Company Information

Regarding the information provided by MSCI, the percentage of our revenue derived from gambling has been corrected to 0.17%, which more accurately reflects our current situation.

Previously, our revenue ratio from the amusement poker business was incorrectly recorded on the MSCI platform. As a result, certain institutional investors – who otherwise would have considered purchasing our shares – faced difficulties in executing trades due to restrictions within their investment mandates.

The previously noted inaccuracies have been resolved, and we are now engaging in transparent communication with institutional investors based on our actual gambling-related revenue ratio of 0.17%.

We have already received inquiries from institutional investors who were previously unable to purchase our shares due to these internal restrictions. Following detailed discussions regarding our actual revenue structure, they have gained a clear and accurate understanding of our business.

Moving forward, we remain committed to timely and accurate information disclosure to ensure market integrity.

Regarding our company information provided by MSCI, while some descriptions have been corrected to 0.17% to better reflect our actual gambling-related revenue ratio, an incorrect figure of 5 to 9.9% still remains. We have received confirmation from MSCI that this information is scheduled to be corrected around March 2026.

The timeline is as follows.

October 31: GENDA formally requested MSCI for correction on the same day we disclosed the “Frequently Asked Questions and Answers.”

November 3: MSCI contacted us, stating the information provided lacked sufficient detail.

November 5: GENDA submitted monthly sales data for the amusement poker business to MSCI.

November 21: The amusement poker revenue data we had submitted was added to our company’s page on MSCI. However, the gambling revenue ratio remains listed as 5 to 9.9%.

November 21: GENDA requested MSCI to correct the erroneous gambling revenue ratio once again.

From November 25 to December 9: GENDA conducted four rounds of continuous follow-up with MSCI.

December 16: Due to the lack of response from MSCI, GENDA escalated the matter by reaching out through a different channel than before.

December 24: Due to the lack of response from MSCI, GENDA followed up again through multiple channels, including email and direct phone calls.

MSCI updated certain pages regarding our company and notified GENDA of the change.

GENDA requested MSCI to ensure accurate information is reflected across all relevant pages.

MSCI responded that they will correct the information on all pages as soon as possible. December 26: GENDA has strongly requested MSCI to promptly correct the pages that remain inaccurate.

In addition to the aforementioned situation, we have taken the following actions.

January 6: Again, GENDA requested MSCI to correct the information.

January 8: MSCI acknowledged our request for correction and confirmed that the figures will be updated in their next scheduled cycle.

GENDA inquired with MSCI about the specific timing for the correction.

January 13: GENDA requested a response as none had been received from MSCI.

January 14: MSCI responded that the next update is scheduled for around March.

January 15: GENDA strongly urged MSCI to expedite the correction process.

January 19: MSCI reaffirmed the correction is scheduled for the next update in March.

January 20: GENDA requested a more explicit and definitive response from MSCI.

January 23: MSCI stated the correction would occur during the next annual review (without specifying a month).

GENDA identified the specific pages containing incorrect information and submitted a formal request for correction and a confirmed timeline.

As of today: Awaiting for MSCI’s response.

Some sections of MSCI’s website regarding our company have been updated to reflect our actual business status, reporting a gambling-related revenue ratio of 0.17%. However, as certain other pages still incorrectly show a range of 5 to 9.9%, we are continuing to request that these errors be corrected as soon as possible.

(Repost: Q4 of “Frequently Asked Questions and Answers (November 2025)” disclosed on November 27, 2025)

We formally contacted MSCI with a request for correction on October 31, 2025, upon the disclosure of the “Frequently Asked Questions and Answers” on the same day, which was the date we, as a company, officially disclosed the revenue from our amusement poker business (approximately 0.2 billion yen per year ÷ Revenue of 111.7 billion yen for the fiscal year ending on January 31, 2025 = approximately 0.1%).

However, as the incorrect information stating 5% to 9.9% is still stated at present, we are currently continuing to request the quickest possible correction.

The timeline is as follows.

October 31: GENDA formally requested MSCI for correction on the same day we disclosed the “Frequently Asked Questions and Answers.”

November 3: MSCI contacted us, stating the information provided lacked sufficient detail.

November 5: GENDA submitted monthly sales data for the amusement poker business to MSCI.

November 21: The amusement poker revenue data we had submitted was added to our company’s page on MSCI. However, the gambling revenue ratio remains listed as 5 to 9.9%.

November 21: GENDA requested MSCI to correct the erroneous gambling revenue ratio once again.

As of today: Awaiting MSCI’s response.

The incorrect listing of our amusement poker business’s revenue ratio on MSCI has resulted in a situation where some institutional investors, who otherwise would have been considering purchasing our company’s shares, are currently finding it difficult to execute purchases due to restrictions in their investment mandates.

We will strive to ensure that the capital market, including MSCI, accurately understands our company’s business activities.

In addition to the aforementioned situation, we have taken the following actions.

From November 25 to December 9: GENDA conducted four rounds of continuous follow-up with MSCI.

December 16: Due to the lack of response from MSCI, GENDA escalated the matter by reaching out through a different channel than before.

December 24: Due to the lack of response from MSCI, GENDA followed up again through multiple channels, including email and direct phone calls.

MSCI updated certain pages regarding our company and notified GENDA of the change.

GENDA requested MSCI to ensure accurate information is reflected across all relevant pages.

MSCI responded that they will correct the information on all pages as soon as possible.

December 26: GENDA has strongly requested MSCI to promptly correct the pages that remain inaccurate. We will maintain continuous communication with MSCI and all other capital market participants to ensure an accurate understanding of our business activities.

We formally contacted MSCI with a request for correction on October 31, 2025, upon the disclosure of the “Frequently Asked Questions and Answers” on the same day, which was the date we, as a company, officially disclosed the revenue from our amusement poker business (approximately 0.2 billion yen per year ÷ Revenue of 111.7 billion yen for the fiscal year ending on January 31, 2025 = approximately 0.1%).

However, as the incorrect information stating 5% to 9.9% is still stated at present, we are currently continuing to request the quickest possible correction.

The timeline is as follows.

October 31: GENDA formally requested MSCI for correction on the same day we disclosed the “Frequently Asked Questions and Answers.”

November 3: MSCI contacted us, stating the information provided lacked sufficient detail.

November 5: GENDA submitted monthly sales data for the amusement poker business to MSCI.

November 21: The amusement poker revenue data we had submitted was added to our company’s page on MSCI. However, the gambling revenue ratio remains listed as 5 to 9.9%.

November 21: GENDA requested MSCI to correct the erroneous gambling revenue ratio once again.

As of today: Awaiting MSCI’s response.

The incorrect listing of our amusement poker business’s revenue ratio on MSCI has resulted in a situation where some institutional investors, who otherwise would have been considering purchasing our company’s shares, are currently finding it difficult to execute purchases due to restrictions in their investment mandates.

We will strive to ensure that the capital market, including MSCI, accurately understands our company’s business activities.

We had already announced in the second quarter financial results that we would pay dividends from each group company to increase the distributable amount, and this was completed in October, the end of the third quarter.

As mentioned in the “Frequently Asked Questions and Answers” in September 2025, generally, we have to wait until the fiscal year-end closing (the fiscal year ending on January 31, 2026). However, since we are afraid that this will delay the implementation of our agile capital policy, we plan to conduct an extraordinary closing after the announcement of the third quarter financial results, which will be announced in December this year.

Through this extraordinary closing, we aim to raise the distributable amount to an appropriate level.

Once these preparations are in place, we will consider implementing a share repurchase at an appropriate time, comprehensively taking into account the market environment and financial conditions.

We will use all means at our disposal to maintain a good relationship with our shareholders and investors and continue our efforts to enhance our enterprise value and equity value. On this basis, we ask for the continued understanding and support of all our stakeholders. The following is based on the answers to the above questions in the minutes of the financial results briefing. We include it in this monthly FAQs as well to inform everyone.

With a background of having established a certain strategy as a M&A enterprise and entering a new growth phase to execute this cycle toward the future, GENDA has decided to change to the most appropriate management structure from the viewpoint of executing the cycle at the fastest speed.

As a result, we have decided that Mai Shin will step down as Representative Director and President at the next General Meeting of Shareholders, to be succeeded by Nao Kataoka, the co-founder of the company, and at the same time, Taiju Watanabe, incumbent Director CFO, and Kohei Habara, incumbent Director CSO, will be appointed as Managing Director.

Shin, who is Representative Director, recognizes that it is important to avoid making the organization rigid and metabolize the management structure to grow sustainably and increase the enterprise value. She has believed from a long-term perspective that it is important to promote the transfer of the management at the right timing for the development of an organization.

At the start of the third fiscal year after we went public in July 2023, while the M&A pipeline is the largest ever in terms of value and further acceleration of growth is anticipated under the unchanged strategy, she believed that we should change the leadership in the time of business strength.

With both the business environment and performance in very good shape, she decided to change President to Kataoka, her co-founder, at this timing, and pass the torch to Watanabe and Habara, who have been leading the whole company and GENDA’s growth in line with Kataoka, and provide rearguard support to the management as a director.

Under the new structure with Kataoka as Representative Director and President, we will once again seriously aim to become the world’s No. 1 entertainment company by 2040.

This definition of the world’s No. 1 entertainment company aims to be the world’s No.1 in the entertainment industry in terms of revenue, EBITDA, market capitalization, and all their indicators.

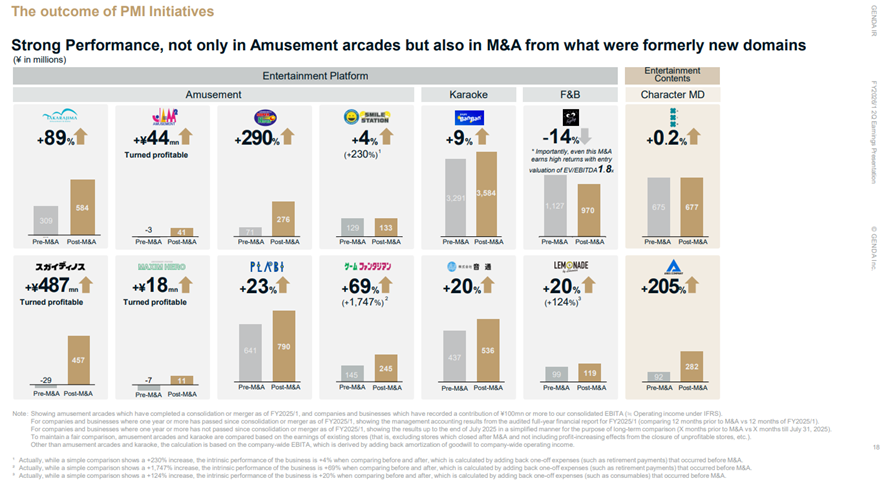

GENDA ended its seventh fiscal year in very good shape, both in terms of organic growth and M&A growth. We believe that we have been able to embody the conglomerate premium of the entertainment industry, where the entertainment is contiguous, and the same group management can grow through synergies rather than stand alone.

