M&A Strategy

If you simply calculate P/E multiple based on actual results stated in the disclosure materials, it may appear at first glance to be a relatively expensive level compared to out company’s P/E multiple. On the other hand, the P/E mulitple based on the projected earnings after the consolidation starts will be more favoravly priced than our company’s P/E multiple.

In this M&A, we have factored in the cost synergies that are expected to be realized promptly after consolidation (e.g., reduction of executive compensation for the retiring owner, elimination of head office rent and company housing burden, and liquidation of recently closed stores). We assume that, due to these effects, the target company’s net income will be at a different level after consideration than its past performance.

Besides, the above valuation is based solely on a conservatively assumed cost reduction and does not factor in the upside of sales. On the other hand, as our M&A track record has shown, we assume that the P/E multiple will consequently decline to a more undervalued level as profitability improves due to synergy creation.

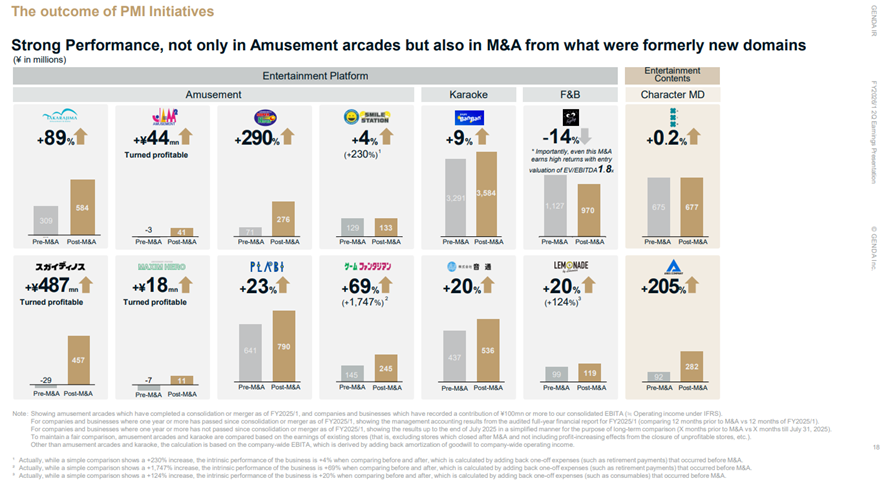

(page 18 of “FY2026/1 2Q Earnings Presentation” disclosed on September 12, 2025)

The purpose of this change in capital allocation strategy is to reduce the burden of financing for M&A. There is no change to the core of our growth strategy, which remains the transformational growth through M&A. And ample fund is essential to continuously execute M&A.

On the other hand, while actively investing in inorganic (M&A), we have also been aggressively pursuing organic growth (existing businesses). Specifically, we were investing more in our existing businesses than the cash flow they were generating from operations, which resulted in a negative free cash flow.

As a result, external funding was also allocated to organic (existing businesses) investments, and inorganic (M&A) investments were, in effect, “entirely” financed with external funds.

Furthermore, because our free cash flow was negative, while we were making loan repayments, our total borrowings were increasing by more than the amount repaid, meaning we were not making any substantial progress in repaying our debt.

For that reason, continuing our M&A activities places a heavy strain on our ability to raise capital.

Therefore, in a major shift of our internal policy, we have decided to focus and prioritize our organic (existing businesses) growth investments. This is a strategic change aimed at making our free cash flow positive, so that for the first time since our founding, we will allocate our own cash flow to inorganic (M&A) investments.

This will ease the burden of creditors and shareholders, who are the providers of external funding.

Specifically, for creditors, this marks the first time that substantive debt repayment will begin. While our company’s debt capacity is still estimated at approximately 30.0 billion yen (please refer to page 8 of “FY2026/1 2Q Earnings Presentation” disclosed on September 12, 2025), the start of debt repayment will further increase our debt capacity.

Additionally, from a shareholder’s perspective, the need for additional follow-on offerings is reduced by the use of our own cash flow for M&A – which is effectively the first time – and by the increase in the aforementioned debt capacity. Since we have always been disciplined with our M&A strategy, our Cash EPS has continued to rise even after follow-on offerings. However, while this approach is effective in the long term, it created a burden on the capital market, as it led to short-term pressure from investors who wanted to “wait and see” until the next follow-on offering.

Our annual cash-in amount, equivalent to EBITDA, is currently approximately 27.0 billion yen (equivalent to the company’s planned EBITDA for the fiscal year ending on January 31, 2027). We will leverage this significant annual cash inflow to its full potential to pursue continuous M&A, all while reducing the strain on the capital markets. This will be accomplished by funding M&A with our own cash flow, initiating debt repayment to increase our debt capacity, and conducting disciplined, stock-based M&A.

Financial Results

The purpose of the share repurchase is to maximize capital efficiency.

While we prioritize M&A discipline – specifically, the rules for acquiring other companies’ shares – a share repurchase becomes an option for us. This would occur if, in light of our own projected future growth, we determine that acquiring our own shares is a more meaningful use of capital than acquiring another company, all from the perspective of maximizing capital efficiency.

Therefore, though it is unusual, we plan to conduct a special, non-consolidated financial closing in the third quarter to increase the distributable amount.

Normally, to increase the distributable amount, we have to wait until the full-year financial results are announced in March 2026. However, as we think that that is too late, we plan to hold an extraordinary settlement of accounts at the end of the third quarter in December 2025, raise the distributable amount on a non-consolidated basis to an appropriate level, and quickly establish a structure that will enable us to make effective share repurchase.

Currently, the distributable amount on a non-consolidated basis is 1.2 billion yen, but on a consolidated basis this amount can be raised to 36.6 billion yen (*1).

Additionally, if we acquire our own shares at an undervalued price and the stock price later rises, we can re-use those shares as consideration for M&A. This would, as a result, lighten the financial burden of future M&A deals.

Business

This revision to our investment policy is the result of a more rigorous internal verification of our past investment performance, coupled with a comprehensive re-evaluation of our entire business portfolio and a reprioritization of our investments. It represents a strategic shift aimed at maximizing our growth by becoming more conscious of capital efficiency, all as we continue to pursue both organic and inorganic growth.

This will enable us to focus our resources on the areas that offer the highest potential return on invested capital. We believe this new policy will make M&A – which has been a key driver of our consolidated growth – even more sustainable, ultimately leading to an improvement in the overall growth of the company.

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)