Financial Results

First, the M&A deals announced after the announcement of our full-year financial results on March 12, 2025, which announced the initial earnings forecast, are not currently included in our earnings forecast for the current fiscal year (ending on January 31, 2026).

- Unaccounted M&A deals in the earnings forecast for the current fiscal year (ending on January 31, 2026) (= M&A deals announced after the announcement of the financial results)

| 1. | A location of TETSUJIN Holdings | Karaoke |

| 2. | Game Goose | Amusement arcade in Japan |

| 3. | SI Amusement | Amusement arcade in Japan |

| 4. | Youing | Amusement arcade in Japan |

| 5. | A store of amusement facilities | Amusement arcade in Japan |

| 6. | A location of Global Staff | Karaoke |

| 7. | Player One | Amusement arcade in North America |

| 8. | Barberio | Amusement arcade in North America |

| 9. | Mini-locations of VENUplus | Amusement arcade in North America |

| 10. | Making LEMONADE Lemonica a wholly-owned subsidiary | F&B |

| 11. | eiga.com | Contents & Promotion |

- Reasons for not revising the earnings forecast for the current fiscal year (ending on January 31, 2026)

- Consequently, the latter half of the current fiscal year is anticipated to see active M&A.

- From today onward, and particularly for M&A deals in the second half of the fiscal year, the recognition of one-off M&A expenses will occur before their earnings contribution.

- As a result, there is a possibility these will offset each other, potentially leading to a negative impact on the current fiscal year’s performance (though naturally, they are expected to contribute significantly to next fiscal year’s earnings).

- We expect to pursue M&A actively over the next six months, yet our earnings forecast for the current fiscal year is unchanged.

- To give a specific example, an M&A completed at the fiscal year-end would make a negative contribution to the results of the fiscal year ending on January 31, 2026.

- There will be no earnings contribution to the fiscal year ending on January 31, 2026, from the M&A target company.

- The full amount of M&A-related expenses will be recognized in the fiscal year ending on January 31, 2026.

- Instead, M&A deals completed during the fiscal year ending on January 31, 2026, will provide a non-recurring positive contribution in the fiscal year ending on January 31, 2027.

- The M&A target companies will contribute their full earnings to the fiscal year ending on January 31, 2027 (12 months).

- No M&A-related expenses will be recognized in the fiscal year ending on January 31, 2027.

- Our official earnings forecast can only reflect the accounting-based forecast, which includes one-off M&A-related expenses.

- We cannot provide figures that exclude one-off M&A-related expenses (= adjusted figures).

- At this time, it is too early to tell which M&A deals will finalize by the fiscal year-end.

- Consequently, disclosure will be made once we have a clear view of M&A activity up to the fiscal year-end.

→ Furthermore, due to the reasons mentioned above, GENDA’s “intrinsic performance, including consolidated M&A targets,” cannot be accurately judged by “the current fiscal year’s results.” Therefore, we are disclosing “next fiscal year’s results,” which will effectively reflect this intrinsic value.

As mentioned earlier, we aim to provide investors with GENDA’s “intrinsic performance after M&A consolidation” (that cannot be fully assessed using the current fiscal year’s earnings).

- Clarification of “intrinsic performance after M&A consolidation”

- The key concern for investors is our company’s steady-state earning capability.

- Assuming publicly announced M&A deals as of today contribute 12 months of earnings

- and one-off M&A-related expenses are not considered

- This is substantially equivalent to next fiscal year’s forecast.

- 12 months of earnings from existing businesses plus publicly announced M&A deals

- However, this assumes zero growth for existing businesses, making it strictly more conservative than next fiscal year’s forecast.

- If we were to disclose figures that include existing business growth, it would become impossible to determine the contribution from M&A.

- Next fiscal year’s growth for existing businesses depends on the current fiscal year’s growth.

Due to our continuous M&A activities, our earning capability can change in significant, discrete steps with each deal announcement, depending on the size of the M&A. We disclose our next fiscal year’s forecast to investors with a focus on providing timely and appropriate disclosure of our underlying earning capability at any given time.

We are aiming for transformational growth through M&A, and we have changed our disclosure policy to highlight this growth strategy.

While we refrained from disclosing specific figures in our most recent earnings presentation, we did indicate that our existing businesses have continued to perform well, in line with last year’s solid trends. In fact, performance in the first quarter exceeded our initial target, and we are seeing continued resilience into the second quarter. Same-store sales growth for the most recent months has remained stable, with +7.0% in May, +2.1% in June, and +5.8% in July.

That said, as the scale of our business continues to expand, the impact of small fluctuations – such as slight up or down in same-store sales growth – has become increasingly limited in terms of its influence on overall earnings. In the context of our medium-term goal of reaching 75.0 billion JPY in EBITDA in the fiscal year ending on January 31, 2030, such metrics are no longer material.

Given this context, and in order to avoid undue investor reaction to a metric whose impact is fundamentally limited, we have decided to discontinue the disclosure of same-store sales growth going forward. The current disclosure will be our last on this metric.

