Financial Results

The following two characteristics lead to this second-half-heavy concentration

①Seasonality of sales

The amusement arcade-related and karaoke-related businesses, which account for approximately 90% of our sales and earnings, have the following seasonality.

・1Q (February, March, April): Farewell and welcome party season (short term)

・2Q (May, June, July): Golden Week holidays (short term)

・3Q (August, September, October): Summer vacation + Silver Week holidays (long term, sales season)

・4Q (November, December, January): Winter vacation + New Year holidays (long term, peak sales season)

Due to the long holidays falling within 3Q and 4Q, sales typically increase during these quarters, consequently leading to a concentration of earnings in the second half of the fiscal year.

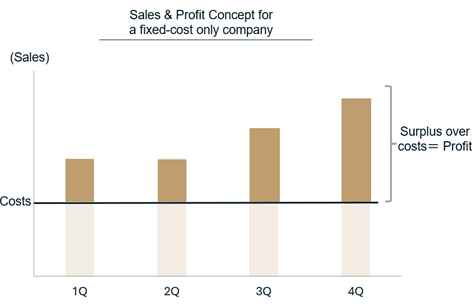

②Fixed-cost heavy business model

Our core business operates on “a fixed-cost heavy model.” This means that nearly consistent expenses arise each quarter (and even daily or monthly), regardless of sales fluctuations (regardless of sales seasons). For amusement arcade operations, fixed costs represent about 70% of total costs, while for karaoke, they comprise roughly 90%. The breakdown is detailed below:

・Rent

・Labor cost

・Depreciation (mainly for game machines and karaoke equipment)

・(For reference) Amortization of goodwill (based on Japanese GAAP)

In a business model heavily reliant on fixed costs, almost all revenue exceeding the break-even point directly contributes to earnings. As a result, earnings increase substantially in quarters with higher sales (which typically align with the peak sales seasons in the second half of the fiscal year).

Here is an illustrative diagram showing the profit structure for a hypothetical company with 100% fixed costs.

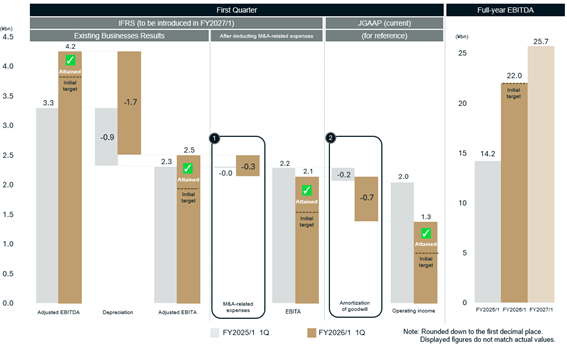

The reason for the decrease in all earnings indicators in our consolidated financial results, based on Japanese Accounting Standards (“JGAAP”), is attributable to the continuous execution of M&A. On the other hand, our existing businesses are performing strongly, having achieved growth in earnings and cash flow, and are exceeding the initial target.

To clarify the difference between our financial reporting and the underlying business reality, we have disclosed the following two aspects.

(1) M&A-related expenses (=adjusted indicators)

(2) Accounting standards (=differences between JGAAP and International Financial Reporting Standards (“IFRS”))

The graph below illustrates points (1) and (2).

(1) M&A-related expenses (adjusted indicators)

In the reported accounting figures, M&A-related expenses are not separated from the profit and loss of existing businesses, making it difficult to discern the true performance (whether good or bad) of these existing businesses. Consequently, we provide “adjusted indicators” to illustrate the performance of our existing businesses, representing the profit generated prior to the deduction of M&A-related expenses.

・Significance of adjusted indicators

-Existing businesses results = Accounting results + M&A-related expenses = Adjusted indicators

・Adjusted indicator results (=existing businesses)

-Adjusted EBITDA, which is our KP, increased by 29% compared to the same period last year and stood at +11% relative to the target.

・Significance of M&A-related expenses

-One-off expenses incurred from M&A funded by existing businesses

-As a result of our continuous M&A transactions, contrary to common corporate practice, these are accounted for quarterly, in addition to being recognized on a full-year basis.

-These expenditures are not core to the continuous running of existing operations. Instead, they are proactive growth investments strategically made to achieve stable and increased profitability in the future. The forecast of 25.7 billion yen in EBITDA for the fiscal year ending on January 31, 2027 assumes no further M&A transactions going forward. We anticipate additional growth potential through future M&A.

(2) Accounting standards (differences between JGAAP and IFRS)

Differences in accounting standards also impact on our earnings reporting.

・Recognition of goodwill under JGAAP

-Under JGAAP, which we adopt currently, goodwill (amortization) is recognized as a cost.

-Amortization of goodwill has the nature of a fixed cost, with a constant amount recorded quarterly, regardless of sales.

-Therefore, the more M&A we pursue, the more fixed costs on our financial statements will increase.

