M&A Strategy

In the roll-up of amusement arcades to this point, many stores have converted to the GiGO brand, and we will continue to largely follow that approach. However, if we determine that this is not necessarily optimal for our customers and stakeholders, we will not be limited to that.

For more information, please see the “Transcript of the 6th Annual General Meeting of Shareholders” posted on logme Finance.

Stock Information

As a Serial Acquirer, we have been growing through continuous M&A and expanding our business performance with 1.8 times sales and 1.6 times EBITDA compared to the previous fiscal year, we have recently been receiving substantial interest particularly from overseas institutional investors. On the other hand, while the majority of our shareholders since our IPO have been stable shareholders (see below for details), we have been receiving comments about increasing the liquidity of our shares, especially from institutional investors with large investment funds who are considering new investments in our shares in the market.

In addition, we are planning further growth through M&A for the next fiscal year, and while we advocate Transformational Growth in the future, we are also making daily efforts to transformationally increase the value of our stock along with our growth. On the other hand, if we were to introduce shareholder benefits in the future, in light of the price level of GENDA Group’s B to C services, it is necessary to maintain the minimum investment amount of our stock at a certain level to create a meaningful shareholder benefit program.

As mentioned above, we have made the decision to carry out this stock split for two reasons: to increase liquidity and to maintain the minimum investment amount. Next, we will explain our stable shareholder base as mentioned at the beginning of this document.

First, as disclosed in our Annual Securities Report, “Hidetaka Yoshimura Midas B Investment Limited Partnership” and “Midas Capital G Fund Limited Liability Partnership” owned approximately 44% of our shares as of January 31, 2024. In addition, officers and employees of GENDA hold approximately 24% of our shares in total.

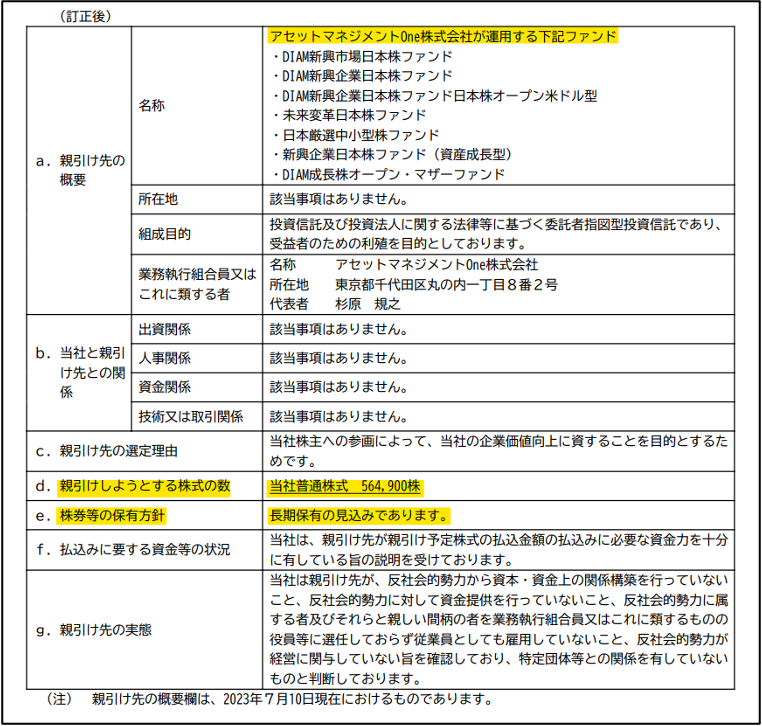

In addition, at the time of the IPO, Asset Management One Co., Ltd. acquired 564,900 shares (1.52%) of our stock through “Oyabike” (A promise by the company issuing the new shares to sell a portion of the new shares to a specific party after consulting with a securities company in advance.), as described in the “Amended Securities Registration Statement (Initial Public Offering)” disclosed on July 19, 2023, and its holding policy at that time was “expected to be a long-term holding”.