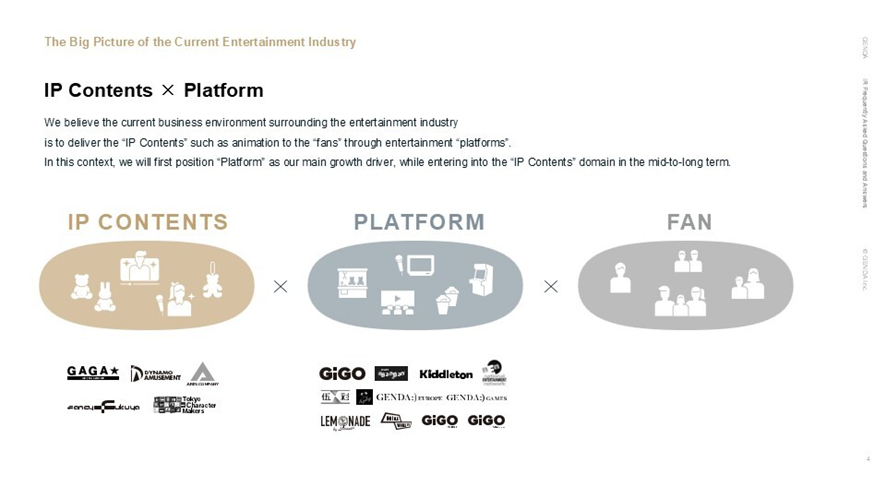

Besides, the entertainment industry has also grown in tandem with the increase in human leisure time, in which Japan’s world-class anime IP culture has taken root globally.

In the future, many Japanese entertainment companies will not fight domestically in Japan but will work together in the same direction and spread their wings to the world.

GENDA is now playing the role of a platform, which is the bridge, through roll-up M&A. In the mid- to long-term, we seriously aim to become a leading entertainment company in Japan, including the IP field, and ultimately to become the world’s No. 1entertainment company originating from Japan.

With 15 years to go until 2040, we will do our utmost to make life more fun for your days. We would be very grateful if you could kindly support us in the long term.

Over the years, Ms Hayashi has produced many works in the entertainment industry based on her keen perspective of the times and deep insight into society.

We are confident that her outstanding creativity and ability to convey messages will provide us with important insights in our goal of creating entertainment that “increases the total amount of fun.”

In addition, Ms Hayashi has connections not only with the publishing industry, but also with prominent figures and companies in a wide variety of fields. We hope that Ms Hayashi’s participation will create new opportunities for us to collaborate with companies we have not been able to approach in the past and to discover new information.

Mariko Hayashi (Mariko Togo) born on April 1, 1954

Newly appointed, outside, independent

January 1986 Won the 94th Naoki Prize for “The Last Flight Home” and “To Kyoto”

January 2011 Won Chevalier de la Legion d’Honneur

November 2018 Won Medal with Purple Ribbon

May 2020 President, Japan Writers’ Association (present)

December 2020 Won Kan Kikuchi Award

July 2022 Chairperson of the Board of Trustees, Nihon University (present)

The “Deal of the Year 2024” is selected and ranked based on a survey conducted by NIKKEI Veritas for institutional investors and securities companies.

The survey has evaluation criteria with three points; (1) whether we have met the issuing entity’s capital needs and business strategy needs, (2) whether the demand survey on issuing or selling situation, the change in prices after issuing were valued by investors and (3) whether the deal was meaningful to the capital markets.

As reported, our follow-on offering conducted in July 2024 was highly valued and we ranked as number three in the Best Equity Finance category for the “Deal of the Year 2024,” which was announced in NIKKEI Veritas dated January 26, 2025 (please refer to “Frequently Asked Questions and Answers (August 2024)” disclosed on August 5, 2024 for more details of the follow-on offering concerned).

Considering the offering size that the No.1, ASICS was about 200.0 billion yen (secondary only) and the No.2, HONDA was about 500.0 billion yen (secondary only), why our 12.6 billion yen (primary + secondary) was ranked number three, we believe that this is primarily due to our shareholders’ support in the capital market and we really appreciate the great support from our valued shareholders.

We will make further efforts in 2025 and aim to make further progress. Your continued support would be highly appreciated.

May 2018

January 31 every year

Please refer to the “IR calendar”.

Please refer to the “IR calendar”.

Unfortunately, we do not accept inquiries regarding IR over the phone. If you are unable to resolve your issue by referring to the FAQ section. Please contact us through the “IR Inquiry” for further assistance.

M&A Strategy

This transaction was decided upon following careful screening in accordance with that policy and was reached after a highly selective process.

The company has already established itself as one of the largest players in Malaysia as a brand that provides a high-quality karaoke experience.

Furthermore, compared to our domestic karaoke business, the company boasts higher profit margins and has consistently generated stable cash flow; therefore, it does not require radical restructuring post-acquisition.

Additionally, regarding the acquisition price, we have determined that the recoupment period based on free cash flow is well within our investment criteria.

The company’s integration into our group marks a significant first step in expanding Japanese-style karaoke culture overseas.

By leveraging the brand power and customer base that “Loud Speaker” possesses in Malaysia and combining them with our operational expertise, we aim to create new entertainment value.

—–

While our North American business remains our top company-wide priority at present, we acknowledge that some may have concerns regarding the potential strain on resource allocation given this acquisition.

In this regard, we would like to clarify that this project will not require significant additional resources post-acquisition; we are bringing a company with an already stable earnings base into the group at an attractive valuation.

Besides, regarding PMI (Post-Merger Integration), we have structured it so that our Karaoke Business Division will lead the efforts, separate from the teams handling North America and Amusement operations; therefore, there will be no competition for management resources.

Consequently, we believe that maintaining our focus on North America and steadily advancing this project are fully compatible, which is why we decided to proceed with this announcement.

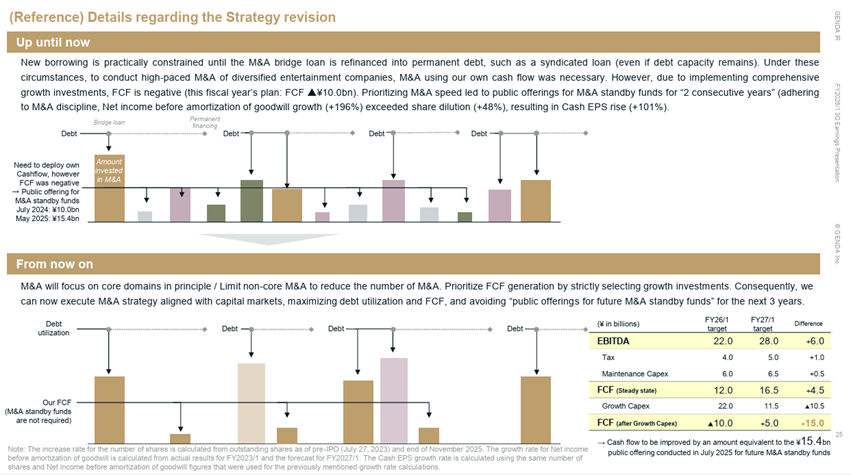

1. Revising our M&A strategy to align with the capital markets

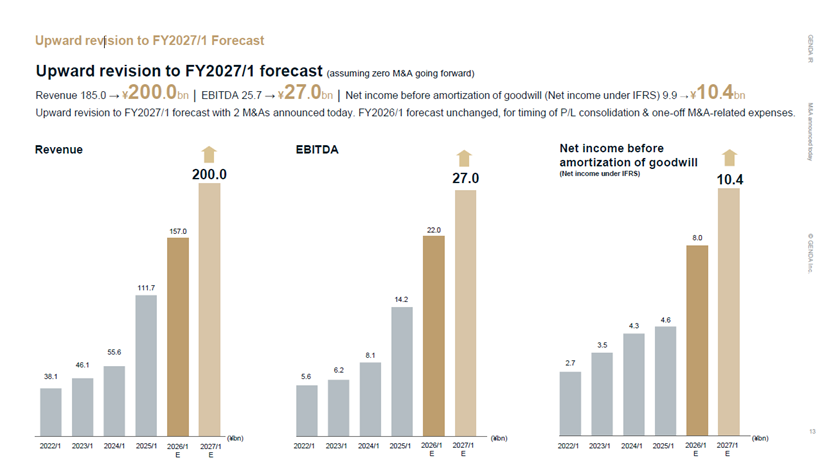

Through the following three policy shifts, we will revise our M&A strategy to align with the capital markets by utilizing Free Cash Flow (FCF) and debt, thereby alleviating concerns regarding future equity financing. Meanwhile, by being more selective with the number of deals while increasing the transaction value per deal, we aim to achieve transformational growth without compromising our growth rate.

- Leveraging our debt capacity by being highly selective with M&A opportunities

- Strictly prioritizing growth investments for our existing businesses and aiming to generate 5.0 billion yen in FCF next fiscal year (The difference compared to this fiscal year is a plus of 15.0 billion yen)

- Implementing a 36-month freeze on public offerings intended for M&A standby funds

For more detail, please refer to Q2 of “Frequently Asked Questions and Answers (December 2025)” and page 9 of “FY2026/1 3Q Earnings Presentation.”

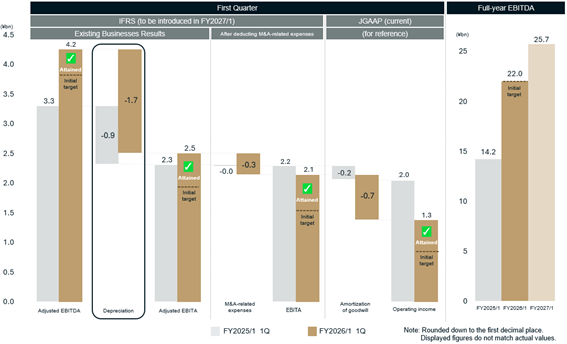

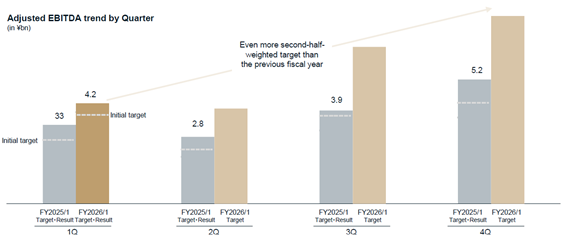

2. Transition to IFRS (International Financial Reporting Standards)

We will adopt International Financial Reporting Standards (IFRS) starting from the fourth quarter of the fiscal year ending on January 31, 2027. Consequently, we expect all income levels from operating income downward to increase compared to current levels – primarily due to the non-amortization of goodwill. As a result, we anticipate that our valuation metrics, such as P/E multiple on various financial databases, will decrease.