-Especially during the first half of the fiscal year when sales are low, our structure results in even less apparent earnings (as explained in Q. Why are GENDA’s consolidated earnings concentrated in the second half of the fiscal year?).

・Discrepancy between accounting results and operational reality

-(Unlike depreciation expense,) amortization of goodwill does not result in any future cash outflow.

-As M&A progresses, disclosures under JGAAP increasingly diverge from the actual cash flow situation.

・Transition to IFRS and temporary measures

-Scheduled to transition to IFRS at the end of the fiscal year ending on January 31, 2027, representing the earliest practical timeline.

-Throughout the transition period from JGAAP to IFRS, we will disclose information by adopting IFRS indicators as our KPI.

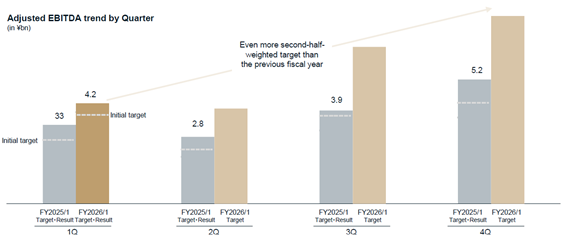

Additionally, in our 1Q financial results presentation, we characterized our existing businesses as having made a “strong start.”

This is based on the achievement of our 1Q target.

Specifically, based on our KPI, adjusted EBITDA;

・Our plan for the current fiscal year projects 22.4 billion yen, a +45% increase in earnings, against the 15.4 billion yen achieved in the previous fiscal year.

・In the first quarter of our planned +45% increase in earnings, we exceeded the target by 0.45 billion yen / +11%.

Should M&A be halted, M&A-related expenses would no longer arise, potentially resulting in a short-term improvement in reported accounting earnings, especially under JGAAP. We also have the option to halt M&A activities, which would improve the appearance of our accounting results, and allow us to pursue a moderate growth of 22.0 billion yen in EBITDA for the current fiscal year.

However, we have a clear policy of focusing on maximizing future cash flow generation capability. Based on this policy, we have proactively chosen to engage in M&A activities and have already disclosed an estimated EBITDA of 25.7 billion yen for the next fiscal year.

Furthermore, over the remaining six months of this fiscal year, we anticipate even more active M&A activities, fueled by funds from our follow-on offering.

We will not just stand by concerning the apparent accounting results, which are a side effect of our strategy. Instead, we will ensure transparent disclosure, focusing on the previously mentioned “(1) M&A-related expenses (adjusted indicators)” and “(2) Accounting standards (differences between JGAAP and IFRS).” Since the summary of financial results (Tanshin) only contains limited information, we kindly ask you to refer to the financial presentation materials for full details.

For reference: “FY2026/1 1Q Earnings Presentation” disclosed on June 11, 2025.

https://ssl4.eir-parts.net/doc/9166/ir_material_for_fiscal_ym2/181316/00.pdf

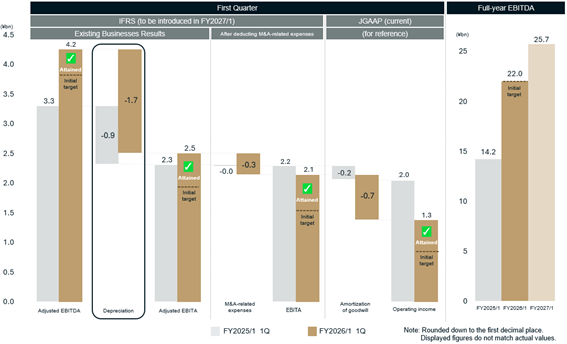

Ultimately, this is a result of the following factors;

(1) The difference between EBITDA and EBITA, which is depreciation expense, is also a significant fixed cost, leading to its concentration in the second half of the fiscal year.

(2) As the concentration in the second half of the fiscal year has accelerated from the previous year to the current year.

Let us explain each of these points.

(1) The difference between EBITDA and EBITA, which is depreciation expense, is also a significant fixed cost, leading to its concentration in the second half of the fiscal year.

The important point is that “depreciation” remains roughly the same in 1Q, when sales are low, as it does in 4Q, when sales are at their highest.

EBITA, which is calculated by deducting the fixed cost of depreciation from EBITDA, will show an even greater concentration in the second half of the fiscal year compared to EBITDA.

Similarly, this trend further intensifies at each profit level.

For your reference, the main fixed costs at each profit level are shown below.

・Sales

-Rent

-Labor cost

・EBITDA

-Depreciation

・EBITA (operating income under IFRS)

-Interest

-(Amortization of goodwill in case of JGAAP)

・Net income

(2) As the concentration in the second half of the fiscal year has accelerated from the previous year to the current year.