https://disclosure2dl.edinet-fsa.go.jp/searchdocument/pdf/S100RFK6.pdf

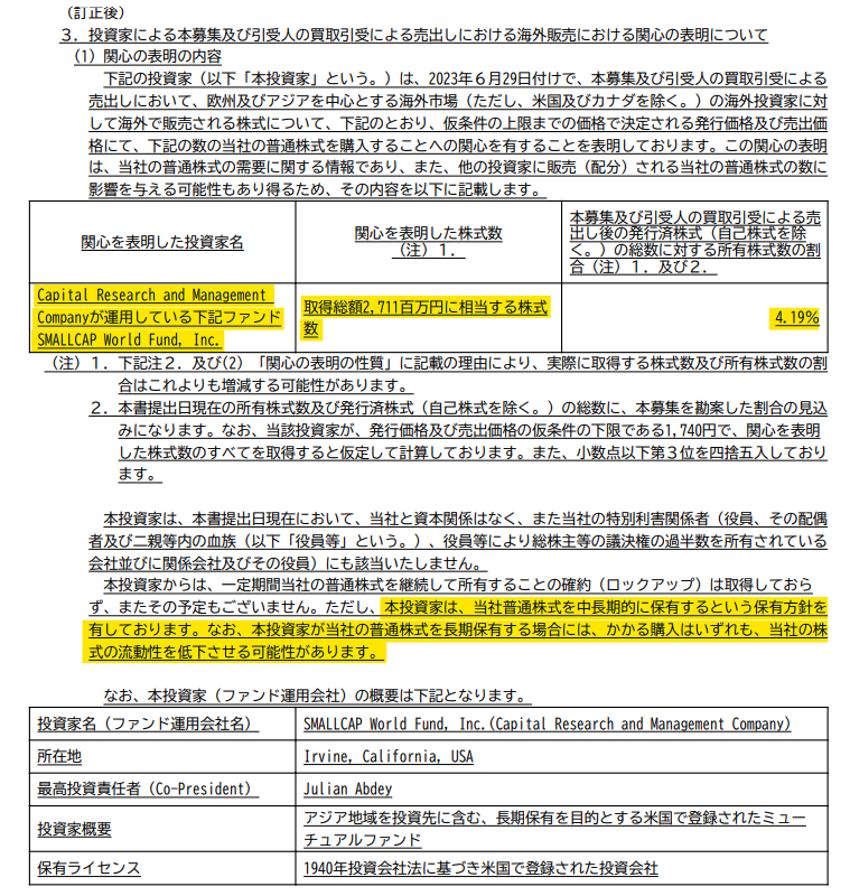

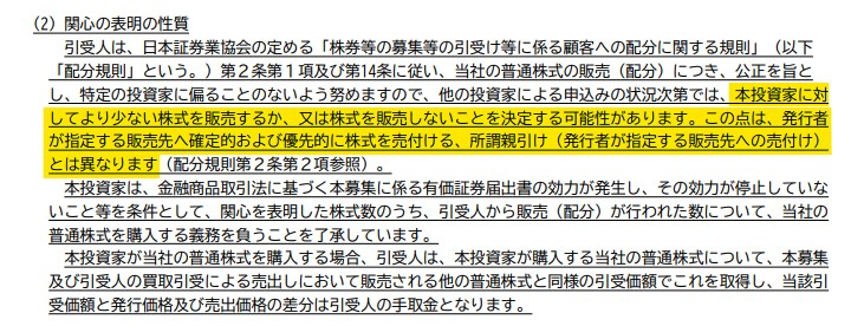

And we received an Indication of Interest from Capital Group in the amount of 2,711 million yen (4.19%), as described in the “Amended Securities Registration Statement (Initial Public Offering)” disclosed on July 10, 2023. (Since this is only an expression of interest, the actual allocation of shares in the IPO is not disclosed.)

https://disclosure2dl.edinet-fsa.go.jp/searchdocument/pdf/S100RD51.pdf

While we are not in a position to comment on future shareholder trading due to the nature of our stock being listed on a liquid stock market, it is true that the majority of our shareholders are stable shareholders with relatively low liquidity, although our business performance is expanding compared to last year. Therefore, we will make efforts in IR activities to increase liquidity by having more shareholders deepen their understanding of our company.