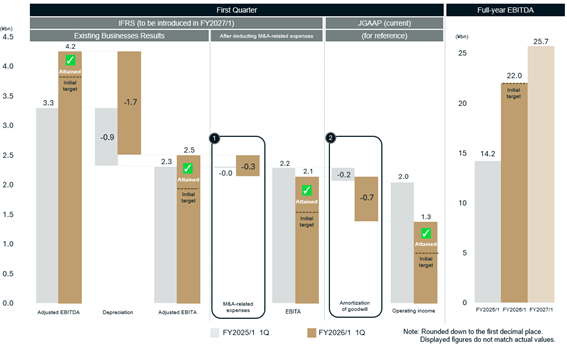

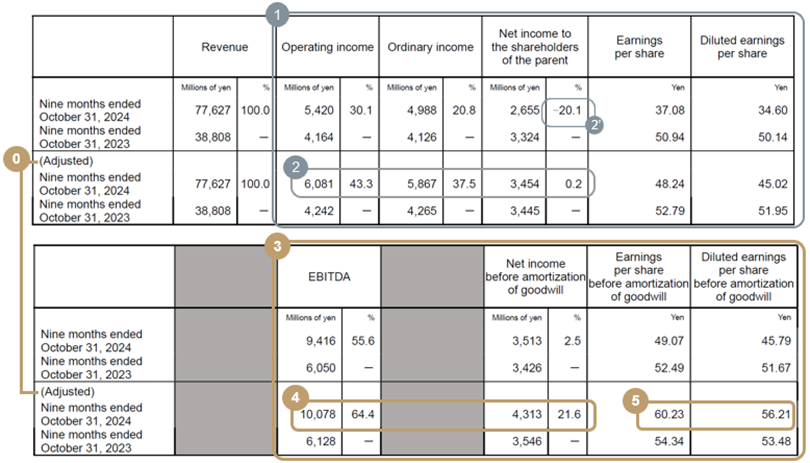

3. Full-year forecast: Switched to adjusted metrics only

Until the fiscal year ending on January 31, 2026, “our full-year earnings forecasts included M&A-related expenses, etc. (statutory figures).” Under this conventional method, forecasting M&A-related expenses – which can occur toward the end of the fiscal year – was difficult. This presented a challenge in making agile upward or downward revisions to our guidance that reflected new M&A activity mid-term.

To resolve this, starting from the fiscal year ending on January 31, 2027, we will transition to using only “Adjusted” metrics – which exclude M&A-related expenses – to more accurately reflect the actual state of our operations. Specifically, we will streamline our official earnings guidance to the following three items: (1) Revenue, (2) Adjusted EBITDA, and (3) Adjusted Net Income.

This will enable us to promptly reflect the impact of new consolidations from M&A into our earnings forecasts during the term. We are committed to providing all our investors with higher transparency and more agile information disclosure.

For more detail, please refer to page 26 of “FY2026/1 3Q Earnings Presentation.”

4. Towards inclusion in the new TOPIX (effective October 2026)

The Tokyo Stock Exchange is currently revising the TOPIX (Tokyo Stock Price Index) framework with the aim of enhancing its market representativeness and investment functionality. We are highly mindful of these new TOPIX selection criteria, particularly regarding liquidity.

Inclusion in such an index serves as a testament to the market’s trust in our company, while simultaneously providing a significant opportunity to increase our visibility among a broader range of investors. We will continue to build a solid track record, step by step, as we strive to meet the expectations of all our shareholders.

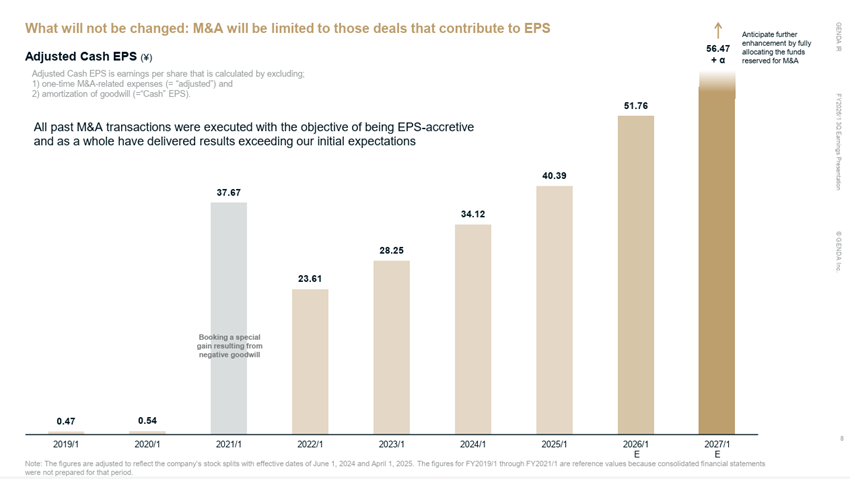

To summarize our position: there is absolutely no change to the core of our strategy – achieving “Transformational growth through continuous M&A” – nor to our discipline of pursuing “M&A that contributes to EPS improvement.”

Building on this foundation, we have announced a “shift toward an M&A strategy aligned with the capital markets,” and have committed to not conducting any “public offerings for the purpose of securing M&A standby funds” until at least the end of January 2029.

(Source: page 6 of “FY2026/1 3Q Earnings Presentation” disclosed on December 12, 2025)

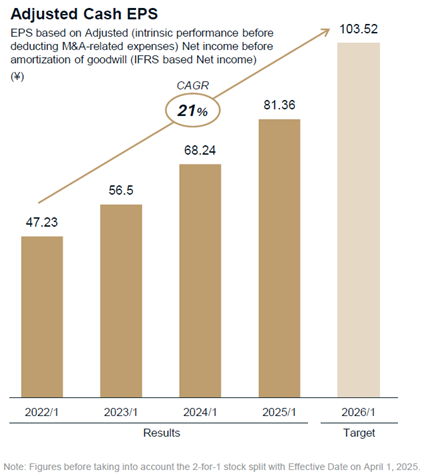

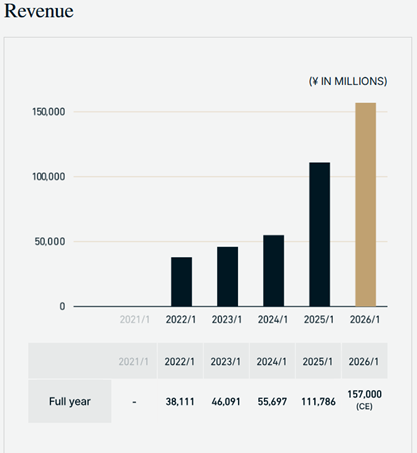

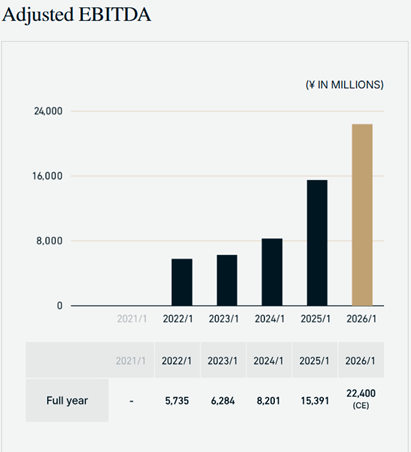

Since our founding, we have remained committed to our strategy of achieving “Continuous Transformational Growth” through M&A in the entertainment industry. By strictly adhering to the discipline of executing only M&A transactions that are EPS-accretive, we have successfully achieved growth that has, as a whole, exceeded our initial expectations.

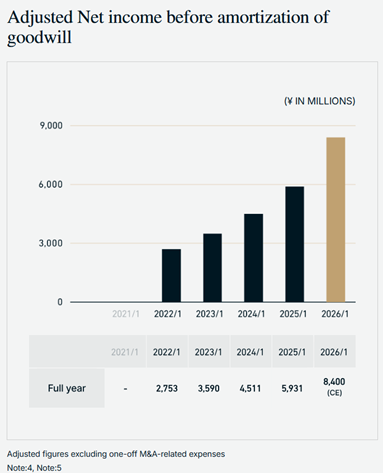

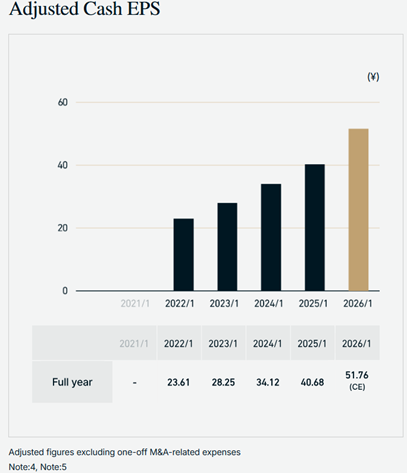

(Source: page 8 of “FY2026/1 3Q Earnings Presentation” disclosed on December 12, 2025)

That said, because we prioritized the speed of our M&A execution, we conducted public offerings to secure M&A standby funds for two consecutive years. By strictly maintaining our M&A discipline, we achieved a 196% increase in projected net income before amortization of goodwill for the next fiscal year, despite a 48% increase in the number of shares outstanding since our IPO. Consequently, our Cash EPS is expected to grow by 101%, effectively doubling. However, if we had continued with this strategy, a series of public offerings would have been unavoidable.

What we miscalculated was that the cost of continuous public offerings – specifically, the resulting short-term supply-demand concerns – was far heavier than we had imagined. Especially, we now recognize that for investors with shorter time horizons, the uncertainty of “not knowing when the next offering might occur” acted as a barrier to new purchases, effectively capping our share price performance.

We take this lack of foresight very seriously, and it is based on this deep reflection that we have decided to present this strategic revision.

(Source: page 9 of “FY2026/1 3Q Earnings Presentation” disclosed on December 12, 2025)

First and foremost, what will remain unchanged is our commitment to achieving “Continuous Transformational Growth” through M&A in the entertainment industry. Furthermore, we will continue to execute only those M&A transactions that are EPS-accretive. We will steadfastly uphold these core strategic principles moving forward.

At the same time, we are refining our M&A strategy to be more aligned with the expectations of the capital markets. Specifically, we will implement changes in the following three areas:

First is the company-wide strategic shift regarding public offerings. We have established a policy that we will not conduct any “public offerings for the purpose of securing M&A standby funds” – a practice we carried out twice in the past – for at least the next three years.

Second is the shift in our M&A strategy. Regarding our future M&A, we will, in principle, focus on roll-up M&A within our core business domains. Conversely, M&A outside of these core areas will be limited and highly selective. As a result, while we expect the total number of M&A transactions to decrease, we will ensure each deal is strictly chosen for its ability to sustain and drive our overall growth.