- Allow us to re-emphasize our perspective on achieving transformational growth through M&A;

- Our main focus is transformational growth through M&A.

- We do not disclose our annual mid-term management plans to uphold our M&A discipline.

- On the other hand, we issued stock acquisition rights to 83 directors and employees last June to promote management from a shareholder’s perspective.

- One of the conditions for exercise is to achieve “EBITDA of 75.0 billion JPY in the fiscal year ending on January 31, 2030” (five times that of the fiscal year ending on January 31, 2025).

- Our management strategy focuses on M&A, aiming to increase EBITDA fivefold within five years.

- Meanwhile, we are also focusing on organic growth, as evidenced by three of our different entertainment businesses (amusement arcade, karaoke and prize) simultaneously achieving record-high earnings since their inception last fiscal year.

- In addition, the organic growth in our U.S. operations has significantly outperformed Japan, making it a new cornerstone for organic growth.

We kindly ask for your understanding regarding our commitment to sustainable growth and enhancing enterprise value.

Business

They are two distinct PMI (Post-Merger Integration) initiatives in our North American mini-location business, and we are aiming to boost sales by placing prizes of popular Japanese IP, etc. into Kiddleton-style game machines. Driven by the strong demand for Japanese anime prizes in North America, both initiatives boast quick cash recoupment and high investment efficiency. Notably, if the same results are achieved, Add on is expected to recoup the cash even faster than SWAP.

- SWAP

- “Replacement” of existing game machines. Mainly implemented at NEN, with smaller stores.

- Replace existing game machines within the limited store space, and the number of machines installed remains the same before and after implementation.

- At NEN, sales pre- and post-SWAP showed an average increase of approximately 2.1 times across 515 locations (See FY2026/1 1Q Earnings Presentation).

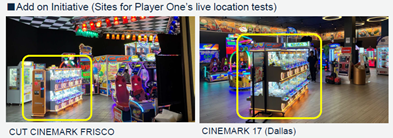

- Add on

- “Net increase” in new game machines. Mainly implemented at Player One, with large stores.

- Leveraging the ample store space, add new game machines as a net increase without removing existing ones.

- Compared to NEN’s average monthly sales per unit of about $500 (derived from a 2.1x sales increase across 515 locations after implementing SWAP), the Add on initiative locations recorded average of approx. $1,000 per unit (See GENDA Store Development Progress Report (July 2025)).

Furthermore, assuming both SWAP and Add on were implemented at the same location, the cash recoupment period for Add on would be even shorter, 70% of that for SWAP (because there is no need to remove the cash flow from existing machinery with Add on). In PMI at Player One, we primarily focus on implementing Add on due to the abundance of available space.

It is a new contract method for opening a store in Walmart in our North American business.

- Traditional “revenue-sharing agreement”

- A variable cost-type agreement in which a portion of sales is paid, and the payment amount fluctuates with changes in sales.

- An agreement model primarily for stores with limited space.

- For some agreements, we also successfully reduced the revenue-sharing percentage after the SWAP-driven sales increase.

- The recent “lease agreement”

- A fixed-cost type agreement where a fixed amount is paid monthly as rent, regardless of sales.

- An agreement model primarily for larger stores.

- We anticipate significantly increasing sales per location through our PMI initiatives such as SWAP and Add on. In this context, fixing rent as a fixed cost could also present an upside.

In our presentation dated April 9, 2025, even when U.S. tariffs on China were as high as 104%, the impact was minor (approximately 3% compared to the current fiscal year’s target). As of July 31, 2025, those tariffs stand at 30%, making the impact on our performance even more negligible.

- Changes in U.S. Tariffs on China

- April 2, 2025: 20%→54%

- April 8, 2025: 54%→104% (the day before the announcement of M&A with Player One)

- April 10, 2025: 104%→145% (the day after the announcement of M&A with Player One)

- May 12, 2025: 145%→30% (90-day suspension)

- July 30, 2025: 30%→30% (re-extension of the 90-day suspension)

- Why the impact is negligible given our business model

(Source: page 14 of “M&A announced today” disclosed on April 9, 2025)

- Impact on prize costs

- The play price for our North American operations is low, at around US$1 per play.

- This can be fully absorbed through adjustments to play unit prices and other measures.

- Impact on machine (mini claw machine) costs

- The mini claw machines that we deploy in North America are relatively inexpensive.

- Even at the tariff rate of 104% as of April 9, the impact on our current fiscal year’s target is around 3%, indicating a negligible effect on overall performance. As of today, with the tariff at 30%, the impact is even more negligible.

- Optimizing PMI investment efficiency

- Start implementing PMI initiatives at locations in Canada, that is not affected by tariffs.

- We are prioritizing locations for PMI implementation, taking into account the difference in investment efficiency between the aforementioned SWAP and Add on.

- PMI leveraging the scale advantages of our North American locations

- We are currently integrating five companies: Kiddleton, NEN, Player One, Barberio and VENUplus.

- We are currently realizing various synergies from both revenue and cost perspectives, leveraging our 13,000 locations in North America.

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)