Please refer to the Annual Securities Report for more information, including the status of other major shareholders.

https://disclosure2dl.edinet-fsa.go.jp/searchdocument/pdf/S100TC50.pdf

Regarding dividends, we are aware of a number of attractive business investment opportunities that exceed the cost of equity, thus we understand that reinvesting our current cash flow will contribute more to shareholder value, rather than returning right now the cash flow to shareholders. For these reasons, we are not considering dividends at this moment.

The concept of share buybacks is generally the same as that of dividends. However, in cases such as when our share price is traded at a significant discount from our fair value, it may be judged that share acquiring “our” shares are more effective in increasing share value as a result of a higher return on investment than acquiring “other company’s” shares through M&A activities We believe that the share buyback is more effective in improving shareholder value relative to dividends, owing to this agility of being able to control the timing of implementation.

On the other hand, although nothing has been decided on shareholder benefits at this time, since our entertainment platform business is a B to C business, we recognize that shareholder benefits are an effective measures for our group from a variety of perspectives.

For example, unlike dividend payments and share buybacks, which are also forms of shareholder return but involve actual cash outflows, shareholder benefits do not directly interfere with the growth investments that are part of our M&A strategy.

In addition, while the shareholder benefits will lead to the development of a new customer base and expansion of the investor base, we believe that the expansion of the shareholder base will also have the effect of reducing the daily volatility of the share price, resulting in a lower cost of capital and subsequent increase in shareholder value. For more information on shareholder benefits, please refer to the following documents.

https://ssl4.eir-parts.net/doc/9166/ir_material_for_fiscal_ym5/157463/00.pdf

Based on the above assumptions, our basic policy is to always continue to implement the optimal allocation of capital from time to time in order to realize an increase in shareholder value.

-

Frequently Asked Questions and Answers (February 2026)

-

Frequently Asked Questions and Answers (January 2026)

-

Frequently Asked Questions and Answers (December 2025)

-

Frequently Asked Questions and Answers (November 2025)

-

Frequently Asked Questions and Answers (October 2025)

-

Frequently Asked Questions and Answers (September 2025)

-

Frequently Asked Questions and Answers (August 2025)

-

Frequently Asked Questions and Answers (July 2025)

-

Frequently Asked Questions and Answers (June 2025)

-

Frequently Asked Questions and Answers (May 2025)(corr)

-

Frequently Asked Questions and Answers (April 2025)

-

Frequently Asked Questions and Answers (March 2025)

-

Frequently Asked Questions and Answers (February 2025)

-

Frequently Asked Questions and Answers (January 2025)

-

Frequently Asked Questions and Answers (December 2024)

-

Frequently Asked Questions and Answers (November 2024)

-

Frequently Asked Questions and Answers (October 2024)

-

Frequently Asked Questions and Answers (September 2024)

-

Frequently Asked Questions and Answers (August 2024)

-

Frequently Asked Questions and Answers (June 2024)

-

Frequently Asked Questions and Answers (May 2024)

-

Frequently Asked Questions and Answers (April 2024)

-

Frequently Asked Questions and Answers (March 2024)

-

Frequently Asked Questions and Answers (February 2024)

-

Frequently Asked Questions and Answers (January 2024)

-

Frequently Asked Questions and Answers (December 2023)

-

Frequently Asked Questions and Answers (November 2023)

-

Frequently Asked Questions and Answers (October 2023)

-

Frequently Asked Questions and Answers (September 2023)

-

Frequently Asked Questions and Answers (August 2023)