Third is the strategic shift in our existing businesses. By being more selective with our growth investments in existing operations, we aim to generate 5.0 billion yen in FCF from these businesses in the next fiscal year.

Until now, we have executed M&A at a rapid pace across a diverse range of entertainment companies. In practice, our new financing could not keep pace with such a high volume of deals despite our remaining debt capacity, necessitating the use of our own cash reserves. Simultaneously, we were aggressively reinvesting in our existing businesses for comprehensive growth, as detailed below, which resulted in a deliberate negative Free Cash Flow (FCF).

(Source: page 25 of “FY2026/1 3Q Earnings Presentation” disclosed on December 12, 2025)

As shown in the table on the bottom right, after paying taxes and maintenance Capex, we are currently in a position to generate approximately 16.5 billion yen in annual FCF if we were to suspend our growth Capex. At the same time, we believe there are still business segments where we should not yet halt our growth investments, and they are primarily located in North America.

By deploying growth investments from our baseline FCF of 16.5 billion yen, we aim to generate a final FCF of 5.0 billion yen in the next fiscal year. This represents an improvement of approximately 15.0 billion yen in FCF compared to the current fiscal year. Notably, this improvement is on par with the 15.4 billion yen raised in our most recent public offering for M&A standby funds. Through these strategic updates, we believe we can sustain the same growth rate without conducting any public offerings aimed at pre-funding for M&A, at least until the end of January 2029.

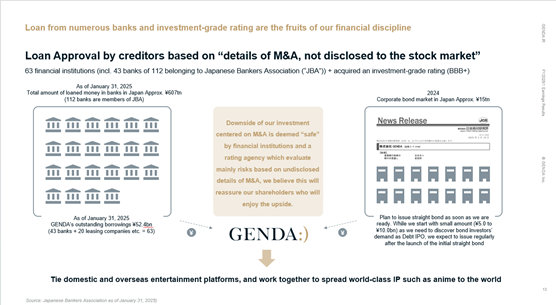

The main reason for raising funds by issuing corporate bonds is to maximize our debt capacity by diversifying our financing sources.

With M&A as the core of our growth strategy, we have maintained financial discipline and continued to grow by striking a good balance between debt financing, mainly through bank loans, equity financing through follow-on offerings, and stock deal M&A.

We have historically preferred to finance our M&A transactions using a “bridge loan” – a temporary borrowing of acquisition funds from a small number of banks – from the perspective of speed and information management, and have executed past borrowings accordingly.

For a bank which provides a short-term “bridge loan,” a key factor in deciding whether to approve the loan is the assurance of whether the “bridge loan” can be refinanced into a long-term “permanent loan.” From this perspective, we believe that the ability to utilize (not only bank financing but also) corporate bonds for “permanent loans” will lead to maximization of debt capacity.

Moreover, we believe that diversifying financing sources is also important from the perspective that it leads to increased negotiating power with financial institutions.

Furthermore, although our company is currently only in its eighth year since founding, we believe that the smooth accumulation of future earnings will allow our current investment-grade credit rating of “BBB+” from Japan Credit Rating Agency, Ltd. (JCR) to rise to the “A” rating zone – the volume zone of the corporate bond market – ultimately leading to the maximization of our debt capacity.

If you simply calculate P/E multiple based on actual results stated in the disclosure materials, it may appear at first glance to be a relatively expensive level compared to out company’s P/E multiple. On the other hand, the P/E mulitple based on the projected earnings after the consolidation starts will be more favoravly priced than our company’s P/E multiple.

In this M&A, we have factored in the cost synergies that are expected to be realized promptly after consolidation (e.g., reduction of executive compensation for the retiring owner, elimination of head office rent and company housing burden, and liquidation of recently closed stores). We assume that, due to these effects, the target company’s net income will be at a different level after consideration than its past performance.

Besides, the above valuation is based solely on a conservatively assumed cost reduction and does not factor in the upside of sales. On the other hand, as our M&A track record has shown, we assume that the P/E multiple will consequently decline to a more undervalued level as profitability improves due to synergy creation.

(page 18 of “FY2026/1 2Q Earnings Presentation” disclosed on September 12, 2025)

The purpose of this change in capital allocation strategy is to reduce the burden of financing for M&A. There is no change to the core of our growth strategy, which remains the transformational growth through M&A. And ample fund is essential to continuously execute M&A.

On the other hand, while actively investing in inorganic (M&A), we have also been aggressively pursuing organic growth (existing businesses). Specifically, we were investing more in our existing businesses than the cash flow they were generating from operations, which resulted in a negative free cash flow.

As a result, external funding was also allocated to organic (existing businesses) investments, and inorganic (M&A) investments were, in effect, “entirely” financed with external funds.

Furthermore, because our free cash flow was negative, while we were making loan repayments, our total borrowings were increasing by more than the amount repaid, meaning we were not making any substantial progress in repaying our debt.

For that reason, continuing our M&A activities places a heavy strain on our ability to raise capital.

Therefore, in a major shift of our internal policy, we have decided to focus and prioritize our organic (existing businesses) growth investments. This is a strategic change aimed at making our free cash flow positive, so that for the first time since our founding, we will allocate our own cash flow to inorganic (M&A) investments.

This will ease the burden of creditors and shareholders, who are the providers of external funding.

Specifically, for creditors, this marks the first time that substantive debt repayment will begin. While our company’s debt capacity is still estimated at approximately 30.0 billion yen (please refer to page 8 of “FY2026/1 2Q Earnings Presentation” disclosed on September 12, 2025), the start of debt repayment will further increase our debt capacity.

Additionally, from a shareholder’s perspective, the need for additional follow-on offerings is reduced by the use of our own cash flow for M&A – which is effectively the first time – and by the increase in the aforementioned debt capacity. Since we have always been disciplined with our M&A strategy, our Cash EPS has continued to rise even after follow-on offerings. However, while this approach is effective in the long term, it created a burden on the capital market, as it led to short-term pressure from investors who wanted to “wait and see” until the next follow-on offering.

Our annual cash-in amount, equivalent to EBITDA, is currently approximately 27.0 billion yen (equivalent to the company’s planned EBITDA for the fiscal year ending on January 31, 2027). We will leverage this significant annual cash inflow to its full potential to pursue continuous M&A, all while reducing the strain on the capital markets. This will be accomplished by funding M&A with our own cash flow, initiating debt repayment to increase our debt capacity, and conducting disciplined, stock-based M&A.

In the first place, the structure makes it almost practically impossible to break the discipline of M&A in itself, and the “discipline of M&A,” which has been the most important aspect of our company since we went public, will not change.

The two reasons are as follows.

①The Company is not in a position to freely use surplus funds at its own discretion and is forced to be examined to get finance for each M&A, making it virtually impossible to force through undisciplined M&A.

② Theoretically, M&A through stock issuance in disregard of stock price is a possibility. However, since the incentive in this case is not cash but a stock acquisition right and the mechanism is such that no benefits accrue without an increase in the stock price, an increase in the stock price itself is a clear incentive.

Let us explain each of them.

①The Company is not in a position to freely use surplus funds at its own discretion and is forced to be examined to get finance for each M&A, making it virtually impossible to force through undisciplined M&A.

If we had ample equity capital and cash on hand, we might be at risk of executing an unreasonable M&A based solely on our own judgment. However, the reality is different.

We are a developing company which is in the eighth year since its establishment and has only accumulated seven fiscal years of financial results. Therefore, each time we execute an M&A, we need to raise funds from creditors and investors and undergo their review.

In particular, in M&A through borrowing, which we mainly carry out, financial institutions as creditors have a strict view of “downside risk.” We go through a process in which detailed M&A information (which is not disclosed to equity investors) is shared with creditors before they make a decision on financing.

Thus, even if we were to ignore our discipline and pursue reckless M&A, it would not be feasible because we would not be able to obtain financing.

→ As a result, our structure has always allowed us to execute only “disciplined M&A.”

We add a supplementary point regarding equity financing just to make sure. Although such a situation is not possible in practice, it is not absolutely impossible for a listed company to raise funds by forcibly issuing new shares in disregard of equity value.

However, the reason why such a situation cannot happen in reality is not simply a matter of ethics or the rule of faith, but because the stock acquisition right incentive we have designed is a mechanism that discourages such behavior from the standpoint of economic rationality. We will explain this in ②.

②Theoretically, M&A through stock issuance in disregard of the stock price is a possibility, but since the incentive in this case is not cash but a stock acquisition right and the mechanism is such that no benefits accrue without an increase in the stock price, an increase in the stock price itself is a clear incentive.

We will explain that the design of the stock options (stock acquisition rights) we are introducing does not in itself have any incentive to break the discipline of M&A.

First of all, if the incentive were to be “a ‘cash’ bonus for achieving EBITDA of 75.0 billion yen,” there could be an incentive to pursue EBITDA alone, even at the expense of the stock price.

However, since these are stock acquisition rights, they can only be exercised if “the stock price at the time of issuance is at or above the stock price at the time of issuance.” We assume the issuance within this fiscal year and the stock price at the time of issuance will be determined at that moment (However, since they can be exercised only when both the performance-related and tenure-related conditions are fulfilled, dilution will not occur until the financial results for the fiscal year ending on January 31, 2030 are finalized.).

Only the amount in excess of the stock price at the time of its issuance will be the incentive. To give a simple example, for example, let me see a case of an officer or employee who was allocated 1,000 shares at a share price of 1,000 yen. If the person remains with the company until the end of January 2029 and an EBITDA of 75.0 billion yen is achieved in the fiscal year ending on January 31, 2030.

If the stock price remains at 1,000 yen, 1,000,000 yen worth of stock acquisition rights become exercisable. However, the incentive is zero because 1,000,000 yen must be paid upon exercise. Similarly, if the stock price were 5,000 yen, the incentive would be 4,000,000 yen because it would be worth 5,000,000 yen and 1,000,000 yen would be paid upon exercise.

In other words, this incentive is designed to be “beneficial only when the stock price rises.”

In addition, especially, our officers and employees, who are in almost constant contact with M&A information, have significant restrictions on selling their shares, unlike our outside shareholders. We will be able to exercise our GENDA shares for the first time approximately five years from now, and will also have to pay the exercise price first upon exercise.

Therefore, we hope that you will understand that even a slight increase in the stock price is not enough.

As described above, the design is to maximize shareholder value along with earnings growth, or more precisely, to maximize “equity value per share,” which is also in the interest of the officers and employees themselves.

As described above, we have a structure that makes it structurally difficult to deviate from discipline in M&A, based on the dual safeguards of rigorous funding screening for each M&A project due to financial constraints and sound incentive design in stock options.