(Source: page 6 of “FY2026/1 1Q Earnings Presentation” disclosed on June 11, 2025)

https://ssl4.eir-parts.net/doc/9166/ir_material_for_fiscal_ym2/181316/00.pdf#page=6

This will be explained using information from the earnings presentation.

・Changes in the composition of store size

-Our long-standing GiGO brand stores are primarily large-format stores.

-Meanwhile, the stores added through M&A activities are comparatively smaller.

・Resulting change in the break-even point ratio

-Smaller stores have a higher break-even point compared to larger stores (due to a higher proportion of fixed costs).

-Therefore, during the off-season in the first half of the fiscal year when sales are low, it becomes even more challenging to generate profit.

-Conversely, during the sales season in the second half of the fiscal year when sales are high, significant earnings are generated.

As a result, with the increasing proportion of smaller stores due to M&A, isolating the three months of 1Q (a slow season) will show an even stronger tendency for lower profit levels.

Business

Our pre-M&A assumption was that there was a risk of monthly sales gradually decreasing immediately after the M&A due to partial closure of stores at Walmart, which is why we acquired NEN’s equity with a buffer at an EV/EBITDA of 3.6x.

However, we rapidly advanced the PMI, and sales after the SWAP increased more than anticipated (1). Additionally, the significant success of this SWAP strategy garnered attention, leading to numerous inquiries for new store openings (2).

As a result, we swiftly offset the sales impact from the partial closure of stores at Walmart, and our monthly consolidated sales have already turned positive year-over-year. Sales continue on a growth trajectory, showing an exceptionally strong start.

(1) Reasons for sales growth: SWAP effect at existing stores

-The sales increase from SWAP is exceeding expectations (an average same store growth rate of +110% across 515 stores).

-We start introducing popular Japanese IP prizes like Sanrio and Godzilla from late June.

-We plan to continuously introduce more Japanese IP prizes in the future.

(2) Reasons for sales growth: Increase in new store openings

-Leveraging the aforementioned doubling of sales due to SWAP, we are actively pursuing new store openings.

-As a result, new store openings that were not anticipated before the M&A are now progressing.

-The number of new monthly store openings now exceeds the monthly store closures at Walmart, resulting in a net increase in our current store count.

-Even at Walmart, where closures were progressing, we have secured new store openings (please refer to Q. Please tell us about the status of business with Walmart in the North American business.).

Both (1) and (2) are unexpectedly positive factors. We have proactively accounted for unbudgeted costs as upfront investments compared to the initial target, and we will continue these as growth investments intended to significantly boost mid-to-long-term earnings in the future.

We believe that by incorporating M&A into our strategy, we are building a new growth story. This involves directly providing global content, specifically Japanese anime IP, to individual consumers in North America through our platform.

As we explained in the recent earnings announcement, we are seeing unexpected positive progress compared to our initial projections.

NEN’s situations with Walmart (please refer to Q. What are the latest trends in your North American operations?)

・The termination of some Walmart store contracts had progressed as planned prior to the M&A.

・Meanwhile, as the SWAP initiative led to significant performance improvements, NEN proactively reached out to Walmart for business development.

As a result, new store openings (seven stores) were realized with Walmart.

・A significant achievement is that these are lease agreements rather than the traditional revenue-share format.

-A lease agreement format is a contract that secures a relatively large space and involves paying a fixed rent.

-A revenue-share format primarily involves rent payments based on a percentage of sales, typically for smaller spaces like entrances of stores.

-Considering the larger store area compared to the traditional revenue-share format, and the fixed-cost-like expenses that occur consistently regardless of store size, the upside is high.

・We plan to continuously introduce various Japanese anime IP prizes, including Sanrio and Godzilla, to capitalize on this opportunity.

-If the results are positive, it could lead to further store expansion within other Walmart stores.

・New store openings at Walmart are happening for the first time in seven years, and these store openings at Walmart under lease agreements are groundbreaking cases, marking a first since our establishment.

The revenue increase achieved through SWAP has become a strong selling point to key business partners, expanding opportunities for new store openings in diverse locations, not just with Walmart.

While this financial results presentation only featured three items from Sanrio and Godzilla, we are actually planning for a much wider variety of IP prizes.

This leads us to expect growth that will surpass the +110% (2.1x) same store sales increase already achieved by traditional SWAP to “Kawaii prizes.”

Through GENDA’s network of approximately 130 amusement arcades and 13,000 mini-locations across North America, we will provide Japanese IP prizes directly to individual consumers in the region. This initiative represents an unprecedented scale for a platform provider, allowing us to introduce Japan’s world-renowned IP to North America, thereby creating new value in the region.

We also plan to announce new prizes almost every month through the end of the year. We will inform you promptly once we are ready to disclose the information. Additionally, we intend to report the progress of our North American business without delay in our upcoming monthly store development progress reports.

Through these initiatives, we will further enhance the appeal of GENDA’s mini-location business in North America and achieve sustainable growth.

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)