time provide substantial benefits in terms of yield.

In fact, at the post-split stock price level, the yield on shareholder benefits is 3.0%, which is high enough for a growth company and meaningful as an absolute value (more than 4% at the current stock price).

If we tried to get the same effect without conducting a stock split, we would have to quadruple the amount of benefits. However, raising the amount of benefits excessively may put pressure on the profitability of the core business and, as a result, may damage the most important shareholder value. We are afraid that this would be putting the cart before the horse and would result in an undesirable outcome for shareholders.

In addition, the Tokyo Stock Exchange requires all listed companies to have a “minimum investment amount of approximately 100,000 yen,” and the stock split has allowed the Company to meet this standard.

Finally, our M&A strategy aims to enhance the medium- to long-term enterprise value rather than short-term performance fluctuations. We will continue to strive to provide detailed and honest information so that our shareholders can gain a deeper understanding of our efforts.

We would be most appreciative if you would kindly give us your continued support from a long-term perspective.

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)