Even if these mechanisms did not exist, we would continue to consistently orient and accelerate our “growth through disciplined M&A.” We will continue to earnestly serve our shareholders and all other stakeholders and work to steadily and sustainably enhance our enterprise value. We would sincerely appreciate your continued support.

In conclusion, the reasons are ①Quantitative side: the growth rate in North America is very different from that in Japan and ②Qualitative side: the strategic significance of becoming a platform which provides Japanese IP in North America, taking the lead in the change by Japanese anime IP occurred in amusement arcades in Japan in North America and creating a new market is extremely significant. There is no change whatsoever in our M&A policy.

①Quantitative side: the growth rate in North America is very different from that in Japan

First, it is true that this level of EV/EBITDA 8.5x is relatively high compared to domestic projects in the past. While M&A deals in Japan are possible at attractive valuations in many cases against a background of business succession needs, the same environment is not necessarily the case overseas.

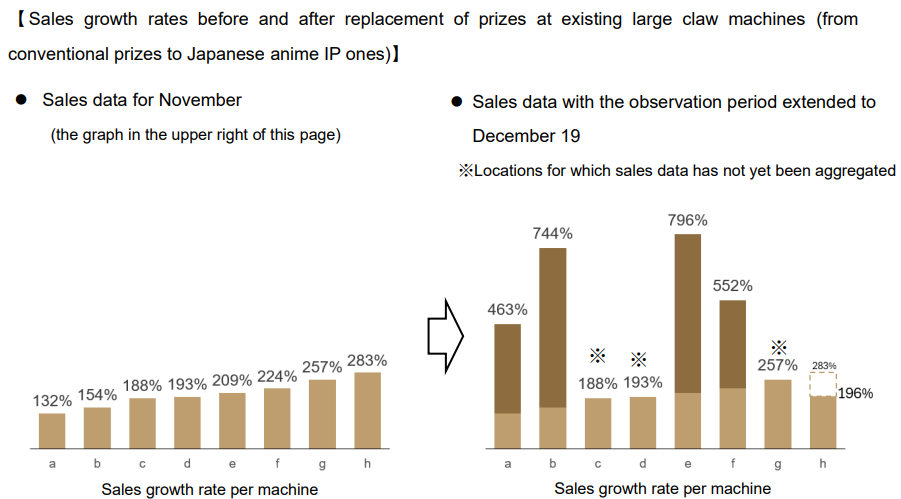

The important point, however, is that we should evaluate not only the multiples on the surface but also take into account the growth rate. For example, in Japan, our M&A projects have achieved a growth rate of 20 to 30% through synergies as we have shown in the past, while the same-store growth rate has been only a few percent. In contrast, NEN, which we acquired in North America last year, has achieved an “average of +201%” same-store growth rate, a completely different performance from that in Japan.

Specifically, although the target company’s most recent EBITDA is $18.2 million, we plan to grow this to $35 million over the medium term. If EBITDA were to double, the effective acquisition multiple would be half as well. One discipline is to make investment decisions without factoring in any future growth. However, it is overly conservative to completely ignore growth potential that has already been demonstrated, and rather risk missing out on investment opportunities that will help maximize shareholder value.

Furthermore, from a shareholder value perspective, we must not forget that we are leveraged. The yield on the investment based on company-wide free cash flow (FCFF) is sufficient in absolute terms (although it is true that domestic projects are very high in relative terms), and we plan to finance the majority of this acquisition with debt, assuming extremely high free cash flow (FCFE) for our shareholders.

The CGS report released today quotes the following: “We analyzed the acquisition ROI of Player One to be approx. 10% on an FCF basis, driven by synergies created through the planned replacement and addition of game machines this fiscal year and next. Additionally, it is estimated that the majority of the acquisition funds (80% assumed) will be financed through debt, and the acquisition ROE is expected to increase to over 60% in the mid-term. From these analyses, CGS believes that the sufficient capital efficiency can be consolidated compared to the cost of capital.” (Page 1 of Capital Growth Strategy Report (PLAYER ONE ROI Analysis) dated April 30, 2025)

If the ROE of 60% as envisioned in the report were to be achieved, we believe it would provide more than adequate returns to shareholders and the management team should not overlook such a project.

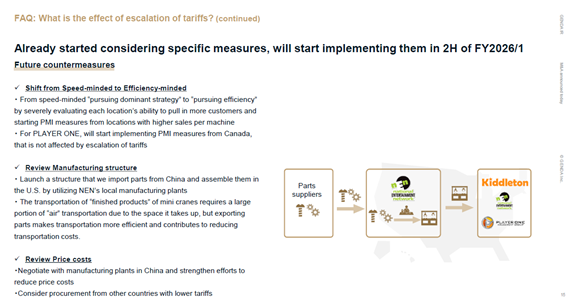

②Qualitative side: the strategic significance of becoming a platform which provides Japanese IP in North America, taking the lead in the change by Japanese anime IP occurred in amusement arcades in Japan in North America and creating a new market is extremely significant

The target company was originally owned by Cineplex. Although it was on our long list since then, we could not directly access to it at that time because we did not have sufficient sourcing capabilities in North America, unlike in Japan. As a result, the business was once sold to a PE fund, which we acquired shortly thereafter.

Even though the acquisition price was naturally higher than the one which the PE fund had paid, we believe that there is significant strategic value in acquiring a North American platform of this size in the first place.

The rationale behind the higher acquisition price than the one which the PE fund paid is a growth strategy through PMI utilizing Japanese anime IPs, which is difficult for foreign players but possible for us as a Japanese player. Instead of growing our business performance through existing game machine contents, we will be able to grow by utilizing prize games.

In Japan, prior to 2014, when prize games began to grow rapidly, the market of overall amusement arcade industry was in decline. Since then, however, the prize game market has consistently expanded, with the exception of the Covid-19 pandemic, and amusement arcades have transformed into “platforms anchored by Japanese anime IPs.”

At present, amusement arcades in North America function as a physical playground as same as the ones in Japan before the tipping point in 2014. By leading the transformation of amusement arcades into platforms for Japanese anime IPs, which occurred in Japan in and after 2014, this transaction is not just an M&A for us, but the first step in creating the “future of the North American market.”

Furthermore, the Japanese anime market has continued to expand rapidly, with overseas consumption growing 7.5 times over the past 11 years, finally surpassing domestic consumption for the first time in 2023. This trend is expected to continue to grow.

In contrast, in the North American market, the prize game business utilizing Japanese IP is still immature and supply is not keeping up with demand. With this M&A, we have secured 120 amusement arcades and approximately 12,000 mini-locations in North America. Considering the population size and economic strength of North America, the potential of the North American market is much greater than that of the domestic market, and we have laid the foundation for growth in this untapped market together with Japanese anime IP. As mentioned above, we should not discuss merely in terms of price in this project. We believe that it was a very meaningful investment decision based on the growth rate in the North American market, the creation of an untapped market utilizing Japanese IP, a future roll-up strategy and a long-term perspective to maximize shareholder value.

This report shows what kind of preconditions (specifically, perpetuity growth rate) we should set to get a stock price of 2,900 yen (which is our present stock price) in a DCF analysis.

The conclusion of the report shows that regarding a perpetuity growth rate in a DCF analysis, while generally setting a precondition of ±1%, it cannot be explained without entering a “excessively low and unrealistic” input of perpetuity growth rate of -19.4%, which means that “in other words, this analysis confirms that the current valuation is significantly undervalued.” (CGS Report p1)

Please let us explain the details.

First, a DCF analysis is the most corporate finance theory-based approach, that calculates theoretical stock prices from the bottom up.

On the other hand, it has drawbacks, too.

Specifically, “the theoretical stock price is highly sensitive to the terminal value assumption, making the results prone to subjectivity,” which means that the theoretical stock price fluctuates greatly depending on the input value of the perpetuity growth rate. (CGS Report p1)

This drawback has been eliminated this time. Specifically, “a reverse DCF helps reduce subjectivity in investment analysis by revealing the perpetual growth rate assumed in the current stock price,” which means that it was calculated backwards what percentage the perpetuity growth rate should be to get 2,900 yen in the DCF analysis (this “back-calculated” part is the reason for the “reverse” DCF). (CGS Report p1)

Consequently, this perpetuity growth rate becomes the explained variable which is calculated backwards to connect DCF⇄ market stock prices based on the DCF analysis, and the arbitrariness is eliminated.

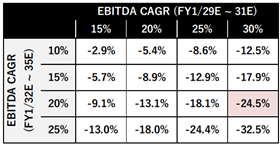

The back-calculated perpetuity growth rate is -19.4% mentioned at the beginning of this section. This means that if we assume that our free cash flow (hereinafter “FCF”) will decrease by -19.4% every year forever (after CGS’s 10-year earnings forecast period), the stock price calculated by the DCF analysis will be 2,900 yen. For EBITDA growth rate, the precondition will be that our EBITDA will decrease -24.5% every year forever.

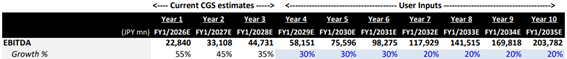

Next, let us take a look at CGS’s 10-year earnings forecast. Since the perpetuity growth rate above is the growth rate after CGS’s 10-year earnings forecast period, if the 10-year earnings forecast was really aggressive, it would be natural that the perpetuity growth rate were -24.5%.

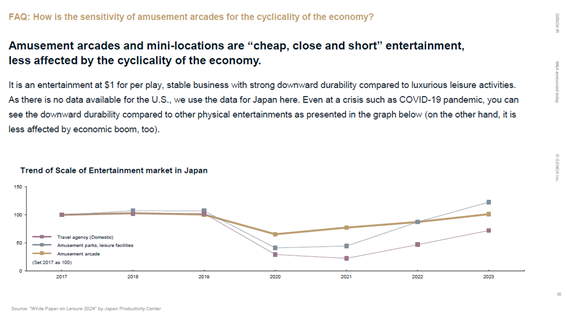

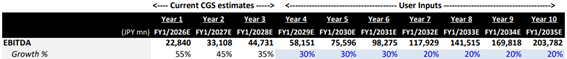

First of all, as a premise, since we went public, EBITDA has grown by approximately +60% for two consecutive fiscal years, from 8.1 billion in FY2024/1 to the forecast of 13.0 billion for FY2025/1, and to the forecast of 21.2 billion for FY2026/1, and we keep conducting M&A activities having a similar growth rate as our benchmark in the future as well.

On the other hand, CGS’s forecast assumes that we failed in our plan. Specifically, it will be +45% for this fiscal year, +35% for the next fiscal year, and then slowing to +30% and +20% each year after that.

As stated above, even though it is a precondition which is far below what we are aiming at, since a 10-year earnings forecast alone exceeds the current market capitalization, the result shows that the only way to calculate 2,900 yen backwards is to push down the perpetuity growth rate to -19.4%.

Besides, against an opinion that the above 10-year earnings forecast is still strong, in this report, the perpetuity growth rate is also calculated backwards in case that the forecast for EBITDA growth rate is further revised downward.

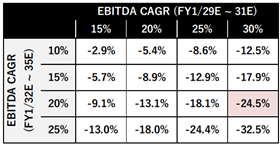

Specifically, as you can see in the upper row of the chart below, if “the EBITDA growth rate from the 4th to the 6th year is 15%” and “the EBITDA growth rate from the 7th to the 10th years is 10%,” a perpetuity growth rate of -2.9% is back-calculated (the upper left in the chart).

Even in the earnings forecast that EBITDA growth rate of 60%, which is our result and target, will slow down to 45%, 35%, 15% and 10%, which means that we cannot conduct M&A for mid- and long-term and the growth is only organic one, it is still -2.9%, a conservative growth rate compared to +/-1%, which is used in a general DCF analysis..

Based on the above result of analysis, the conclusion is that “In other words, this analysis indicates that the current stock price and valuation are highly undervalued.” (CGS Report p2)

We have maintained our M&A discipline by intentionally not issuing a medium-term management plan to prevent blind M&A. However, internally, we have the current growth of 60% per annum as a benchmark.

Therefore, we do not assume an EBITDA growth rate of 10 to 15% on a mid- and long-term basis, which substantially means that we can barely conduct M&A (“the long-term EBITDA and FCF projections do not reflect any input or intentions from GENDA” (CGS Report p2)).

In addition, it says that “CGS does not consider the market consensus forecast for GENDA to be a good reference for the mid-to-long term. The primary reason is that we estimate the consensus forecasts have largely not incorporated the company’s future M&A potential beyond those that have been publicly announced.“ (CGS Report p4).

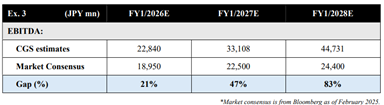

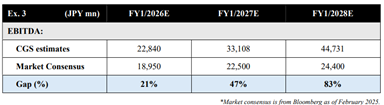

In fact, regarding the EBITDA forecast for FY2026/1, while the market consensus is 18.95 billion yen, we have already disclosed that the EBITDA forecast for FY2026/1 will be 21.2 billion yen in the presentation on December 24,2024, and this is a forecast under the assumption that there will be no M&A conducted in the future.

Based on them, the report ends with “a consensus forecast that largely excludes future M&A is not particularly useful given the GENDA’s growth strategy. Furthermore, it means that the trading multiples derived from consensus estimates do not account for the cash flow contribution from future M&A. For a valuation that incorporates the potential earnings contribution from future M&A as an estimated figure, please refer to the trading multiples based on CGS projections.” (CGS Report 4).

Our business model is in the early days in the domestic market, and we believe there are a lot of different views on valuations. However, this result of DCF analysis by CGS, which eliminated the arbitrariness, shows that the level of our market stock price is the one which cannot be derived theoretically.

We will keep striving to quickly execute, enhance our capability to generate cash flow, our equity and enterprise value, and to deliver the fruits of Continuous Transformational Growth to our investors.

Reference: “Capital Growth Strategies Report (Valuation Analysis),” February 12, 2025

https://capital-gs.co.jp/wp-content/uploads/2025/02/GENDA-CGS-Report-English-20250212.pdf

In February 2024, Shin Corporation, which operates karaoke boxes nationwide under the “Karaoke BanBan” brand, joined GENDA. The karaoke business operated by Shin Corporation has achieved robust growth as of the third quarter compared to the initial target thanks to successful PMI (post-merger-integration) after joining GENDA. In addition, Shin Corporation is expected to achieve the highest earnings in this fiscal year in its 35 years history since its establishment and in its first year in GENDA.

With Karaoke JIYU-KAN’s joining of GENDA, we now operate a total of approximately 390 karaoke boxes. As PMI in the karaoke domain, we have implemented measures to both increase sales and reduce costs to create synergies in the group.

【Measures to increase sales】

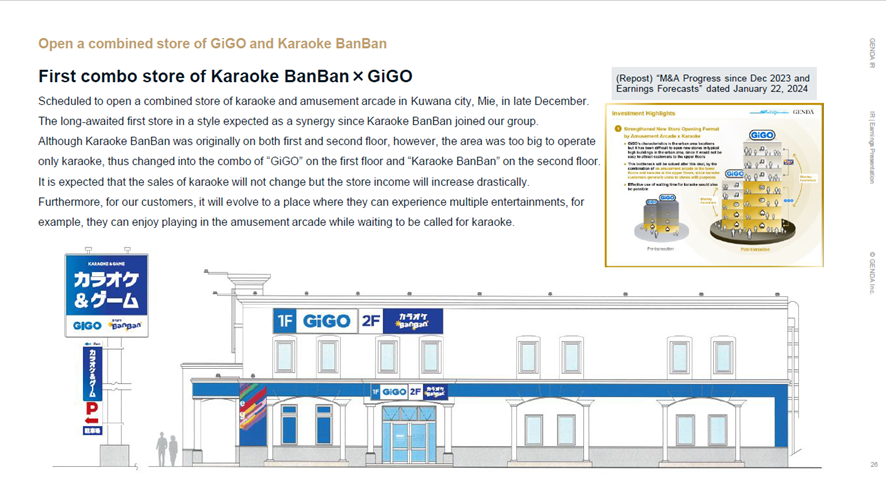

- Develop and open a new combined store with amusement arcades

(Page 26 of “FY 2025/1 3Q Earnings Presentation” disclosed on December 10, 2024)

This is the first combined store with GiGO on the first floor and Karaoke BanBan on the second. Originally, only Karaoke BanBan used to operate on both floors there as Karaoke BanBan Kuwana. As a result, while using the same building but operating both GiGO and Karaoke BanBan, sales increased 2.2x year-on-year.

As previously reported, the karaoke business itself has significantly exceeded its initial target. However, we believe that there is room for further growth through these full-scale synergies, and we believe that we can see the core of roll-up M&A in the M&A of these 23 stores.

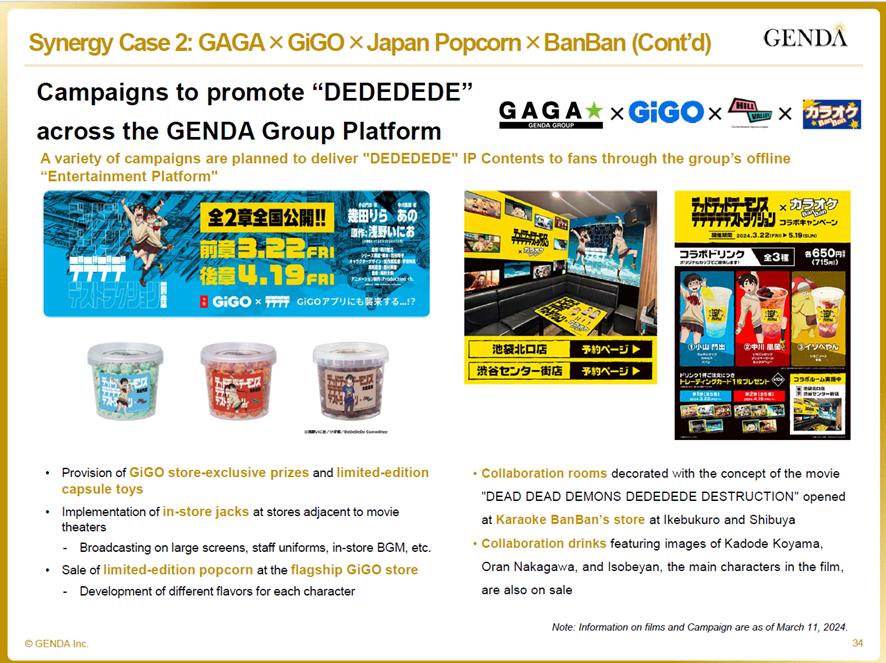

- Mutual expansion of sales by developing IP collaborations and providing food and beverage products of the F&B domain

(Page 34 of “FY2024/1 Earnings Results and FY2025/1 Earnings Forecasts” disclosed on March 11, 2024)

- Strengthen measures to enclose customers by utilizing GENDA ID

- Mutual customer transfer with amusement arcades between neighboring stores

We have implemented a mutual customer transfer measure between stores within a 1km radius of each other since last June. The targets are 75 GiGO stores and 67 Karaoke BanBan stores, which have distributed service tickets and displayed promotional posters.

【Measures to reduce costs】

- Make the cost more efficient such as bulk purchase of consumables etc. as GENDA, which is the core of roll-up M&A.

- Make the capital more efficient by GENDA’s group finance.

In terms of valuation, karaoke boxes have a strength which recoupment period is shorter than that of amusement arcades because they require less investment in equipment upgrades. Specifically, while the conversion ratio from EBITDA to free cash flow (FCF) is about 50% in amusement arcades, this indicator is about 70% in karaoke boxes because machine installment and maintenance CAPEX are less. Therefore, if M&A were conducted in amusement arcades and karaoke boxes at the same EV/EBITDA multiple, karaoke boxes would have an advantage of a shorter recoupment period.

Although the acquisition of “Karaoke JIYU-KAN” resulted in an EV/EBITDA 7x+ (the latest actual value), in light of the above EBITDA to FCF, the recoupment period is comparable to that of M&A with EV/EBITDA 5x+ in amusement arcades. Furthermore, the above valuation is based on the “actual results of the previous fiscal year” of “23 stores in the single business.” If this is evaluated based on the “results of the next fiscal year and beyond” with “group synergies” arising among “approximately 390 consolidated stores” and “a recover of number of customers after COVID-19 pandemic,” we can expect a shorter recoupment period.

The above “EBITDA to FCF” denotes FCF divided by EBITDA. The background is, since the actual source of investment recoup is not precisely EBITDA but FCF, from which taxes and maintenance CAPEX are deducted, we consider the investment recoup on a cash flow basis as most important in a M&A transaction.

On the other hand, since actual FCF fluctuates greatly depending on the CAPEX in a single year, thus EV/EBITDA is generally used as a simple reference. Therefore, we disclose EV/EBITDA multiple whenever possible.

We place a high priority on investing at appropriate valuations. Besides, we consider the roll-up of amusement arcades, which is easy to enter at appropriate valuations and for which a PMI pattern has been established, to be the most important in our M&A strategy. However, we believe that the roll-up of the karaoke business, which is currently significantly higher than our target, will also have great significance from the perspective of investment recoupment efficiency.

As we aim to become the world’s No. 1 entertainment company, our M&A targets are not limited to the amusement arcade industry, which has a market size of 540 billion yen, but rather target the whole entertainment industry. As individual companies of the entertainment industry formed a group of companies, countless cross-selling synergies have been actually generated, resulting in significant growth in business performance after joining in the group even outside of amusement arcades.

Fukuya and Shin Corporation are specific examples of non-amusement arcade companies that have had a significant impact on consolidation. In this fiscal year, which is the first one after M&A, it is already ensure that they will achieve a record profit in their corporate history, 71 years of Fukuya and 35 years of Shin Corporation. We believe that it is difficult to explain this without synergies.

On that condition, synergies and PMI are only means, not goals, in M&A. In order to make M&A succeed, the goal should be that “the total amount ofcash flow acquired through M&A exceeds the consideration for M&A paid.” On the other hand, we think that having synergies and PMI as their goal, which means “having means as the goal,” is a typical example of failure in M&A. The details are explained below.

・Our definition of failure in M&A is a reduction in capital as a result of M&A

First, let me explain our definition of failure in M&A. Our definition of failure in M&A is that “the total amount of cash flow acquired through M&A is less than the consideration for M&A paid,” which means that we have decreased our capital as a result of M&A. The reasons for this are as follows.

As a stock company, it is required to maximize its stock value. Maximizing stock value requires maximizing corporate value. Maximizing corporate value requires maximizing cash flow. Nevertheless, if “the amount paid for M&A > the total amount of cash flow acquired through M&A,” the stock value will be damaged because cash flow is lost as a result of the M&A.

We define a M&A which damages stock value, which means “the total amount of cash flow acquired through M&A is less than the consideration for M&A paid,” as “a failure in M&A.” In other words, the definition of success in M&A is that “the total cash flow acquired through M&A exceeds the consideration for M&A paid (on a present value basis),” and we have this as our goal.

・A typical example of failure in M&A is “having means as the goal,” which means having synergies and PMI as the goal.

The goal of M&A is as stated above, and synergies and PMI are just means to increase cash flow. However, we believe that having “synergies and PMI” which are means as a goal, which means “having means as the goal,” is a typical example of failure in M&A. Specifically, this means “to conduct M&A (regardless of the acquisition price) because synergies are likely to be generated with the existing business and increase by PMI.”

When a company has been conducting M&A aggressively in a particular field, if it continues to conduct M&A without caring the acquisition price only because it is likely to generate synergies, even if synergies are actually generated, the acquisition price may be higher than the synergies and it could fail to recover the investment. We should have cash flow as our goal, and having synergies or PMI as the goal is a typical example of failure in M&A.

・Background factors behind the likelihood of failure in M&A by having synergies as a goal.

We believe that the following characteristics of M&A are behind the likelihood of such failures.

・ It is easy to conduct M&A just by paying a high price and we can increase PL immediately afterwards.

・On the other hand, it takes some years to find out if the acquisition price was right.

・In M&A, the sunk cost is high because it has a lot of person-hours. People on the line want to complete the M&A if possible.

・To solve this issue, the function to check the acquisition price deteriorates in the cause of synergies.

These are the characteristics of M&A. We have analyzed that the cause of typical failure is having means as the goal, which means that “Let’s carry out M&A because it looks like we can generate synergies (even at a slightly higher price).”

・The premise of the doubt that synergies and PMI are all right is a thought that “M&A = overpriced.”

When it comes to M&A, there is a common doubt that “synergies and PMI are all right.” A cause underlying this doubt is a mind that “basically, the acquisition price in M&A is relatively high compared to the cash flow of the target company on its own, and M&A will fail if the cash flow of the target company does not increase through synergies and PMI because we cannot recover the investment in the first place.”

However, the premise that M&A = relatively expensive is not correct. In the entertainment industry, which is our target, there are structures which are suitable for M&A, such as stable business conditions with a long business history, balance sheets of net cash and needs for business succession etc. For more information, please see the following sponsored research report.

(For reference: “Capital Growth Strategies (Initial Report)” dated October 18, 2024)

・GENDA is an operating company which conducts M&A specializing in the entertainment field by using an investment firm’s perspective of M&A.

We firmly emphasize M&A at the right price, not conducting M&A based on synergies or PMI. M&A will fail if the goal is not to increase cash flow, and the axis of investment decisions is whether this can be secured or not. Acknowledging the aforementioned temptation, we avoid having means as the goal and make investments which are faithful to the theory of stock value.

On that basis, countless cross-selling synergies have been generated. Let me explain specific examples of the synergies that have actually occurred in Q2, that is why GENDA is an operating company, not an investment firm in Q3, the rationality of conglomerate in Q4 and the connection between GENDA’s strategy and its Aspiration “More fun for your days” in Q5.

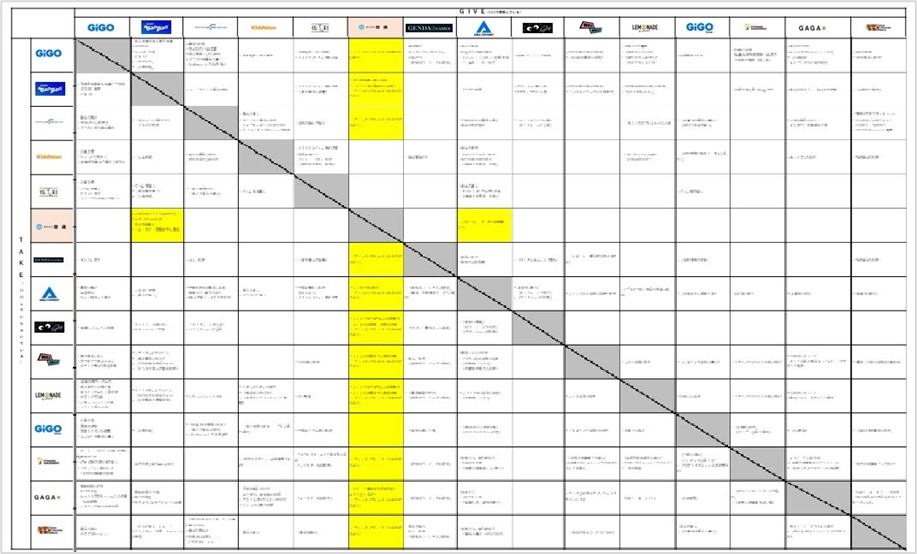

We have countless synergies within our group and we have verbalized them in detail. Below is the latest table of our group synergies that we use in our internal management meetings.

This is just an example for your reference.

For example, although amusement arcades and karaoke seem to be different businesses and customer segments, the concept of opening new stores is the same, and the amount of information on available tenants is critical. While we used to collect tenant information as an operator of about 330 amusement arcades, the addition of about 360 karaoke premises has improved our store development capabilities by integrating store development with tenant information on the karaoke side.

This has also made it possible that it is possible to open an amusement arcade even if it is unprofitable to open karaoke (or vice versa). Even among existing stores, we have changed a store which is too big only for karaoke to an amusement arcade and improved the profitability. In areas where store locations overlap, we attract new customers by distributing discount coupons for both.

Fukuya, which designs prizes, is located on the upstream of value chain of amusement arcades. Its volume of transactions has dramatically increased not only because of the expansion of GiGO’s operation, but also the creation of huge demand for Japanese Kawaii products in North America through Kiddleton and NEN as GENDA. There is a big effect of increasing the stock value just to take in the profits by making it consolidated, which would flow away outside if we did not conduct the M&A. Besides, we share the information on sales of each product in a timely manner and this makes us possible to make minor changes. The same effect has arisen for Ares, too, which has a function as a trading company of prizes.

As for Lemonade and Kleiner, the sales functions have dramatically improved, that was difficult when they stood alone. By joining in the group, products of Lemonade and Kleiner are distributed on the grand menus of all 360 Karaoke BanBan premises, and they have opened new stores in existing amusement arcades, too. In addition, it is possible for them to share the opportunity when we open a new amusement arcade in a shopping center.

Furthermore, since ONTSU, which is a distributor of karaoke equipment, joined us, the volume of business with Karaoke BanBan has increased and this has enabled our group to take in the profits which were supposed to flow away outside of the company. In addition, it is now possible to sell Kleiner for the night market which is ONTSU’s customer base. C’traum, which sells Kleiner, did not have any employee or sales function before the M&A. But now it is possible to access to sales channels on a number of fronts without no additional cost.

GAGA, which is a movie distribution company, has also created countless cross-selling synergies that were difficult to achieve on its own, such as extensive advertising of its movies on digital signage at GiGO Flagship Store facing Ikebukuro Sunshine 60 Street, staff of amusement arcades wearing a T-shirt with movie ads, and offering rooms with movie characters and food and beverages at karaoke etc.

These are just a few of the verbalized synergies, but the reason for the various synergies is that although the entertainment industry seems to be broad, from a broad perspective, it is connected from the upstream “Contents” to the downstream “Platform” from the customers’ (entertainment fans’) perspective. Based on the structure of entertainment industry, which is “IP→platform→fans,” there are countless cross-selling synergies.

Of course, there are synergies from roll-up M&A of amusement arcades. However, there is much room to create synergies in M&A focused on the entertainment field which is contiguous, more than in M&A limited to amusement arcades. From these perspectives above, we believe that the formation of an entertainment conglomerate through GENDA’s unique Entertainment Ecosystem has many advantages.

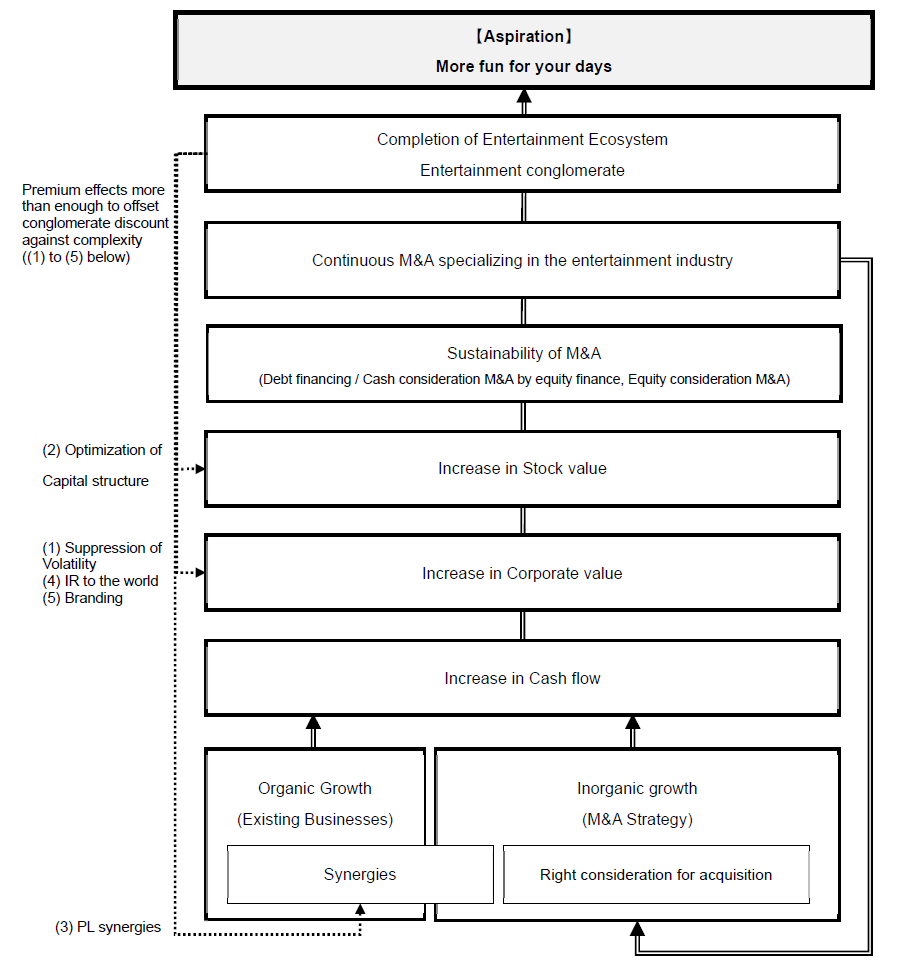

In conclusion, we believe that GENDA’s Entertainment Ecosystem can realize a “conglomerate premium” that more than offsets the conglomerate’s discount for complexity. We provide more details below.

・What is conglomerate discount?

This is a phenomenon in which the corporate value of a company with multiple businesses is valued lower than the sum of the business values of the individual businesses. This basically occurs because investors dislike “incomprehensibility.”

・Why GENDA believes that a conglomerate premium can be achieved.

GENDA hopes to achieve the exact opposite: a “conglomerate premium”. In other words, a state in which the value of the whole group continues to be valued higher than the sum of the values of the individual businesses. The following five points explain why we can achieve this.

(1)Suppression of Volatility: Increase in Corporate value (and increase in stock value by that)

“Individual entertainment companies are undervalued.”

Entertainment is ever-changing, ups and downs and tends to be valued low by investors who avoid volatility from the perspective that “Will what is accepted by the world now be accepted next year and the year after?” “Will it be able to maintain sales profits?” Even if individual businesses are volatile, GENDA will transcend this volatility by forming an appropriate business portfolio. In other words, we aim to create a situation where “we keep growing strongly every year as a group even though an individual business might have a bad year.”

→As it is necessary to tolerate volatility when you invest in each company itself, the expected return goes up and the capital cost is high, too. However, by forming an entertainment conglomerate, the volatility will be reduced as whole GENDA and the capital cost will decrease. The decrease in capital cost, which is the discounted rate of cash flows, will increase the present value of total amount of cash flows and the corporate value will increase.

(2)Optimization of capital structure: Increase in Stock value

“Individual entertainment companies have unnecessary cash.”

For the same reason as (1), individual entertainment companies themselves often have cash which they do not need for the time being to prepare for “future volatility.” GENDA, by managing funds on a group-wide basis, will put the remaining funds into investments for the next growth while preparing for sudden capital needs.

→Based on the “Modigliani-Miller Proposition (MM Proposition),” the first proposition of the MM Proposition theoretically proves that “capital structure has no effect on corporate value in a perfect capital market.”

On the other hand, even if the corporate value remains constant, we can increase the stock value by capital structure. We can do that by utilizing excess funds and debt properly and making the stock structure more appropriate (In reality, the capital market is not perfect, and taxes and bankruptcy risks exist. Therefore, the pursuit of the best capital structure will increase the corporate value as well). In addition, it is possible to do business on a consolidated basis with financial institutions that each company could not meet on their own, making it possible to effectively utilize debt with low capital cost compared to the equity, which also leads to an increase in corporate value.

(3)PL synergies: Increase in Corporate value (and increase in stock value by that)

Realization of countless and cross-selling synergies within the group

As stated in Q2, countless cross-selling synergies are generated, which occur in the contiguous entertainment industry.

→Improved PL of each subsidiary increases cash flow and the corporate value will increase.

(4)Communications with investors: Increase in Corporate value (and increase in Stock value by that)

Detailed and sincere explanations to investors

GENDA is committed to explaining our business to investors around the world. We will continue to make efforts to give investors whom we could not meet if we remained an individual company a better understanding of the attractiveness of each business and that of the group.

→As we expand our investor base around the world, we will be able to meet investors and funds with lower capital cost, and as the capital cost decreases, corporate value will increase.

(5)Branding: Increase in Corporate value (and increase in stock value by that)

We will increase the number of fans of GENDA. By doing that, we will achieve greater effects as a group than if each individual company acted individually in all aspects, including recruitment, opening new stores, purchasing, sales, business tie-ups, M&A, fundraising etc.

→Corporate value will increase due to the improvement of PL and decrease in capital cost of each company in points other than (1) through (4).

With GENDA’s becoming a conglomerate, the occurrence of a conglomerate discount due to certain complexities may be unavoidable. However, we believe that there will be effects of increasing corporate value and stock value as described in (1) through (5) above, including reasons specific to entertainment, and these effects will more than offset the discount, resulting in a conglomerate premium that will keep the value of the whole group valued higher than the sum of the values of the individual businesses.

We are an operating company, not an investment firm. Although we are an operating company, we place M&A at the center of our strategy as same as an investment firm does, and conduct M&A based on the same judging criteria as an investment firm. However, we limit our target domain to the entertainment domain, and in reality, countless synergies are generated in the entertainment domain, and we consider ourselves an operating company, not an investment firm.

First, since it is necessary to define an investment firm and an operating company, let me provide a definition based on our ideas.

・Our definition of “investment firm”

Regardless of synergies, an investment firm will choose M&A if it comes into existence as an investment, in other words, if cash flow increases through M&A. No one asks a question about Company A and Company B, with which the investment firm has conducted M&A, “Why did the investment firm conduct M&A with each of these two companies, although they were not related in any way?” This is because it is obvious for the investment firm that there is an assumption that “Company A and Company B, each of them comes into existence as an independent investment (we can recover cash flow compared to the invested capital).

・Our definition of “operating company”

We consider a company to be in a state where it operates business in a specific area, each creating synergies and creating more value than if it existed as a stand-alone company. Although operating companies may also conduct M&A, they are not considered as an investment firm only because they conduct M&A. If an operating company continues to conduct M&A in an industry that is too unrelated to its own, it may be considered as an investment firm. However, if there are more synergies by doing business together as a group than by doing that independently, then we believe that the company can be considered as an operating company.

・GENDA is an operating company that conducts M&A based on the same judging criteria as an investment firm.

Although we are an operating company, we place M&A at the center of our strategy as same as an investment firm does, and conduct M&A based on the same judging criteria as an investment firm. However, our target domain is limited to the entertainment domain, and in reality, countless synergies are generated in the entertainment domain, and we believe that we are an operating company, not an investment firm.

When you hold several companies which are completely unrelated as an investment firm, there are cases where the value of the whole group is lower than the sum of the corporate values of each group of companies due to the usual conglomerate discount. On the other hand, GENDA will benefit from the advantages of conducting M&A as an operating company through the conglomerate premium described above. Besides, since multiple indexes such as PER are calculated based on the growth rate in theory, we would like to justify it by maintaining a high growth rate through M&A.

The relationship between GENDA’s strategy and our Aspiration based on the description of this document is as follows.

GENDA believes that “fun” is essential for human beings to live life in their own way and has set “More fun for your days” as our Aspiration.

To achieve this Aspiration, GENDA’s vision is to “become the World’s No.1 Entertainment Company by 2040,” and we aim to “complete GENDA’s unique Entertainment Ecosystem” by keeping making “Continuous Transformational Growth” through “M&A in the entertainment industry” as a growth strategy to achieve it.

GENDA will transcend the volatility of the ever-changing, ups and downs entertainment business by diversifying our business portfolio, and at the same time, GENDA’s becoming an entertainment conglomerate will create countless synergies for each entertainment company and we will continue to create new values.

Mr. Nobuzane, Representative Director and President of CGS, who has a career as a foreign institutional investor mainly in Fidelity, prepared this report for the purpose of verbalizing to investors the reality of our roll-up M&A strategy and the resulting transformational growth in equity value (through increased corporate value by increased cash flow).

As a result, while the index of “investment recovery” relative to “invested capital” (=Incremental ROI), which is important for the company which conducts M&A, was at the highest level compared to other companies in the same industry, the EV/EBITDA multiple, which took growth rate into account, was discounted by approximately 70% to 80% compared to other companies in the same industry.

While the selection and the forecast for growth rate by other companies in the same industry are based on CGS, the above analysis is a mechanical calculation based on actual market value, and we believe that we have quantitatively presented the upside to investors. We present the specific summary below.

As a company whose core business is M&A, we have consistently emphasized “M&A at appropriate valuations” since we got listed. Specifically, we have emphasized the importance of “investment recovery” (EBITDA of the target company) relative to “invested capital” (EV of the target company) through M&A.

However, we focused only on EBITDA growth of the target company after the M&A in IR to date. While it is true that an increase in cash flow of the target company promotes the investment recovery is good, this is only a means, not an end. We were not able to measure the effect of “investment recovery” relative to “invested capital,” which was the main objective.

Therefore, in this report, in order to measure the effect of “investment recovery” against “invested capital,” we measured the increase in operating cash flow (≒ EBITDA) ÷ the increase in invested capital (=”Incremental ROI”) by using the increase (due to M&A) in GENDA’s consolidated balance sheet (≒EV), not the one of the target company itself, as “invested capital” and the increase in operating cash flow (due to M&A) (≒EBITDA) as “investment recovery” and compared it with other companies in the same industry.

The other companies in the same industry are defined as “companies from a boarder range of industries that similarly employ roll-up M&A strategies within mature markets (p21 of CGS Report)”. There are a number of companies that are engaged in this industry on a large scale in the U.S. Among those companies, the report mentions Waste Management, which conducts roll-up M&A in industrial waste services (Incremental ROI is about 20%), Service Corp International (about 8-9%), which conducts roll-up M&A in funeral services, Rollins (about 25%), which conducts roll-up M&A in pest control industry, and Danaher (about 10%), a leading company that achieves growth through M&A.

In contrast, the result of the analysis shows that our index is approximately 25%, which is the highest level in comparison to other companies in the same industry (“This expected performance compares favorably with global companies in other sectors following a roll-up M&A growth strategy (p. 20)“). Therefore, it is quantitatively shown that it is justified even if valuations are relatively high compared to other companies in the same industry.